In Pain? Call Caine

Taxes on a Settlement What You Need to Know

5 Min read

By: Caine Law

Share

So, you’ve finally received your settlement check. It’s a moment of relief after what was likely a stressful legal fight. But before you start planning what to do with the money, there’s one more party to consider: the IRS.

It’s a question I get all the time: "Is my settlement taxable?" The short, and often frustrating, answer is: it depends.

Are Legal Settlements Taxable? Getting a Clear Answer

The taxability of your settlement all comes down to a simple concept the IRS calls the "origin of the claim." In plain English, they want to know what the money is for.

Think of it like this: your settlement is meant to replace something you lost. If the money is to compensate you for physical injuries from an accident, it’s replacing your good health. Since your health isn’t a taxable asset, the money you receive for physical injuries and medical bills is generally tax-free.

But what if you missed months of work because of that injury? Part of your settlement replaces those lost paychecks. Since your regular wages would have been taxed, that portion of your settlement is almost always taxable.

Common Settlement Components

A single settlement check is often a mix of different types of compensation, and each piece can have its own tax treatment. This is why having a settlement agreement that clearly spells out how the money is allocated is your single best tool for avoiding tax headaches later. Understanding this is a vital first step for anyone navigating a personal injury claim.

The most crucial question the IRS asks is: "What was the settlement intended to replace?" The answer to this question determines whether you will owe taxes.

To make this a bit easier to digest, here’s a quick-reference table that breaks down how the most common parts of a settlement are typically treated.

Quick Guide to Taxable vs. Non-Taxable Settlement Money

This table provides a great starting point, but remember, the specific details of your case are what truly matter.

Settlement Component | Generally Taxable? | Key Consideration |

|---|---|---|

Physical Injuries & Sickness | No | Must be for observable bodily harm. |

Emotional Distress (from injury) | No | The distress must stem directly from the physical injury. |

Lost Wages or Profits | Yes | Replaces income that would have been taxed anyway. |

Punitive Damages | Yes | Always taxable, as this is meant to punish, not compensate. |

Interest on the Settlement | Yes | Considered investment income by the IRS. |

Ultimately, working with your attorney to properly structure your settlement agreement is the most effective way to protect your compensation from an unexpected tax hit. The language matters.

If you've been injured and aren't sure about your next steps, don't wait to get answers. In pain? Call Caine.

Understanding the “Origin of the Claim” Rule

To figure out taxes on a settlement, you have to start thinking like the IRS. Their whole approach is built around a legal idea called the "origin of the claim" doctrine. It sounds intimidating, but the concept itself is actually pretty simple.

The IRS just wants to know one thing: "What was this settlement money meant to replace?" How you answer that single question is the key to whether your settlement gets taxed. It doesn't matter what the check is labeled; what truly counts is the reason you filed the lawsuit to begin with.

Think of it like tracing the money back to its source. The tax rules for the settlement have to match the tax rules for whatever you lost.

Why the Lawsuit's Origin Matters

Let's look at a couple of different situations. Say you were hurt in a bad car accident. The "origin" of your claim is the physical harm you suffered. Because things like your health and well-being aren't considered taxable income, the part of your settlement that pays you back for those physical injuries is usually tax-free.

Now, imagine a different case where a business partner breaks a contract, and you lose out on a year's worth of profits. Here, the origin of the claim is lost income. Since you would have paid taxes on that income if you'd earned it normally, the settlement money that replaces it is also taxable.

The core idea behind the "origin of the claim" is that a settlement's tax treatment is tied to the nature of the original loss, not whether the claim itself was proven right or wrong.

This is a critical distinction. The IRS doesn't get involved in who was at fault in the lawsuit. They only care about what kind of loss the money is supposed to make right.

This concept of tying taxes to a specific grievance isn't new. Disputes over taxes have been a flashpoint for centuries. Think back to the American Revolution, when colonists faced mounting poll taxes and property tax hikes to fund wars. This led to the famous cry of "no taxation without representation" and events like the Boston Tea Party. It just goes to show how deeply the principles of fair taxation are woven into our legal system. You can learn more about the history of colonial taxation and its effects.

Real-World Application of the Rule

So how does this play out in a typical personal injury case? Imagine you get a settlement that covers several different things. It might be broken down like this:

Medical Bills: This is directly tied to your physical injury, so this part isn't taxed.

Pain and Suffering: Since this also comes from your physical injury, it's non-taxable.

Lost Wages: This replaces income you would have paid taxes on, so this piece of the settlement is taxable.

Punitive Damages: These are designed to punish the person at fault and are always taxable, no matter what the case was about.

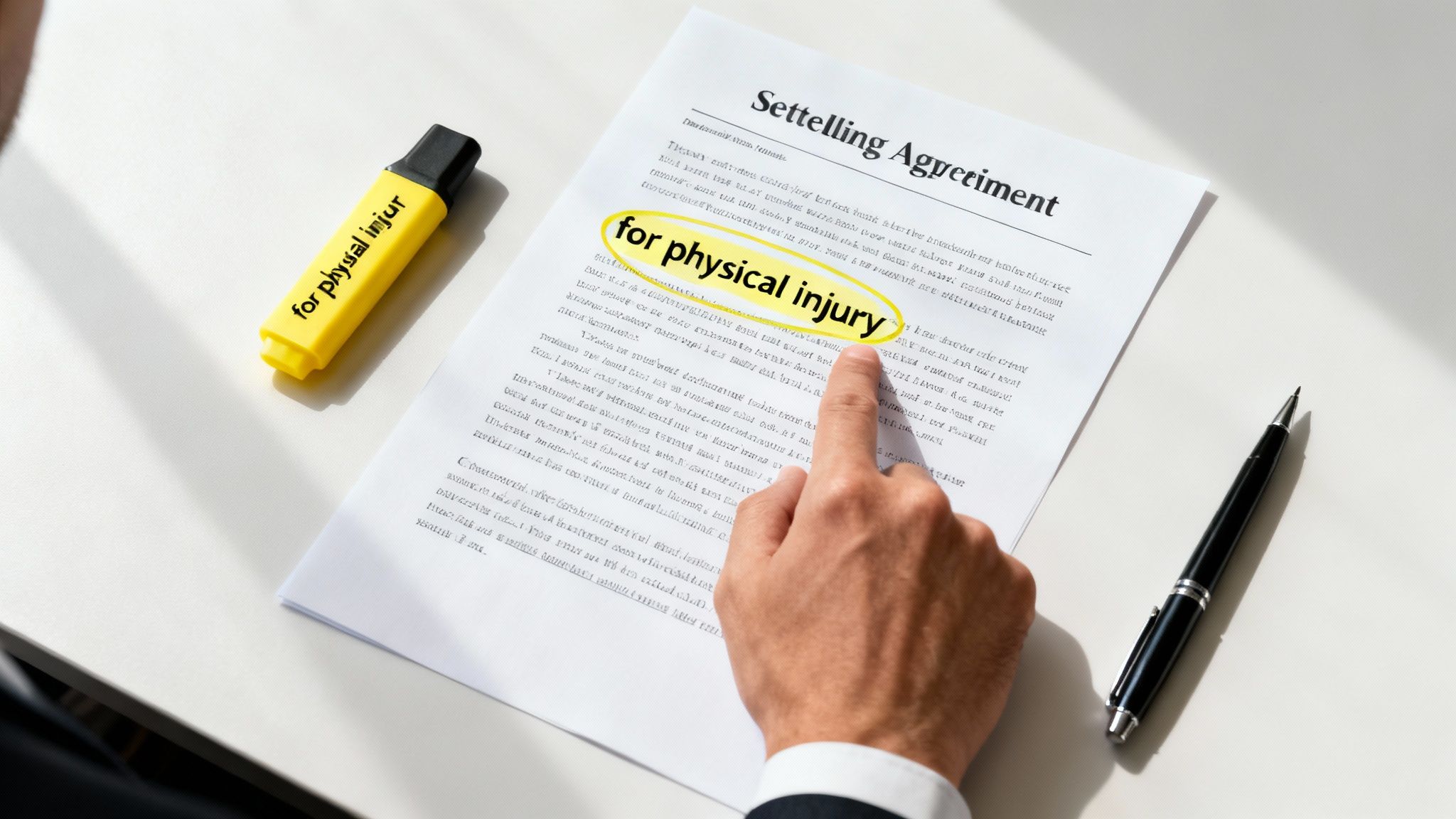

This is exactly why the wording in your settlement agreement is so important. A well-written agreement will clearly "allocate," or assign, specific dollar amounts to each type of damage. This creates a clear roadmap for you, your accountant, and the IRS, making it much harder for anyone to argue about the tax-free status of the money meant for your recovery.

Without that clarity, you're leaving the door open for the IRS to potentially declare the whole amount taxable.

Trying to sort through these rules is tough, especially when all your energy is focused on healing. Having an experienced legal team in your corner is the best way to make sure your settlement is structured to protect you, both today and down the road. In pain? Call Caine.

When you get a settlement check, it's natural to see it as one single amount. The IRS, however, doesn't see it that way. To them, that check is a bundle of different payments, and each piece gets its own special tax treatment. Getting a handle on this breakdown is the absolute key to managing the taxes on a settlement without getting a nasty surprise later.

Think about it: a single settlement might be covering your medical bills, making up for lost income, and compensating you for your pain. We have to pull these components apart, because one part might be completely tax-free while another is fully taxable just like regular income.

This is exactly why the specific wording in your settlement agreement becomes one of the most important financial documents you'll ever sign.

Lost Wages and Business Profits

If your settlement includes money to replace the wages you couldn't earn while recovering, that portion is almost always taxable. The logic from the IRS is pretty simple: your regular paycheck would have been taxed, so any money that replaces that paycheck has to be taxed, too. This rule applies to both past lost earnings and any compensation for future lost earning capacity.

For instance, if a car wreck kept you out of work for three months, the part of your settlement specifically earmarked for those three months of lost salary is going to be hit with income tax. The same goes for lost business profits if the incident tanked your company's revenue.

Emotional Distress and Mental Anguish

Now, this is where the tax rules start to get a little tricky. When it comes to compensation for emotional distress, there's a critical line in the sand:

Emotional distress that stems from a physical injury: If you're dealing with anxiety, PTSD, or other emotional trauma because of a physical injury or sickness from the incident, any money you receive for that distress is tax-free. It gets the same favorable treatment as the money for your physical injuries.

Emotional distress without a physical injury: If your entire case is built on emotional distress alone—think of a defamation or a harassment case with no physical harm—that settlement money is taxable.

This distinction shows you just how much hinges on the origin of your claim. A physical injury acts as an anchor, keeping the related emotional distress damages safely in the non-taxable harbor. Without that physical anchor, the IRS sees the payment as taxable income.

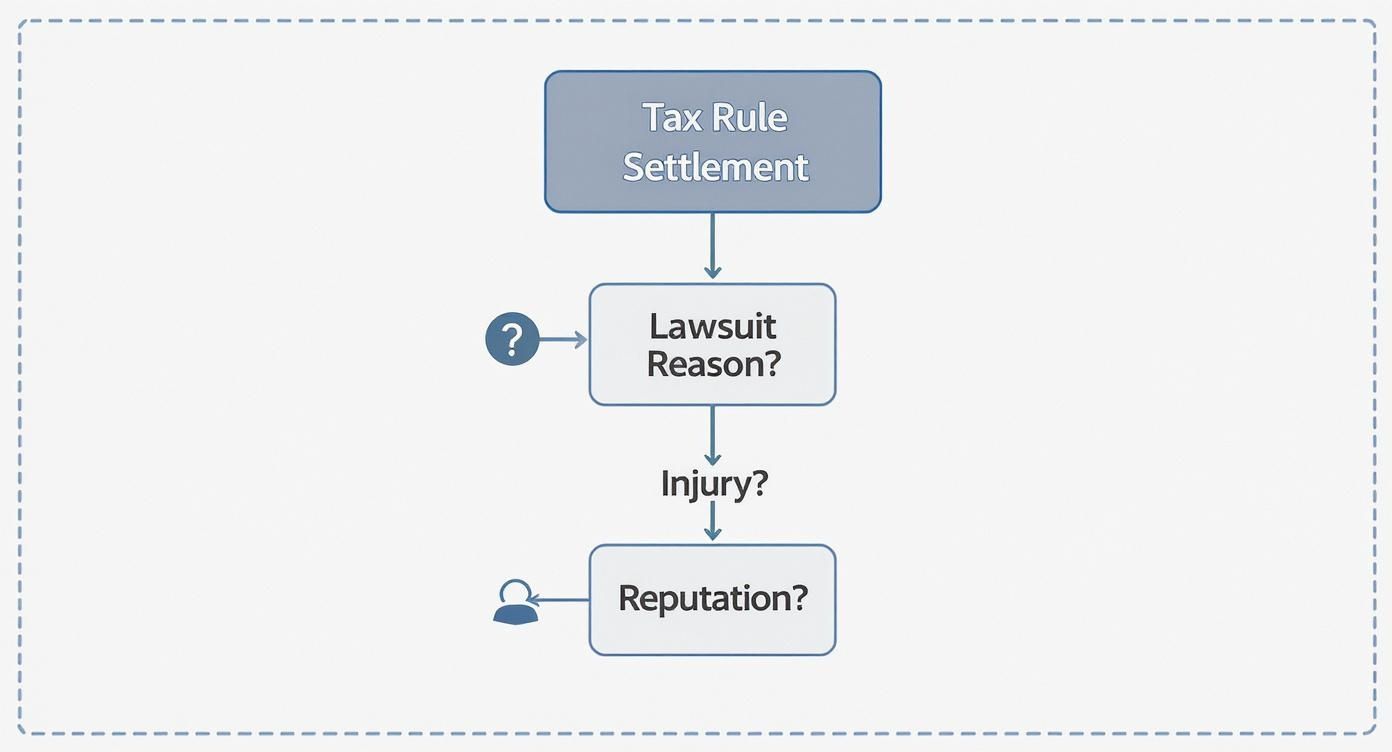

This flowchart gives you a quick visual of the logic the IRS applies to figure out if your settlement money is on the hook for taxes.

As you can see, the very first question—was this lawsuit about a physical injury?—is the most important one. The answer changes everything for how other related damages are treated.

To make this even clearer, let's break down how different parts of a settlement are viewed by the IRS.

Tax Treatment of Common Settlement Elements

Settlement Element | IRS Tax Treatment | Example Scenario |

|---|---|---|

Physical Injuries | Non-Taxable | Compensation for medical bills, hospital stays, and physical therapy after a slip-and-fall accident. |

Lost Wages | Taxable | A payment specifically replacing the salary you missed while out of work recovering from a car crash. |

Emotional Distress (from Physical Injury) | Non-Taxable | Damages awarded for PTSD that developed as a direct result of a severe physical assault. |

Emotional Distress (without Physical Injury) | Taxable | A settlement from a wrongful termination lawsuit where the primary claim is for emotional harm. |

Punitive Damages | Always Taxable | An extra amount awarded to punish a company for knowingly selling a dangerous product that injured you. |

Interest | Always Taxable | Interest that accumulates on your settlement award between the time of the judgment and when you are paid. |

Understanding these distinctions is crucial because a single case can easily involve several of these elements.

Punitive Damages

The rule for punitive damages is straightforward and absolute: they are always taxable. No ifs, ands, or buts.

Punitive damages aren't there to make you whole; they exist to punish the defendant for incredibly reckless or malicious behavior. Their goal is to send a message and deter others from doing the same thing. Because this money isn't replacing something you actually lost, the IRS views it as a financial windfall and taxes it under "Other Income."

It doesn't matter one bit if your case was based on a physical injury. Even if the heart of your settlement is tax-free, any dollar specifically labeled as "punitive damages" will be taxed.

This is a huge reason why getting the allocation language right in your settlement agreement is non-negotiable. If punitive damages are just lumped in with your compensatory damages, you could be facing a massive tax headache. It might even put the tax-free status of your entire award at risk. Some defendants involved in insurance disputes might push for vague language, but a sharp lawyer will demand crystal-clear wording to protect your money.

Interest Earned on a Settlement

Finally, any interest that your settlement earns is also taxable. This can pop up in a couple of scenarios. Sometimes, a defendant pays out a settlement over several years, and interest builds up on the unpaid balance. In other situations, you might be awarded pre-judgment or post-judgment interest as part of the final amount.

No matter how it got there, the IRS treats this interest income just like the interest you'd earn from a bank's savings account. It's considered investment income, and you have to report it on your tax return.

Trying to sort through all these different pieces requires a sharp eye for detail, both while you're negotiating and long after the check is in your hand. Every element has a different tax consequence, and a simple mistake can be incredibly expensive. If you're staring at a settlement offer and can't make heads or tails of the tax implications, getting expert guidance isn't just a good idea—it's essential.

How to Protect Your Settlement's Tax-Free Status

Knowing which parts of your settlement are taxable is one thing. Actively protecting your money from the IRS is the real challenge. Your single most powerful tool in this fight is the official settlement agreement. This document isn't just a formality; it's your best defense if the IRS ever comes knocking.

The language inside that agreement is your financial safeguard. Vague wording can leave the door wide open for the IRS to claim the entire amount is taxable income. That’s why you absolutely must get the wording right from the start.

The Power of Specific Allocation

The key to a tax-proof settlement agreement lies in specific allocation. In simple terms, this means the document needs to clearly break down the total amount and assign a specific dollar figure to each type of damage. Think of it like giving the IRS a detailed, itemized receipt.

A poorly written agreement might say something lazy, like, "$200,000 for all claims." This is a massive red flag.

A properly drafted agreement, on the other hand, will be crystal clear:

$100,000 for past and future medical bills from physical injuries.

$75,000 for pain and suffering directly caused by those physical injuries.

$25,000 for lost wages.

This level of detail creates an undeniable record. It proves the bulk of the funds are tied to your physical recovery, which reinforces their tax-free status. It draws a bright, clear line between money meant to make you physically whole (non-taxable) and money meant to replace income (taxable).

When to Have These Conversations

Timing is everything. You have to talk about tax implications and how the money will be allocated during settlement negotiations, not after the check is in your hand. Once an agreement is signed and finalized, it's incredibly difficult—and often impossible—to go back and change the language.

Your attorney and a qualified tax professional need to be in on this conversation before you agree to any final terms. This is the only way to ensure the final document is structured to protect your financial interests.

This idea of documenting value to sidestep taxes isn’t new. Back in colonial America, tax resistance was so common that farmers would undervalue property to lower their tax burden. This led to a system where a person's financial situation was carefully scrutinized. You can learn more about the colonial roots of American taxation on hoover.org and see how those early struggles shaped the tax principles we live with today.

Asking the Right Questions

You have to be your own best advocate, and that starts with asking the right questions. When you’re looking at a settlement offer, your attorney should be able to clearly explain how the funds are broken down and what the tax hit will be. Many of the same principles in these 9 questions to ask your slip and fall attorney before hiring apply to any personal injury case.

This isn't about finding clever loopholes. It’s about making sure the agreement honestly reflects the "origin of the claim" for every single dollar you receive. By demanding clarity and specific allocation in your settlement document, you build a rock-solid foundation to defend the tax-free status of the money you deserve for your recovery.

Don't leave this critical detail to chance. An experienced attorney knows they aren't just negotiating for the highest possible dollar amount; they're also fighting for the most favorable language to protect that money from the IRS.

If you’re facing a complex negotiation, make sure you have a team that understands every angle. In pain? Call Caine.

Once the agreement is signed and the check is in your hands, a whole new set of responsibilities kicks in. How you manage and report that settlement money is just as important as the amount you negotiated. Getting this part right will save you a world of trouble when tax season comes knocking.

https://www.youtube.com/embed/pbZRZ038iNc

Let's break down the practical steps. First, be on the lookout for tax forms. If any part of your settlement is taxable, the other party will most likely send you an IRS Form 1099-MISC or a 1099-INT. These forms report the taxable income to both you and the IRS, putting it officially on their radar.

When you file your taxes, any taxable income from the settlement—like money for lost wages or punitive damages—needs to be reported on your Form 1040. You'll usually find the spot for it under "Other Income" on Schedule 1. Trying to ignore it is a bad idea; it can easily trigger an audit and lead to penalties and interest piling up.

Proactive Financial Planning Is Key

The absolute biggest mistake you can make is to spend the entire settlement amount without thinking about the tax bill waiting for you. A surprise tax liability can be a devastating financial blow, especially if the money is already gone.

To sidestep this nightmare, you need a smart plan from day one:

Review the Final Agreement: Go back to the settlement paperwork and confirm the specific allocations. You need to know exactly what dollar amount is for non-taxable physical injuries and what's for taxable damages.

Set Aside Tax Funds Immediately: The moment that check clears, do the math on the estimated tax for the taxable portion. Then, move that money into a separate savings account. Consider it untouchable.

Consult a Professional: Your lawyer is great for explaining the settlement's terms, but a tax professional or CPA is the expert you need to figure out how to report the income and handle any quarterly estimated tax payments.

A settlement check feels like one big windfall, but the safest way to think about it is as two separate pots of money: one for you, and one for the IRS. This mindset keeps you from accidentally spending the government's share.

It’s easy to forget how much the tax landscape can change. Back in the mid-20th century, the U.S. government pushed top individual income tax rates as high as 94% to fund war efforts—a world away from today's brackets. This history is a powerful reminder that tax policy is always evolving, which is why understanding the current rules on the taxes on a settlement is so critical. You can get more insights into the history of U.S. tax rates on concordcoalition.org.

Trying to navigate post-settlement finances while you’re also trying to recover from an injury is an overwhelming burden. You deserve an advocate who not only fights to get you the compensation you need but also gives you the guidance to protect it.

In pain? Call Caine.

Even when you grasp the basics, a lot of practical questions pop up when it's time to actually deal with settlement taxes. Let's walk through some of the most common ones I hear from clients to help clear up any confusion.

Will I Get a Tax Form for My Settlement?

Yes, you can count on it. If any part of your settlement is taxable, the defendant or their insurance company is required to report that payment to the IRS. You should expect to see one of two forms in your mailbox:

Form 1099-MISC: This is for "Miscellaneous Income." You'll most likely get this if your settlement includes taxable damages like lost wages, emotional distress damages (that aren't tied to a physical injury), or any punitive damages.

Form 1099-INT: This one reports "Interest Income." If your award included pre-judgment or post-judgment interest, that specific amount gets reported here.

When one of these forms shows up, it's a sure sign the IRS knows about the money. You absolutely must report it on your tax return. Ignoring it is a surefire way to trigger an audit and face penalties down the road.

How Are Workers' Compensation Settlements Taxed?

This is a question I get all the time, and the answer is usually good news. Under federal law, benefits you get through a workers' compensation claim for an on-the-job injury or illness are fully exempt from taxes. That goes for both the weekly checks and any final lump-sum settlement.

Why? The law sees these payments as compensation for a work-related physical injury, putting them squarely in the non-taxable category we talked about earlier.

The only exception, which is pretty rare in workers' comp cases, is if a portion of your settlement is specifically set aside for something else, like punitive damages. If that happens, that specific part could become taxable.

What If My Settlement Check Mixes Taxable and Non-Taxable Money?

This isn't just common; it's the reality for most personal injury cases. The check you receive is almost always a blend of compensation—some for your tax-free physical injuries, and some for taxable things like lost wages.

This is exactly why the specific language in your settlement agreement is so critical.

Without clear, precise wording that allocates specific dollar amounts to each type of damage, the IRS has every right to challenge how you've categorized the funds. A well-drafted agreement is your best defense; it draws a clear line in the sand between what's taxable and what isn't.

Can I Deduct My Attorneys' Fees?

Here's where things have gotten tricky—and frankly, unfair—for many people. Thanks to the Tax Cuts and Jobs Act of 2017, the old rules were thrown out. For most personal injury cases today, you cannot deduct your attorney’s fees.

This sets up what’s often called a "tax trap." Let’s say you get a $100,000 settlement purely for taxable lost wages. Your attorney works on a 40% contingency fee, so they receive $40,000. You only pocket $60,000.

Here's the kicker: The IRS forces you to report the entire $100,000 as income, but won't let you deduct the $40,000 you paid your lawyer. You end up paying taxes on money that never even touched your bank account. This harsh reality makes it absolutely essential to understand the taxes on a settlement from the very beginning.

Navigating the financial aftermath of an injury is complex, and you shouldn't have to do it alone. At CAINE LAW, we fight to maximize your recovery and provide the clear guidance you need to protect it. In pain? Call Caine. Get your free consultation today.