In Pain? Call Caine

Stacked vs Unstacked Uninsured Motorist Coverage a Clear Guide

5 Min read

By: Caine Law

Share

When you’re setting up your car insurance, you’ll come across a choice that has huge implications for your financial safety: stacked vs unstacked uninsured motorist coverage. At first glance, it might seem like a minor detail, but this decision can dramatically change how much you’re protected if an uninsured or underinsured driver hits you.

Let's break down exactly what this means for you and your family.

What Is the Difference Between Stacked and Unstacked Coverage?

Uninsured/Underinsured Motorist (UM/UIM) coverage is your personal safety net. It steps in to cover your medical bills, lost income, and other damages when the person who caused the crash either has zero insurance or not nearly enough to cover the harm they’ve caused. The real question is, how big is that safety net? That’s where stacking comes in.

The Stacking Multiplier Effect

Think of unstacked UM coverage as a single, fixed amount of protection. Let's say you have $50,000 in unstacked UM and insure three cars on your policy. If you're in a serious accident, the absolute most you can recover from your own policy is $50,000. The fact that you pay to insure three vehicles doesn't change a thing.

Now, let's look at stacked UM coverage. This is where things get interesting. Stacking lets you multiply your coverage by the number of vehicles on your policy. With the same three cars and $50,000 coverage limit, stacking combines those limits. Your potential recovery just jumped from $50,000 to a much more substantial $150,000 ($50,000 x 3 cars).

That difference can be life-changing, covering devastating medical bills and lost wages that the lower limit wouldn't even touch.

Stacked vs Unstacked Coverage at a Glance

This table makes the difference crystal clear. See how the same policy can offer drastically different levels of protection based on one simple choice.

Coverage Type | How It Works | Example Limit ($50k/Car, 3 Cars) |

|---|---|---|

Unstacked UM | A single, fixed limit applies per accident, no matter how many cars are on the policy. | $50,000 |

Stacked UM | The coverage limit is multiplied by the number of insured cars, creating a larger combined pool. | $150,000 |

As you can see, stacking creates a much deeper pool of funds to draw from when you need it most.

Why This Choice Matters

Deciding between stacked and unstacked coverage is one of the most important decisions you'll make about your auto insurance. It’s not just about policy jargon; it’s about your financial survival after a bad accident. A crash with an uninsured driver can leave you with a mountain of medical debt and no way to support your family.

Stacked coverage is designed to provide a more substantial shield against the worst-case scenario. While it comes at a slightly higher premium, the exponential increase in protection can be invaluable when you need it most.

If you’ve been hurt in an accident and are fighting with the insurance company, you don’t have to do it alone. Insurers often look for ways to limit their payout, making it incredibly difficult to get the full compensation you’re owed. An experienced attorney can step in, protect your rights, and make sure your policy is used the way it was intended. In pain? Call Caine.

How Insurance Stacking Actually Works

It's one thing to hear the definition of stacked coverage, but it's another thing entirely to see how it can literally multiply your financial protection when you're hurt. At its heart, stacking is simply a way to combine the Uninsured/Underinsured Motorist (UM/UIM) coverage from multiple vehicles to create a much bigger financial safety net. This isn't just a small tweak to your policy; it fundamentally changes how much help you can get when you need it most.

How you can stack depends on state law and what your specific insurance company offers, but it generally works in one of two ways.

Stacking Within a Single Policy

The most common way people stack their coverage is within a single policy. This is for folks who insure more than one vehicle on the same auto policy. When you choose to stack, you’re essentially pooling the UM coverage from each car into one large sum.

Let’s walk through a real-world scenario to see what a dramatic difference this makes.

Example: Stacking with Multiple Cars on One Policy

Your Policy: You have three family cars all insured on one policy.

Your UM Coverage: You selected a $50,000 per person UM limit for each of those vehicles.

The Accident: An uninsured driver blows through a red light and hits you, leaving you with $120,000 in medical bills and lost income.

If your policy was unstacked, your recovery would be capped at $50,000. Period. That leaves you on the hook for a crippling $70,000 shortfall.

But with stacking, you combine the limits: $50,000 (Car 1) + $50,000 (Car 2) + $50,000 (Car 3) = a total of $150,000 in available coverage. Suddenly, you have more than enough to cover your entire $120,000 in damages.

Stacking Across Separate Policies

While a bit less common, some states allow you to stack across policies. This lets you combine UM/UIM limits from separate insurance policies within your household. For instance, if you have your own auto policy and your spouse has another, this provision might let you combine the UM coverage from both.

It's an extra layer of protection that can be a lifesaver for families that have cars insured with different companies or on separate plans.

When stacking is allowed, you can often increase your available recovery by 200–400%. That difference is critical when you learn that roughly one in seven drivers on the road has no insurance at all. You can read up on the latest uninsured motorist statistics on iii.org.

The Real-World Financial Impact

The choice between stacked vs. unstacked coverage has a massive, real-world effect on your ability to put your life back together after a crash. When medical bills are piling up and you can’t go back to work, the difference between a $50,000 limit and a $150,000 limit can be the difference between financial ruin and a secure recovery.

Think of stacked coverage as an investment in a much stronger financial backstop. It’s an acknowledgment of the harsh reality that a lot of drivers can’t pay for the damage they cause. That slightly higher premium you pay for stacking translates directly into a significantly larger benefit when it matters.

Of course, insurance companies don't always make it easy to get what you paid for. They might try to downplay your injuries or argue about how your stacked limits apply to minimize what they have to pay. If you've been hurt and you're getting the runaround from an insurer, you need an advocate who knows how to make them honor the policy you paid for. In pain? Call Caine.

Understanding State-Specific Stacking Rules

The option to stack your uninsured motorist (UM) coverage isn't a universal right; it's a privilege granted or denied by state law. Whether you can even choose between stacked vs unstacked uninsured motorist coverage depends entirely on where you live. This geographic lottery means the first step in making an intelligent decision is to understand the rules of the road in your own state.

Across the U.S., state laws on insurance stacking generally fall into one of three buckets. Some states are pro-consumer, mandating that insurers offer stacked coverage—often making it the default unless you specifically reject it in writing. Others take a middle-of-the-road approach, allowing stacking as an optional upgrade you can purchase for a higher premium. And then there's the third group, which prohibits stacking entirely, leaving you with a single, unstacked limit.

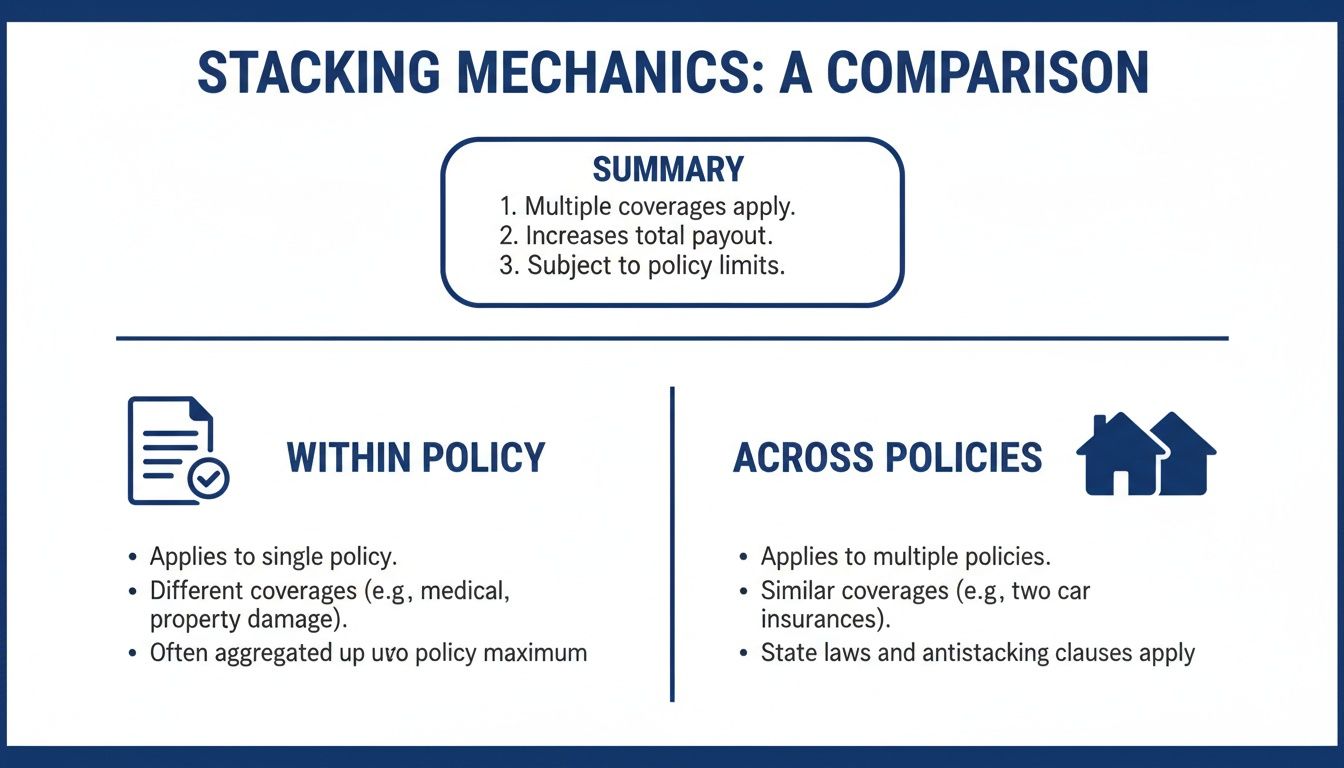

This diagram offers a great visual breakdown of how stacking works when your state allows it.

As you can see, you can either stack the limits for multiple cars on one policy or, in some cases, combine the coverage from separate policies within your household. It all comes down to your state's specific rules.

Florida A Key Case Study

Florida is a perfect example of why state laws and local driving conditions make stacking such a critical choice for drivers. In the Sunshine State, insurers are legally required to offer stacked UM coverage by default if you have more than one vehicle on your policy. To get the cheaper, unstacked version, you have to formally reject stacking by signing a specific form from your insurance company.

This "opt-out" system is a consumer protection measure. It forces insurers to make you aware of the better coverage before you agree to less. When you think about Florida's packed roads, constant stream of tourists, and alarmingly high number of uninsured drivers, the value of having a bigger pool of money to draw from after a wreck becomes crystal clear.

The decision to stack is more than just a policy detail; it's a strategic response to local risk. In states with a high prevalence of uninsured drivers, stacked coverage acts as a vital financial buffer against catastrophic loss.

The logic here is painfully simple: the more uninsured drivers on the road, the higher the odds you’ll be the one left holding the bag for your own medical bills after a crash.

Why Your State Matters So Much

The percentage of uninsured drivers varies wildly from state to state, which directly impacts how valuable stacked coverage really is. In 2023, for example, the uninsured motorist rate was as low as 5.7% in Maine but skyrocketed to nearly 28% in Mississippi. States like Florida, New Mexico, and Washington, D.C., all have rates hovering over 20%. That means more than one in five drivers you pass has no insurance.

In these high-risk states, the probability of being hit by someone without coverage is dangerously high, making a strong case for stacking your UM limits to cover potentially life-altering injuries. When complex insurance disputes arise over these policies, knowing your rights is your best defense.

These stark differences force state legislatures to constantly walk a tightrope between protecting consumers and keeping insurance costs down. In places with a lot of uninsured drivers, the pressure is on to allow stacking so that innocent victims aren't bankrupted by medical bills and lost income. That’s why understanding your state's stance on the stacked vs unstacked uninsured motorist debate is the first and most critical step in protecting yourself and your family. If you're hurt and your insurer is giving you the runaround on your stacked coverage, it might be time to get some legal muscle on your side. In pain? Call Caine.

When it comes to stacked versus unstacked uninsured motorist coverage, the decision really boils down to one simple question: Is the extra protection worth a slightly higher premium?

There’s no one-size-fits-all answer. It forces you to take a hard, honest look at your personal risk, your financial situation, and exactly what you stand to lose if you’re seriously hurt in an accident.

Try to think of stacked coverage less as an expense and more as an investment in your family’s financial security. That higher premium is a direct reflection of the insurance company’s increased risk—they know they could be on the hook for a much bigger payout if a serious crash happens. You’re essentially paying a little more now for the peace of mind that a much deeper pool of money will be there if you ever need it.

How to Assess Your Personal Risk Profile

To make a smart decision, you need to do a quick personal risk assessment. Your daily life and circumstances are what truly dictate your level of exposure to uninsured or underinsured drivers. Start by asking yourself a few key questions:

How many vehicles does your household insure? The more cars on your policy, the more powerful stacking becomes. A family with three or four vehicles can create a very substantial financial safety net.

What’s your daily commute like? If you spend hours every week stuck in heavy city traffic or navigating dangerous highways, your risk of a crash is just naturally higher.

Who is actually covered by your policy? If you have young, inexperienced drivers or several family members constantly on the road, your household's overall risk profile goes up.

What are the driving conditions where you live? In a state like Florida, with its notoriously high rate of uninsured drivers, the odds that the at-fault driver won't have the insurance to cover your injuries are significantly higher.

The grim reality is that the number of unprotected drivers is alarmingly high. By 2023, the combined share of uninsured and underinsured drivers in the U.S. ballooned to roughly one-third of all motorists. That means your chance of getting hit by someone with inadequate coverage is far from a long shot, which makes the cost-benefit analysis of stacking a very serious consideration. You can dig into more of these auto insurance trends over at ConsumerAffairs.com.

Who Really Benefits from Each Option?

The true value of stacking becomes crystal clear when you look at specific, real-world situations. For some drivers, stacked coverage is almost a necessity. For others, going with unstacked might be a calculated risk they’re willing to take.

Stacked coverage is usually the smarter choice for:

Multi-car families: This is the core benefit of stacking. The ability to multiply your coverage across two, three, or even more vehicles is a game-changer.

People with high-deductible health insurance: If a major accident would saddle you with thousands in out-of-pocket medical bills, stacked UM can be the policy that fills that gap and saves you from financial ruin.

The primary earner in a household: If you can't afford to be out of work for a long period, the higher limits from stacked coverage provide a crucial financial buffer to keep your family afloat.

Unstacked coverage might be considered by:

Single-vehicle owners: Since you don't have another vehicle's policy to "stack," this is your only option.

Drivers with exceptionally strong health and disability insurance: If you already have excellent coverage that would handle the vast majority of medical bills and lost wages, you might feel the extra UM protection isn't as critical.

In the end, it’s a tradeoff. You’re balancing a predictable, modest increase in your premium against the unpredictable, potentially catastrophic financial loss of a major accident. It’s about buying peace of mind.

No matter which option you choose, just know that insurance companies can be incredibly difficult to deal with after a crash. They often try to downplay your injuries or find loopholes in your policy to limit their payout. If you’ve been hurt and find yourself in a fight to get the compensation you rightfully deserve, having an experienced attorney in your corner is essential. In pain? Call Caine.

How to Review Your Policy and File a Claim

It’s one thing to understand the difference between stacked and unstacked uninsured motorist coverage in theory. It's another thing entirely to know what your own policy actually says. You have to know where you stand before an accident happens. That means it's time to dig into your insurance documents and get familiar with the claims process, just in case you ever need this critical protection.

This isn't just about reading the fine print. It’s about arming yourself with the knowledge to fight for your rights, whether you're adjusting your coverage now or demanding a fair settlement later.

Locating Stacking Language on Your Policy

Your auto insurance policy can feel like a mountain of paperwork, but the key document you need is the declarations page. This is usually the first page or two, and it serves as a high-level summary of your coverages, limits, and premiums.

Scan the page for the section on Uninsured/Underinsured Motorist (UM/UIM) coverage. The language here should tell you whether your coverage is stacked or unstacked.

Keep an eye out for specific terms like:

"Stacked Bodily Injury": This is a clear confirmation that you have stacked coverage.

"Unstacked Bodily Injury": This tells you the opposite—your coverage is unstacked.

"Rejection of Stacked Coverage": In states like Florida, you might even find a specific form or line item confirming that you actively signed away your right to stack.

If the wording is confusing or vague, don't leave it to chance. Pick up the phone, call your insurance agent, and ask for a direct, written confirmation of your stacking status.

Modifying Your Coverage with Your Insurer

So, what happens if you pull out your policy and discover you have unstacked coverage when you’d rather have the superior protection of stacking? Fortunately, making the change is usually pretty simple.

Contact Your Agent: Give your agent a call or send an email. State clearly that you want to switch your unstacked UM coverage to stacked UM coverage.

Request a Quote: Ask what the exact premium difference will be. Many people are surprised to learn how affordable the extra protection really is.

Complete the Paperwork: Your insurer will probably send over a new declarations page or an endorsement form for you to sign. Read it over carefully to make sure it correctly shows the change to stacked coverage.

Don’t wait until after a crash to find out your coverage isn't what you thought. A five-minute call to your agent today can prevent a devastating financial disaster tomorrow.

The Steps for Filing a UM Claim

If the worst happens and you're injured by an uninsured or underinsured driver, filing a claim is your next move. Every situation has its own quirks, but the process generally follows the same basic path.

Report the Accident Immediately: Call 911 to get the police to the scene and make sure an official report is filed. This document is crucial for proving the other driver was at fault and uninsured.

Notify Your Insurer: Contact your own insurance company as soon as you can to open a UM claim. Have the accident report number and details of the collision ready.

Document Everything: This part is critical. Keep meticulous records of all medical appointments, bills, lost income, and every conversation you have with the insurance company. This evidence forms the backbone of your claim.

Submit a Demand: Once you have a handle on the full extent of your damages, you or your attorney will send a formal demand letter to your insurer. This letter will outline your losses and request payment up to your policy limits.

Knowing the first steps to take after an accident is vital. For a more detailed guide, check out our post on what to do when accidents happen. The aftermath of a crash is chaotic, but having a solid plan helps you protect your rights from day one.

Remember, even your own insurance company may put up a fight. They might question how bad your injuries are, argue about how your stacked limits apply, or just throw a lowball settlement offer your way. If you meet any resistance at all, it's a clear signal that you need a legal professional in your corner to fight for the full compensation you’re owed. In pain? Call Caine.

When You Should Contact a Personal Injury Attorney

Trying to make sense of things after a car wreck is overwhelming, especially when you find out the other driver has no insurance. You might think your own insurance company will have your back and pay what you’re owed, but sadly, that's often not how it plays out. The whole process can quickly turn into a fight, and knowing when to call in legal backup is everything.

Some situations are giant red flags telling you it's time to get an experienced advocate on your side. If your insurance company is lowballing your claim, dragging its feet without a good reason, or twisting the words of your own policy, you need professional help. These are classic tactics they use to pay out as little as possible.

When Your Injuries Are Severe

The single most important time to call an attorney is when you've been seriously hurt. If your medical bills, lost income, and other damages are getting close to or have already blown past your policy limits—especially a non-stacked limit—the financial stakes are sky-high. A good lawyer will turn over every stone to find all possible sources of compensation for you.

This is particularly true when navigating the thorny rules around stacked vs unstacked uninsured motorist benefits. Insurance companies love to argue over how your stacked limits should apply, all in an effort to slash their payout. An attorney who lives and breathes these policies will fight to make sure your coverage is calculated correctly and you get every dollar you're entitled to.

When an insurer unfairly denies or devalues your claim, they are putting their profits ahead of your well-being. A personal injury lawyer acts as your dedicated advocate, leveling the playing field and holding the insurance company accountable for the coverage you paid for.

When a Claim Is Unfairly Denied or Devalued

It’s a frustratingly common story: you file a completely valid UM claim, and your insurer either denies it flat-out or comes back with a settlement offer that’s just insulting. They might try to say your injuries aren't that bad or that some of your medical care wasn't "necessary."

This is not a battle you want to fight on your own. Insurance adjusters are professional negotiators, and their one and only job is to save the company money. They know the system like the back of their hand.

An attorney can shut down these tactics by:

Gathering and presenting powerful evidence of your injuries and all the money you've lost.

Bringing in medical experts to confirm the seriousness of your damages and what you'll need for future care.

Negotiating aggressively with the insurer, armed with a deep understanding of Florida insurance law.

If you’re stuck in a frustrating fight with your insurance company, you don’t have to go it alone. An experienced legal team can take over the entire process, freeing you up to focus on getting better. The world of personal injury law exists to protect people in exactly these kinds of situations, ensuring they get the full and fair compensation they deserve.

You paid your premiums for this protection. If your insurer won't hold up their end of the deal after you've been hit by an uninsured driver, it’s time to get a fighter in your corner. In pain? Call Caine.

Got Questions About Stacking UM? We've Got Answers.

When you're trying to figure out the difference between stacked and unstacked uninsured motorist coverage, a few key questions always seem to pop up. Let's clear the air with some straight-up answers to the things policyholders ask most.

"Can I Stack Coverage If I Only Have One Car on My Policy?"

The short answer is no. Stacking is a feature built specifically for people who insure more than one vehicle. Think of it this way: the whole point of stacking is to combine the UM limits from multiple cars to build a bigger safety net.

If you only have one car insured, there are no other policies to "stack" on top of it. Your coverage limit is simply what's written on your declarations page.

"Realistically, How Much More Is This Going to Cost Me?"

This is the big one, right? The cost difference between stacked and unstacked coverage can change depending on your state, your insurance company, and how high you set your limits. But honestly, most drivers are pleasantly surprised to learn how little it costs to get a massive boost in protection.

The only way to know for sure is to get on the phone with your agent. Ask them to give you a side-by-side quote comparing the two options. When you see the actual dollar amounts, it makes the decision a lot easier and you can be confident you're making the right call for your budget.

"What If I'm Not in My Car? Does Stacking Still Cover Me If I'm a Passenger or Pedestrian?"

Yes, and this is a huge benefit that many people completely miss. In most states that allow it, your UM/UIM coverage is portable—it follows you, not the car.

That means your stacked UM protection is there for you even if you are:

Hurt as a passenger in your friend's car.

Hit by an uninsured driver while you're out for a bike ride.

Struck as a pedestrian just crossing the street.

Your stacked UM coverage is designed to protect you personally, no matter where you are. It's your financial backstop against an uninsured driver, regardless of what you were doing when the accident happened.

This "follows the person" feature is what makes stacked coverage such a powerful shield against financial ruin after a bad accident. Getting this part of your policy right is one of the single most important things you can do to protect your financial future.

Knowing what your auto insurance says is step one. Forcing the insurance company to honor it after a serious accident is a whole different fight. If you’re hurt and the insurer is giving you the runaround, let CAINE LAW take over. In pain? Call Caine.