In Pain? Call Caine

Stacked vs Unstacked Auto Insurance in Florida Explained

5 Min read

By: Caine Law

Share

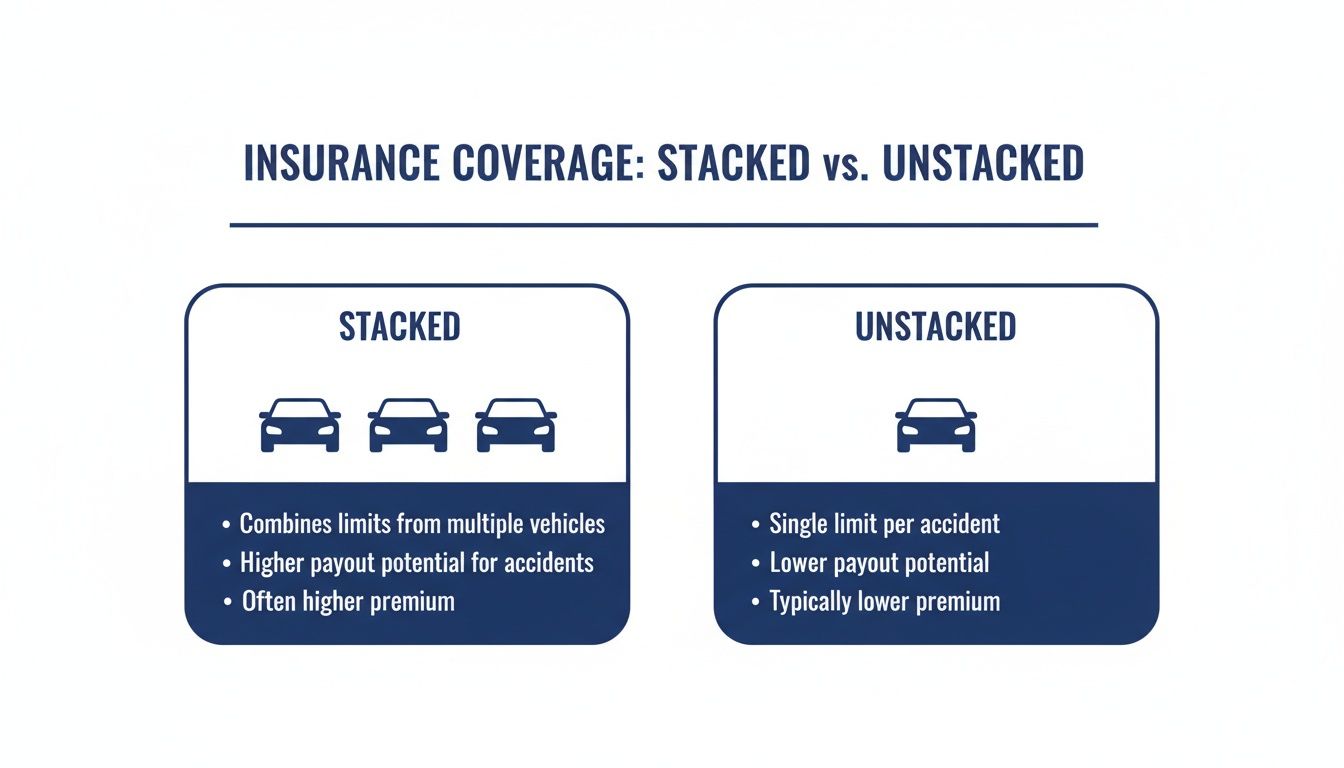

The real difference between stacked and unstacked auto insurance boils down to simple math. Stacked coverage lets you combine the Uninsured/Underinsured Motorist (UM) limits from multiple vehicles, creating a much larger pool of money to draw from. On the other hand, unstacked coverage restricts you to the limit on just one vehicle. Your choice here directly impacts the financial safety net you'll have after a crash with an underinsured driver.

Understanding Your Florida UM Coverage Options

When you buy Uninsured/Underinsured Motorist (UM) coverage in Florida, you're essentially buying peace of mind. This coverage protects you and your family when you're hit by a driver who doesn't have enough insurance to pay for the damage they've caused. The choice between stacking or not stacking that coverage determines just how much protection you can actually access.

Stacked insurance is a powerful feature that lets you multiply your coverage limits. If you have more than one car on your policy, you can combine—or "stack"—the UM limits for each one. This creates a much bigger fund for your medical bills, lost income, and other serious damages.

Unstacked insurance keeps things separate. Even if you insure three cars, you can only use the UM limit tied to the specific vehicle you were in during the crash. This option usually comes with a lower premium, but that savings comes at the cost of significantly less financial protection when you need it most.

Key Differences Between Stacked and Unstacked UM Coverage

To make it clearer, let's break down the fundamental differences between these two crucial insurance choices. This table gives a straightforward comparison of what you're getting with each option.

Feature | Stacked Insurance | Unstacked Insurance |

|---|---|---|

Coverage Limit | Combines UM limits from all your insured vehicles for a much higher total payout. | Limited to the UM coverage amount for only the single vehicle involved in the crash. |

Premium Cost | Generally costs more because of the significantly increased level of protection it offers. | More affordable on a monthly basis, as the insurer's potential payout is much lower. |

Best For | Households with multiple vehicles, especially in a state like Florida with many uninsured drivers. | Single-vehicle owners or those who must prioritize the lowest possible monthly premium. |

Claim Payout | Offers a substantially larger potential payout, which is critical for covering severe injuries. | The payout is capped at a lower, pre-defined limit for that one specific vehicle. |

At the end of the day, stacking is about creating a stronger financial backstop for a worst-case scenario.

This visual helps illustrate how stacking multiplies your available coverage if your household has more than one vehicle.

As you can see, stacking leads to a direct multiplication of your benefits—an absolutely critical factor when medical costs from a serious crash can skyrocket in a hurry.

The real power of stacked insurance lies in its ability to transform multiple smaller policies into a single, substantial financial shield when you need it most.

Here in Florida, where nearly 1 in 4 drivers is uninsured, stacked auto insurance can be a financial lifesaver for families with more than one car. Imagine a family with three vehicles, each with $25,000 in UM coverage. With stacking, they could access a total of $75,000. Without it, they’re stuck with just $25,000. That difference is vital, as medical bills from serious collisions often blow past standard limits, potentially leading to debt or even bankruptcy. You can learn more about how Florida's high uninsured driver rates affect your insurance needs.

If you're unsure which coverage is right for you or you're fighting with an insurance company after an accident, getting legal advice is a smart next step. In pain? Call Caine.

It's one thing to read a definition of stacked vs. unstacked auto insurance, but it's another thing entirely to see how it plays out when the bills start rolling in. Stacking isn't just some industry jargon; it’s a powerful tool that literally multiplies the money available to you after a bad crash with an uninsured or underinsured driver.

This isn't a loophole. It’s a feature of Florida insurance law that can mean the difference between getting back on your feet and facing a mountain of medical debt. The math is simple, but the impact is huge.

Stacking Within a Single Policy

The most common way this works is by stacking within a policy. This is for people who have more than one vehicle on the same insurance policy. When you opt to stack, your insurer lets you combine the Uninsured Motorist (UM) limits for each vehicle.

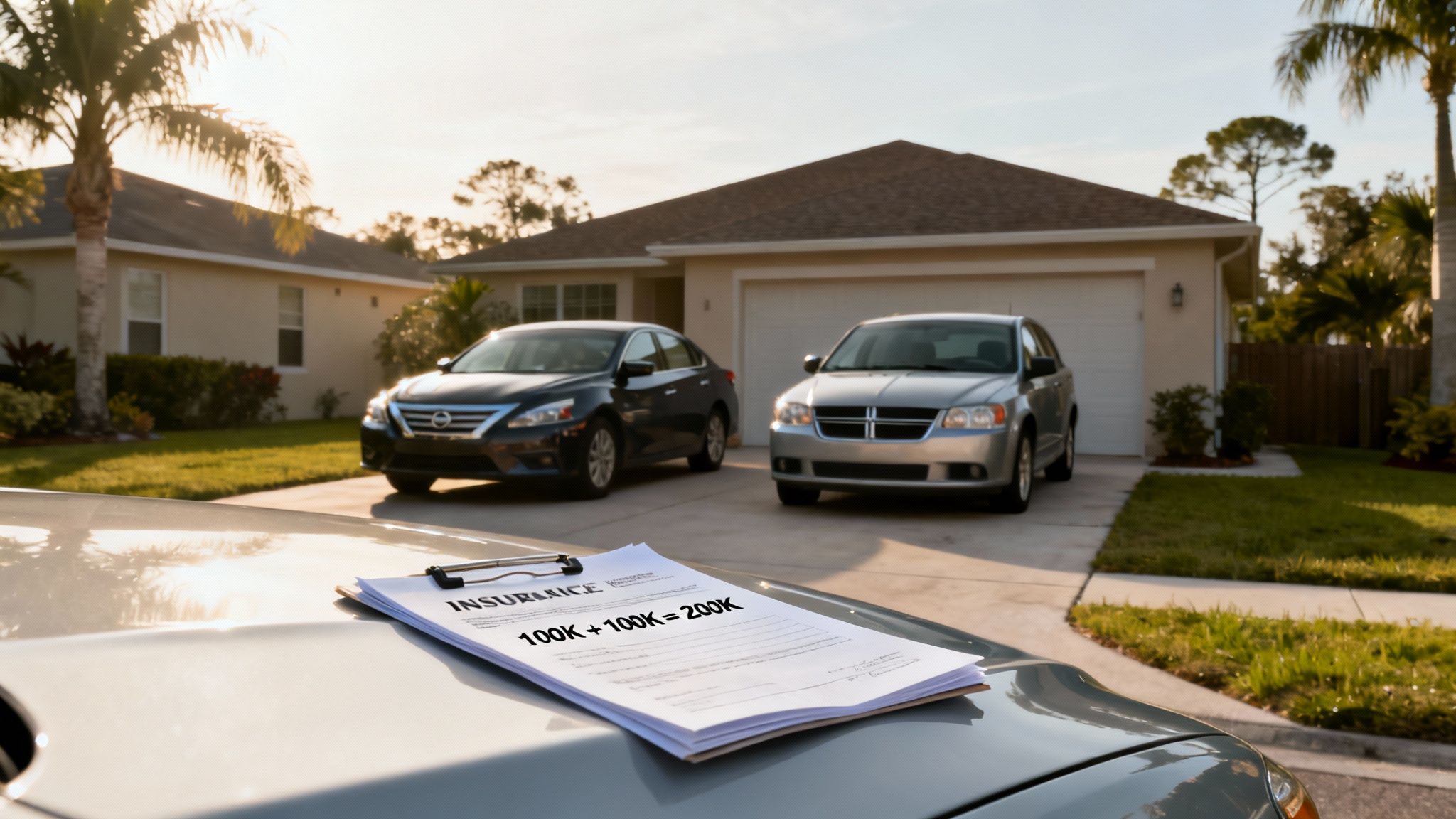

Let's say a family in Orlando has two cars on their policy, each with $100,000 in UM coverage.

Vehicle 1: $100,000 UM Coverage

Vehicle 2: $100,000 UM Coverage

If one of them gets seriously hurt by an uninsured driver—it doesn't matter which car they're in, or even if they were a pedestrian—their stacked policy kicks in. The coverage totals are simply added together: $100,000 + $100,000 gives them $200,000 in total available benefits.

Now, imagine they had an unstacked policy. Even with two cars insured, they can only use the UM limit for the specific vehicle involved in the crash. Their coverage would be stuck at $100,000, and the second car's UM limit would be useless.

By stacking your coverage within a single policy, you are directly multiplying your financial protection. Two cars double your coverage, and three cars triple it, creating a critical buffer against catastrophic expenses.

Stacking Across Multiple Policies

Florida law also allows for stacking across policies. This comes into play when a household insures vehicles on separate policies, which can happen for a number of reasons. As long as the policies cover family members living in the same household, you can still combine the UM coverage from each one.

Think about a couple in Miami. They each have their own car and their own separate insurance policy.

Spouse A's Policy: $50,000 UM Coverage

Spouse B's Policy: $50,000 UM Coverage

If Spouse A is hit by an underinsured driver on their way to work, they can pull from both policies because they chose to stack. That means they can access up to $100,000 ($50,000 + $50,000) for medical bills and lost wages. Without stacking, they'd be capped at the $50,000 on their own policy—a limit that can disappear fast after a serious wreck.

A Real-World Calculation: The Financial Impact

Let's put some hard numbers to this. Picture Maria, a Tampa resident with two cars on her policy, each carrying $50,000 in UM coverage. She gets hit from behind in a severe collision caused by a driver with zero insurance.

Her medical bills, physical therapy, and lost income quickly add up to $90,000.

Scenario 1: With Stacked Insurance Maria can combine the UM coverage from both of her cars.

Car 1 Limit: $50,000

Car 2 Limit: $50,000

Total Available Coverage: $100,000

With $100,000 available, Maria's entire $90,000 in damages is covered. Her policy does exactly what it's supposed to do: it provides the financial safety net she needs to recover without destroying her savings.

Scenario 2: With Unstacked Insurance Maria is limited to the UM coverage of the car she was driving at the time.

Total Available Coverage: $50,000

Her damages are $90,000, but her policy will only pay $50,000. She is now personally on the hook for the remaining $40,000. This is the exact financial nightmare UM coverage was created to prevent.

Figuring out damages and fighting with insurance adjusters is draining, especially when you're trying to heal. Knowing the ins and outs of these claims is critical, which is why getting professional advice on auto and motorcycle accidents is often the key to getting what you're owed.

When you're facing stacks of bills after a crash, the small decision you made about your insurance policy suddenly becomes crystal clear. If you find yourself in this situation, you don’t have to figure it out by yourself. In pain? Call Caine.

Analyzing the Cost vs. the Protective Benefit

The big question always boils down to one thing: is stacked coverage actually worth the extra money? It’s a fair question. To answer it, you have to look past the monthly premium and really weigh the cost against the massive financial shield it gives you, especially here in Florida.

Stacked coverage costs more for a simple reason: the insurance company is taking on a much bigger risk. When they let you combine the limits from all your vehicles, they’re agreeing to a potentially huge payout if you have to file a claim. That increased exposure for them gets passed on to you as a higher premium.

Putting a Price on Peace of Mind

That extra cost isn't just a random number. Studies consistently show that stacked auto insurance premiums are typically 20-30% higher than unstacked policies. A 2022 QuoteWizard study focusing on our state found that the average driver paid about $36 more per month for stacked coverage. You have to balance that against the sobering fact that you’re sharing the road with drivers where the uninsured rate can be as high as 25%. You can dig into some of these stacked vs unstacked insurance findings to see how the numbers play out.

While an extra $36 a month might sting a little, it's critical to frame it the right way. This isn't just another bill—it's an investment in a much, much larger financial safety net. Think about it: a single serious car wreck can easily rack up medical bills and lost wages well into the six figures.

When you compare a few hundred dollars more a year against a potential $100,000+ financial hole, the real value of stacked coverage snaps into focus. It’s a strategic trade-off, plain and simple.

The Real-World Cost-Benefit Scenario

Let's walk through a practical example to show you exactly what’s at stake when choosing between stacked and unstacked insurance.

Imagine a Florida family with three cars on their policy. They’re paying an extra $432 a year to stack their Uninsured Motorist (UM) coverage. That might feel like a lot, until one of them gets into a severe crash caused by an uninsured driver. The medical bills and lost income quickly hit $150,000.

With Unstacked Coverage: They’d be stuck with their single-vehicle UM limit, let's say it's $50,000. Once that’s used up, they are personally on the hook for the remaining $100,000. That’s the kind of debt that can lead to bankruptcy or financial hardship for years.

With Stacked Coverage: They can combine the $50,000 UM limits from all three of their cars, giving them access to $150,000 in total. This covers the entire loss, letting them focus on healing instead of worrying about financial ruin.

In this scenario, that $432 annual investment just prevented a $100,000 personal disaster. The return on investment is almost impossible to calculate—it's immense.

When Does Unstacked Make Sense?

Now, to be fair, stacked coverage isn't the right call for everyone. If you only own one vehicle, the whole idea of "stacking" is off the table because there’s nothing to stack it with. In that situation, choosing unstacked coverage is the only logical move.

For a single-car household, a much smarter strategy is to take the money you would have spent on a stacking premium and use it to buy a higher UM limit. Instead of a basic $50,000 limit, you might bump it up to $100,000 or $250,000 in unstacked UM coverage. You get robust protection without paying for a feature you can’t even use.

Ultimately, the choice comes down to your specific circumstances. For families with multiple cars in a high-risk state like Florida, stacked insurance is often a wise and necessary investment in your long-term financial security. If you’ve been in an accident and are fighting to get the compensation you deserve from your insurer, don’t go it alone. In pain? Call Caine.

How to Select or Reject Stacked Coverage on Your Policy

Managing your auto insurance options in Florida isn't a passive process, especially when it comes to stacked vs. unstacked coverage. The law is set up to protect you, which is why insurers are legally required to offer you stacked Uninsured/Underinsured Motorist (UM) coverage by default. That means if you do nothing, you get the better coverage—it’s the standard.

To get unstacked coverage, however, you have to take a very specific, legally binding step. You must formally reject stacked coverage in writing. This isn't just a box you check online; it involves signing an official document from your insurance company. This choice has big, lasting consequences for your financial protection if you're ever in a crash.

The Rejection Form Explained

When you decide to opt for unstacked coverage, your insurance agent will give you a specific form. Often called the "Selection/Rejection of Uninsured/Underinsured Motorist Coverage" form, this document is a legal declaration of your choice, designed to be crystal clear.

The form will explicitly state that you're waiving your right to stack UM coverage. By signing it, you are officially acknowledging that you understand a few key things:

You are giving up the ability to combine UM limits from your multiple vehicles.

Your potential payout after an accident will be capped at the coverage limit for a single vehicle.

You are accepting a lower level of financial protection in exchange for a lower premium.

Signing this form is a serious step. It legally documents your decision to limit your own insurance protection. Insurance companies require this signed rejection to cover themselves from future disputes where a policyholder might claim they didn't realize they were giving up such a valuable benefit.

By signing the rejection form, you are actively choosing a lower tier of protection. Florida law ensures this is a conscious decision, not an oversight, by requiring a written waiver.

Adding Stacked Coverage Back to Your Policy

What if you previously rejected stacked coverage and now realize how important it is? The good news is that your decision to opt out isn't set in stone. You can almost always add it back to your policy.

The process is pretty straightforward. You just need to contact your insurance agent or company and tell them you want to switch your UM selection to stacked. They will walk you through the necessary steps, which usually involves updating your policy and adjusting your premium accordingly.

You should expect your premium to go up once you add stacked coverage. The exact amount will depend on your policy, your coverage limits, and how many vehicles you insure. While it means a higher payment, you're buying a significantly larger safety net for yourself and your family. Reinstating stacked coverage is one of the smartest, most proactive steps you can take to secure your financial future against the risk of an accident with an uninsured driver.

If you’re navigating the aftermath of a collision and are confused about your policy limits or how to move forward with a claim, getting professional guidance is crucial. Insurance policies are complex, but an experienced attorney can clarify your rights and fight for the full compensation you are owed. In pain? Call Caine.

Deciding When Stacked Insurance Is the Right Choice

Making the final call on stacked vs. unstacked auto insurance isn't about finding a single right answer. It's a personal decision that hinges entirely on your life, your finances, and the level of risk you're comfortable with. By looking at a few common driver profiles, you can get a much clearer picture of where you fit and which option makes the most sense.

Stacked insurance isn't for everyone, but for certain people, its value is immense. The slightly higher premium becomes a small price to pay for a much larger financial shield when you need it most.

Who Benefits Most from Stacked Coverage

Some situations make stacked insurance a near-necessity. If you see yourself in one of these categories, the protective benefits almost certainly outweigh the bump in your premium.

You should seriously consider stacking your Uninsured/Underinsured Motorist (UM) coverage if you are:

A Family with Multiple Cars: This is the classic, textbook case for stacking. When your household insures two, three, or more vehicles, stacking lets you multiply your coverage limits, creating a massive safety net for everyone in the family.

A Household with Teen Drivers: Let's be honest, younger drivers are less experienced and, statistically, at a higher risk of being in a crash. Stacking adds an essential layer of financial protection for them and for you.

A Long-Distance Commuter: The more time you spend on the road, the higher your odds of an encounter with one of Florida's many uninsured drivers. Stacking ensures that if something happens, you have a deeper pool of resources to draw from for your recovery.

Someone with Limited Health or Disability Insurance: If your health plan comes with a high deductible or your disability coverage is minimal, stacked UM can be a lifesaver. It’s designed to cover medical bills and lost wages that your other policies might not, preventing a car accident from spiraling into a financial disaster.

For multi-vehicle households, the choice is clear: stacking transforms separate, modest insurance limits into a powerful, unified financial resource capable of handling the severe costs of a serious injury.

This decision goes beyond just your car; it's about protecting your entire financial future after a wreck. Understanding the complexities of a personal injury claim highlights just how fast costs can add up, making robust insurance coverage an absolute must.

When Unstacked Coverage Might Be a Reasonable Option

While stacked insurance often provides superior protection, it isn't the best fit for every single person. There are specific scenarios where choosing unstacked coverage is the more practical and financially sound move.

The most obvious candidate for unstacked insurance is a single-vehicle owner. Stacking works by combining coverage from multiple vehicles. If you only have one car, there’s nothing to combine, and the feature provides zero benefit. Paying extra for a stacking option you can't use is just throwing money away.

Instead of paying for stacking, a single-car owner should put that money toward higher single-policy UM limits. For example, instead of a $50,000 UM limit, you would be far better off buying a $100,000 or even a $250,000 unstacked policy. This strategy maximizes your protection without wasting money on a feature that doesn't apply to you.

Ultimately, the decision demands an honest look at your daily risks and financial priorities. For multi-car families in Florida, stacking is a strategic investment in security. For single-car owners, focusing on a higher individual limit is the wiser path.

If you are struggling to get the compensation you deserve after an accident, the complexities of your policy shouldn't be your burden to bear alone. In pain? Call Caine.

How Stacking Affects Your Claim After an Accident

The moment you're in a crash with an uninsured or underinsured driver, that abstract choice you made between stacked and unstacked coverage becomes painfully real. It’s the single biggest factor determining how much money is available for your recovery. The entire claims process plays out differently based on that one decision, and it will absolutely shape your financial future.

With stacked coverage, you've essentially created a much larger pool of funds to draw from. That combined limit is your lifeline for paying off crushing medical bills, making up for lost income while you can't work, and getting compensated for your pain and suffering. You aren't stuck with one vehicle's meager limit; you have the collective strength of all your policies fighting for you.

Navigating the Claims Process

Filing a claim should be simple, but it rarely is—even when you have great coverage. Insurance companies are still businesses, and their number one goal is to pay out as little as possible. They will still nitpick the severity of your injuries, question your doctor's treatment plan, or argue over the value of your lost wages, no matter how high your policy limit is.

This is where the real fight begins. Having $200,000 in stacked coverage is a world away from a $50,000 unstacked limit, but you still have to claw for every dollar you're owed. Insurers have a playbook of tactics designed to delay, deny, and underpay even the most straightforward claims.

Having stacked insurance gives you a higher potential recovery, but it doesn't guarantee the insurance company will pay it willingly. The fight to secure your full benefits is often just as challenging.

This is precisely why you need an experienced legal advocate in your corner. An attorney who knows the insurers' game can build an airtight case, meticulously document all your damages, and shut down the company’s attempts to devalue your claim. Taking on these challenges is at the heart of handling insurance disputes and making sure our clients get every penny they are entitled to under their policy.

Your stacked policy is a powerful tool for getting your life back on track, but you might need help wielding it effectively. Don't let an adjuster put a price on your health. If you've been injured and the insurance company is giving you the runaround, it's time to protect your rights. In pain? Call Caine.

Frequently Asked Questions About Florida UM Coverage

When you start digging into the details of stacked versus unstacked insurance, a lot of questions pop up. It’s completely normal. Below, I’ve answered some of the most common questions Florida drivers have, hopefully giving you the clarity you need to make a confident decision.

Can I Stack UM Coverage if My Cars Are on Different Policies?

Yes, you absolutely can. This is a common scenario we see, and Florida law allows for it. The practice is often called "stacking across policies."

If you and a family member living in your household have cars insured on separate policies, you can combine the Uninsured Motorist (UM) limits from both if one of you is in an accident. This gives you the same powerful financial safety net as stacking multiple cars on a single policy.

Does Stacked Insurance Cover Damage to My Vehicle?

This is a critical point of confusion for many drivers: No, it does not. Stacked Uninsured Motorist (UM) coverage in Florida is exclusively for Bodily Injury (BI) claims.

Think of it this way: it’s there to cover the human cost of an accident—medical bills, lost wages from being unable to work, and compensation for your pain and suffering. To get your car fixed after a run-in with an uninsured driver, you’ll need to turn to your Collision coverage.

Your stacked UM policy is your shield against personal injury costs, not property damage. Collision coverage is the tool for getting your car fixed.

What if I Only Own One Car? Is Stacking Relevant to Me?

If you only have one vehicle on your policy, the idea of stacking simply doesn't apply. The whole concept is based on combining coverage limits from multiple vehicles or policies. With just one car, there's nothing to "stack" it with.

For single-vehicle owners, the best strategy is to buy the highest single limit of unstacked UM coverage you can comfortably afford. This ensures you have the most protection possible without paying a higher premium for a feature you can’t use.

Why Would Anyone Choose Unstacked Insurance in Florida?

It almost always comes down to one thing: cost. The main reason someone would opt for unstacked insurance is to get a lower premium. Since stacked coverage can increase your UM premium by 20-30%, some drivers on a tight budget might choose to opt out to save money every month.

But this decision is a major trade-off. When you sign that official waiver rejecting stacked coverage, you are knowingly limiting your financial protection. In a state with one of the highest rates of uninsured drivers in the country, it's a gamble that can have devastating consequences if you're in a serious crash.

Trying to make sense of an insurance claim after an accident is overwhelming, especially when you're hurt. At CAINE LAW, we step in to handle the legal fight so you can focus on getting better. If you've been injured and need someone to fight for the compensation you deserve, we’re here for you. In pain? Call Caine.