In Pain? Call Caine

Statute of limitations negligence florida: Florida Negligence Deadline Explained

5 Min read

By: Caine Law

Share

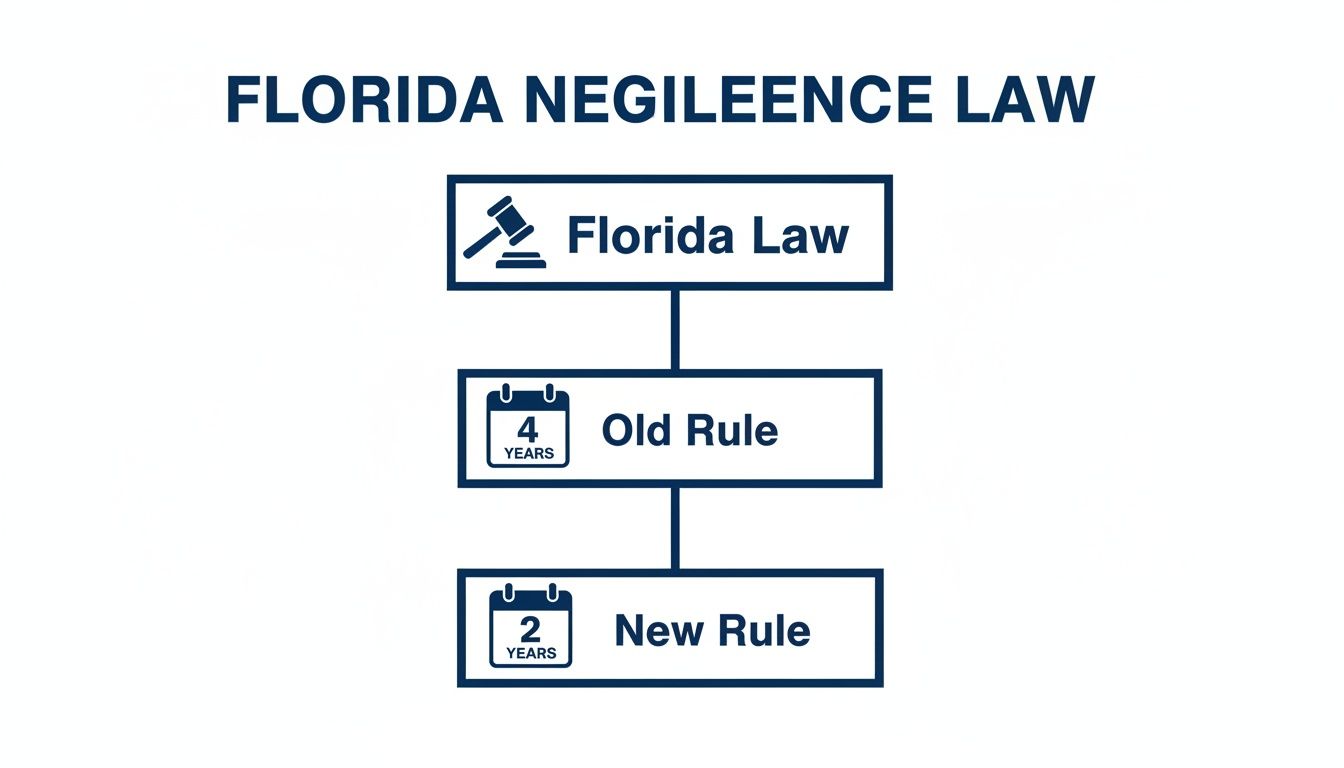

In Florida, the clock starts ticking the moment you're injured due to someone else's carelessness. For a long time, you had four years to file a lawsuit. That felt like a reasonable amount of time. But things have changed—and not in your favor.

The window to seek justice has been slammed shut to just two years. This is a massive shift that affects anyone harmed by another's negligence, and acting fast is now more critical than ever.

The New Two-Year Deadline for Florida Negligence Claims

Think of it like a countdown timer. That four-year timer you thought you had? It's been cut in half. This isn't some minor legal technicality; it’s a fundamental change to your rights after an injury in Florida.

This shortened two-year deadline applies to a huge range of incidents that fall under the umbrella of negligence. In legal terms, that just means someone had a responsibility to act with reasonable care, they failed to do so, and you got hurt as a result.

What Does Negligence Look Like in the Real World?

Negligence isn't just a stuffy courtroom term. It's the real-world reason behind injuries that leave people facing stacks of medical bills and an uncertain future. Here are a few common examples that now fall under this tight two-year rule:

Car & Motorcycle Wrecks: A distracted driver texting blows through a red light and causes a serious collision.

Slip and Falls: A store manager ignores a puddle on the floor, and a customer slips, fracturing their hip.

Negligent Security: An apartment complex owner knows about crime in the area but fails to fix broken locks or lights, and a tenant is attacked.

Dangerous Products: A defectively designed ladder collapses, causing the user to fall and suffer a severe back injury.

In every one of these situations, someone dropped the ball on their duty to keep others safe. These are the exact kinds of cases we at CAINE LAW fight for every single day.

Florida’s Recent, Drastic Change

The game changed completely when Florida lawmakers passed House Bill 837. This new law officially slashed the statute of limitations for negligence claims in Florida from four years down to two.

This change kicked in on March 24, 2023, and it applies to any negligence-based injury that happened on or after that date. If you'd like to dig into the legislative side of things, you can review the details of Florida's recent legal reform.

The image below shows just how dramatic this shift is.

As you can see, the time you have to file a claim has been sliced in half, which creates a real sense of urgency for anyone who's been injured.

That two-year clock starts the moment the incident happens—not when you feel up to calling a lawyer. If you wait too long, the courthouse doors can be shut to you forever, no matter how strong your case is. The single most important thing you can do is understand this timeline and protect your rights. In pain? Call Caine.

How Deadlines Differ for Specific Negligence Claims

While Florida’s new two-year negligence deadline is the general rule, it’s definitely not a one-size-fits-all timeline. The specific facts of your case matter, big time. Why? Because different types of negligence claims have their own unique triggers for when the legal "clock" officially starts ticking. Getting this wrong can be a fatal mistake for your right to seek compensation.

Think of it like setting different timers in a kitchen. The timer for a quick-sear steak is a lot shorter than the one for a slow-braised roast. In the same way, Florida law sets distinct starting points for car wrecks, medical errors, and defective products, each based on the nature of the harm.

General Personal Injury Claims

This is the catch-all category for many of the injuries people suffer in their day-to-day lives because of someone else's carelessness. We're talking about things like car accidents, motorcycle collisions, or a nasty slip-and-fall on someone else's property.

For these common personal injury claims, the rule is pretty straightforward: the two-year clock starts running on the date of the incident that caused your injury.

Example 1: Car Accident: You’re rear-ended on the Palmetto Expressway on May 1, 2024. Your deadline to file a lawsuit is May 1, 2026. Simple as that.

Example 2: Premises Liability: You slip on a puddle in a Kendall grocery store on July 10, 2024. Your filing deadline would be July 10, 2026.

The moment the accident happens is the moment your legal window opens—and starts to close. With thousands of crashes on Florida highways every year, this timeline is absolutely critical to understand.

Medical Malpractice Claims

Medical malpractice cases are a different beast entirely. They're far more complex because the harm from a doctor's mistake might not show up right away. You could leave a hospital feeling fine, only to discover months later that a surgeon left a sponge inside you or a misdiagnosis allowed a treatable condition to become terminal.

Because of this hidden danger, Florida law gives you a slightly different starting point.

For medical malpractice, the two-year clock generally starts ticking from the date the malpractice was discovered or should have been discovered with reasonable care. This is what we call the "discovery rule."

But there’s a catch—a big one. Florida also has a "statute of repose," which acts as a hard stop. It typically prevents you from filing a medical malpractice claim more than four years from the date the error actually happened, no matter when you discovered it (though there are a few very narrow exceptions). This dual-timeline system makes these cases incredibly tricky to handle on your own.

Product Liability Claims

When a defective product hurts you, that claim falls under product liability. This could be anything from a faulty e-bike battery that catches fire to a poorly designed power tool that causes a serious injury.

Much like general personal injury, the statute of limitations for product liability is two years. The clock usually starts on the date the injury occurs.

However, the discovery rule can sometimes come into play here, too. If the connection between your injury and the faulty product isn't immediately obvious, the clock might start when you reasonably figure out that the product was the root cause of your harm.

Wrongful Death Claims

Losing a loved one is a devastating experience, and the law gives surviving family members a way to seek justice through a wrongful death claim. These cases have their own distinct and unforgiving deadline.

The statute of limitations for a wrongful death claim in Florida is two years.

This is one of the most misunderstood timelines in all of personal injury law. The clock does not start on the date of the accident or the negligent act. It starts on the date of the person's death.

An Example to Make It Clear

Let's walk through a scenario:

The Crash: On January 15, 2024, a truck runs a red light and hits a bicyclist, who is rushed to the hospital with catastrophic injuries.

The Fight for Life: The victim bravely fights for three months but tragically passes away from their injuries on April 15, 2024.

The Deadline: The two-year statute of limitations for the family's wrongful death lawsuit begins on April 15, 2024—the date of death. Their absolute deadline to file is April 15, 2026.

This distinction is crucial. The date of the original crash becomes irrelevant for the wrongful death claim's timeline. Waiting too long, even while grieving, can permanently shut the door on holding the at-fault party accountable. Each case has its own rhythm, and knowing which one applies to you is the first step toward protecting your family. In pain? Call Caine.

Critical Exceptions That Can Pause or Extend Your Deadline

What happens if you glance at the calendar and realize the two-year mark for your injury is right around the corner—or worse, it’s already passed? It’s a gut-wrenching feeling, but it doesn’t automatically mean your case is over. Florida law gets that life is messy and not all injuries show up on a convenient schedule. This is where legal exceptions, known as tolling, come into play.

Tolling is just the legal term for "pausing the clock" on your statute of limitations. Think of it like hitting the pause button on a stopwatch. Certain circumstances can temporarily stop that two-year countdown, giving you the extra time you need to pursue justice. These exceptions are complex and very specific, but understanding them can sometimes reveal a path to compensation you thought was lost for good.

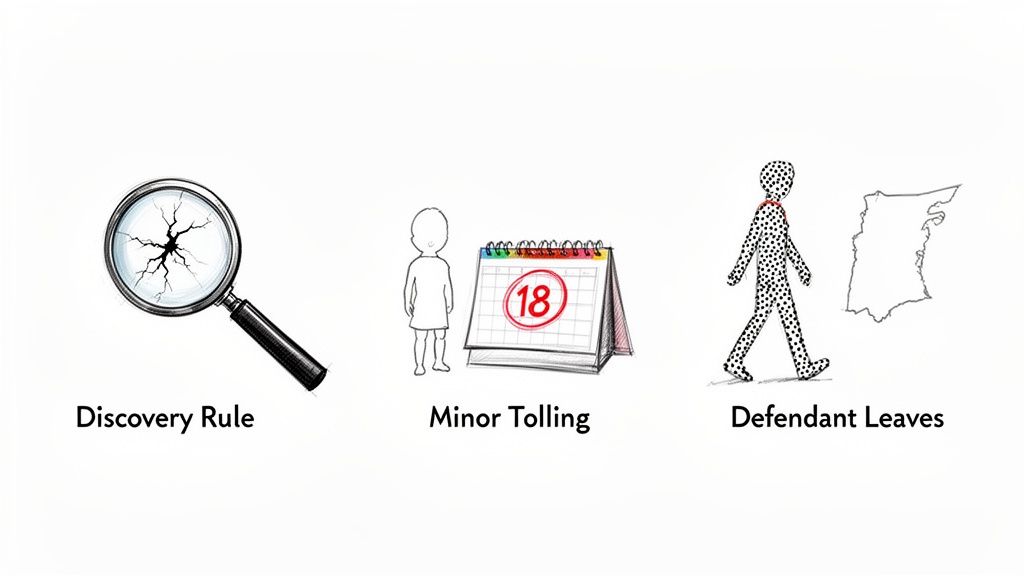

The Discovery Rule: Uncovering Hidden Injuries

One of the most powerful exceptions is the Discovery Rule. It’s designed for situations where an injury isn’t immediately obvious. The harm might be internal, slow to develop, or its connection to someone else's negligence might be unclear at first.

Imagine you buy a new home appliance. On the day of installation, everything seems fine. But six months down the road, a hidden electrical defect causes a fire, injuring you and damaging your home. When did your injury really happen? Was it the day of installation, or the day the fire broke out?

The Discovery Rule clears this up. It says the statute of limitations clock doesn't start ticking when the negligent act happened, but when the injury was discovered or reasonably should have been discovered. In our appliance example, your two-year window would begin on the date of the fire, not the installation date six months earlier.

This rule is a game-changer in many negligence cases where the damage isn't immediately apparent.

Tolling for Minors: Protecting the Vulnerable

Children injured due to negligence get special protection under the law. It’s completely unreasonable to expect a minor to understand their legal rights, find an attorney, and file a lawsuit. Because of this, Florida law typically tolls the statute of limitations for an injured child.

The clock on their claim is often paused until they reach the age of majority. In most cases, this means the two-year deadline for a personal injury claim doesn't start running until their 18th birthday. This ensures they have a fair shot at pursuing their case once they are a legal adult.

Example: A 12-year-old is injured in a serious slip-and-fall at a theme park. The statute of limitations is paused. On their 18th birthday, the two-year clock begins, giving them until their 20th birthday to file a lawsuit.

When a Defendant Goes Into Hiding

Justice requires holding the person responsible for your injury accountable. But what if they try to dodge that responsibility by fleeing the state or actively concealing where they are? Florida law prevents a defendant from running out the clock by simply disappearing.

If the at-fault party leaves Florida or goes into hiding to avoid being served with a lawsuit, the statute of limitations can be tolled. The clock is paused for the time they are absent or concealed and only starts back up when they return or can be located. This rule ensures that a defendant's attempts to game the system don't end up penalizing the person they injured.

Understanding these exceptions is not just a legal exercise; it's a critical step in protecting your rights. The difference between a valid claim and a lost opportunity often lies in the details of tolling and the Discovery Rule.

The two-year statute of limitations under Florida's updated negligence laws includes key exceptions like the discovery rule, which can shift the starting point from the injury date to when you reasonably should have known about the harm, offering critical relief in delayed-impact cases. Tolling provisions further pause the timer for minors, incapacitated plaintiffs, or when defendants flee the state, which proved vital in 12% of negligence cases reviewed in recent Florida circuit court statistics. You can learn more about these time limit exceptions for negligence claims in Florida and see how they apply in real-world scenarios.

Figuring out if an exception applies to your case is not something you should ever try to do alone. The rules are intricate, and a miscalculation can be devastating. An experienced attorney can analyze the unique facts of your situation, identify any applicable tolling provisions, and fight to preserve your right to file. Never assume your time has run out without a professional legal evaluation. In pain? Call Caine.

The Permanent Consequences of Missing Your Filing Deadline

Missing the deadline to file your lawsuit isn't a small mistake you can just fix later. It's a fatal blow to your case. This isn't a rule with wiggle room or second chances. Once that two-year window slams shut, the courthouse doors are permanently locked for your claim, no matter how obvious the negligence was or how severe your injuries are.

Think of your legal claim as a key designed to open the courthouse doors. That key only works for a limited time. The day your deadline passes, the lock is changed forever. Your key, which once fit perfectly, is now completely useless.

Your Right to Compensation Is Extinguished

I can't overstate how final this rule is. When you miss the filing deadline, your legal right to recover a single dime is extinguished—gone for good.

This means you lose the ability to get payment for everything, including:

All your past and future medical bills from the injury.

Lost wages from being out of work.

Reduced earning potential if you can no longer do your old job.

The incredible physical pain and emotional trauma you've been forced to endure.

It all just vanishes. The person or company responsible for your suffering gets off scot-free, and you're left holding the bag for all the financial and personal fallout.

How Insurance Companies Exploit Delays

Insurance companies and their lawyers have this calendar memorized. They know the statute of limitations for negligence in Florida down to the exact day, and they absolutely use it as a weapon against people trying to handle things on their own.

An adjuster might act like your best friend, promising a fair settlement is just around the corner. They may ask for endless paperwork or drag out talks for months, all while reassuring you they're working hard on your claim. These are often very deliberate delay tactics.

Their goal is simple: keep you talking and waiting until your time to file a lawsuit expires. Once that happens, their legal obligation to pay you anything—even a dollar—disappears. They can legally deny your claim and walk away, leaving you with nothing.

This predatory strategy shows just how dangerous it is to wait. The insurance company isn't on your side; their goal is to protect their profits by paying you as little as they possibly can.

To protect yourself, you have to be proactive. The moment you're hurt, a clock starts ticking—not just on your legal rights, but on the insurance company's strategy to run you out of time. Don't let their stall tactics become your permanent loss. An experienced attorney forces them to negotiate in good faith and makes sure your lawsuit is filed long before this critical deadline even becomes a concern. Don't let a delay tactic cost you everything. In pain? Call Caine.

What To Do to Protect Your Claim After an Injury

It's completely normal to feel scattered and overwhelmed after an accident. But what you do in the first few minutes, hours, and days is absolutely critical for protecting your legal rights, especially with Florida’s tight two-year deadline breathing down your neck. The focused steps you take right now will build the foundation for a strong case later on.

Think of it like being the lead detective at your own crime scene. You need to secure the area and gather the evidence to piece together what happened. This guide breaks down exactly what you need to do.

Step 1: See a Doctor Immediately

Your health is, and always will be, priority number one. Even if you feel okay or think your injuries are minor, you need to get checked out by a doctor right away. Serious issues like internal bleeding or a traumatic brain injury don't always show symptoms right away.

Why This Matters: Getting prompt medical care creates an official, time-stamped record that ties your injuries directly to the incident. This documentation becomes the irrefutable proof that shuts down an insurance company's favorite argument—that you weren't really hurt or that your injuries came from something else entirely.

Step 2: Document Absolutely Everything

Evidence is the heart and soul of any personal injury claim. In the moments right after it happens—before anything is cleaned up, moved, or forgotten—you are in the perfect position to capture the truth.

Your documentation checklist should include:

Photos and Videos: Snap pictures of everything from every possible angle. This means your injuries, any property damage, the entire accident scene, and specific hazards like a wet floor or a broken handrail.

Witness Information: If anyone saw what happened, get their full name and phone number. A good witness can be incredibly powerful in backing up your side of the story.

Official Reports: If the police, a store manager, or a property owner created an incident report, make sure you get a copy of it or at least the report number.

By gathering all this evidence, you're not just taking pictures—you're creating a permanent, factual record of the negligence that caused your pain. This one step can literally make or break your ability to get fair compensation down the road.

For a more detailed walkthrough, you can learn more about how to document evidence needed for a personal injury claim in FL in our in-depth guide.

Step 3: Don't Give a Recorded Statement to the Insurance Adjuster

It won’t take long for the other party’s insurance adjuster to call you. They will likely sound friendly, concerned, and helpful. Don't be fooled. Their only job is to protect their company's profits by paying you as little as possible. They will almost certainly ask for a recorded statement.

You should politely but firmly say no.

Why This Matters: Adjusters are masters at asking tricky, leading questions designed to trip you up. An innocent comment like, "I'm feeling a little better today," can be twisted and used to argue your injuries aren't that serious. Anything you say in that recording can, and absolutely will, be used against you.

Step 4: Call a Personal Injury Attorney Right Away

This is the single most important thing you can do. Trying to navigate the statute of limitations for negligence in Florida while you're in pain and fending off insurance companies is not a fair fight. An experienced attorney takes over, shields you from common traps, and makes sure every single deadline is met.

Don't wait until you feel better or until the insurance company dangles a lowball offer. The clock started ticking the second you were hurt, and every day you wait is another day the other side is using to build their case against you. Taking this step ensures your rights are protected from the very beginning. In pain? Call Caine.

Why You Need an Experienced Attorney to Secure Your Claim

Trying to navigate Florida’s statute of limitations on your own is like walking through a legal minefield blindfolded. With a two-year deadline staring you down, there is absolutely no room for error. Thinking of this as a DIY project is a gamble you can't afford to take; getting an experienced legal team on your side isn't a luxury, it's a necessity.

From the moment you hire Caine Law, we get to work. Our team immediately launches a full-scale investigation into your accident, moving fast to preserve crucial evidence before it’s lost forever. We track down witnesses for statements, get our hands on official reports, and document the scene—all the building blocks of a solid negligence case.

It's More Than Just Filing Paperwork

A great attorney does so much more than just beat a deadline. We dive deep into calculating the true scope of your damages, a complex process that accounts for future medical bills, lost earning potential, and the real-world impact on your quality of life. This is how we make sure you're demanding what you are actually owed, not just the lowball number an insurance company wants to pay.

Our team has been doing this for decades. We know how to prepare and file every necessary legal document correctly and well ahead of schedule. One tiny mistake in following the intricate rules of civil procedure can put your entire case in jeopardy, and that's a risk we never take.

Our founding attorney used to work for the insurance companies. We know their playbook because we helped write it. This insider knowledge gives us a powerful edge, allowing us to anticipate their tactics and build a case designed to dismantle their arguments.

Your Advocate and Your Shield

With Caine Law in your corner, you can finally put your energy where it belongs: on your recovery. We take over all communications with insurance adjusters, shielding you from their high-pressure tactics while we aggressively negotiate for you. And if they refuse to offer a fair settlement, we are always prepared to take the fight to court.

Your free consultation is the first critical step toward protecting your rights with proven advocates. To see how we can help with your specific situation, learn more about our firm's approach to personal injury cases in Florida.

Don't wait until the clock is about to run out. The single best way to secure your claim is to act decisively. In pain? Call Caine.

Your Top Questions About Florida's Negligence Deadlines, Answered

The aftermath of an injury is a confusing time, and Florida's unforgiving legal deadlines can make a stressful situation even worse. We get a lot of questions about this, so here are some quick, clear answers to the ones we hear most often.

What if My Accident Happened Before the Law Changed in March 2023?

This is a big one. If you were injured before the new law went into effect on March 24, 2023, the older four-year statute of limitations for general negligence probably applies to your case.

But don't just assume you have that much time. The way these laws are interpreted can get tricky, especially around the changeover date. The only way to know your exact deadline for sure is to have an experienced attorney review the specific facts of your situation.

Does Talking to an Insurance Adjuster Pause the Deadline?

No. Absolutely not. This is one of the most dangerous myths out there.

Speaking with an insurance adjuster or negotiating a settlement does not stop the clock on your statute of limitations. The legal deadline keeps ticking, no matter what they promise you on the phone. Some adjusters might even intentionally drag out the conversation, hoping you'll miss your window to file. Once that deadline passes, they have zero legal obligation to pay you a dime. You have to file a formal lawsuit before the deadline expires, regardless of any settlement talks.

Are the Rules Different for Claims Against the Government?

Yes, and this is critical. If you're trying to file a claim against a government entity in Florida—like a city, county, or state agency—you're playing by a completely different and much stricter set of rules. This area of law is governed by what's called "sovereign immunity."

These cases have much shorter deadlines. You are often required to file a formal written notice of your claim within a very short timeframe, long before the regular statute of limitations is up. If you don't follow these complex notice procedures to the letter, your claim can be permanently denied before it even gets off the ground. If a government body might be at fault for your injury, you need to contact an attorney immediately.

Don't let a legal deadline rob you of your right to justice. The team at CAINE LAW is ready to evaluate your case and protect your claim. For a free, no-obligation consultation, visit us at https://cainelegal.com. In pain? Call Caine.