In Pain? Call Caine

Florida Premise Liability Settlements A Guide to Case Value

5 Min read

By: Caine Law

Share

When you get hurt on someone else’s property because they were careless, the legal system provides a way to make things right. A premises liability settlement is the financial agreement that resolves your injury claim, compensating you for everything you’ve been through. These resolutions can range from a few thousand dollars to life-changing, multi-million dollar awards, all depending on the specific facts of what happened to you.

What Is a Typical Florida Premises Liability Settlement?

Let’s get right to the question on everyone’s mind: what’s a “typical” settlement worth? The honest answer is that there’s no such thing. Every single case is unique.

Think of it like building a custom home. The final value isn’t based on a template; it’s determined by the specific materials, the complexity of the design, and the quality of the craftsmanship. Your claim works the same way. The total compensation is built piece by piece from the unique details of your accident and the losses you’ve suffered.

Understanding this from the get-go helps set realistic expectations. Just like two houses on the same block can have wildly different price tags, two people who slip and fall in the same store can end up with vastly different settlement amounts. The key is to identify every "building block" of your claim and make sure each one is properly valued.

The Core Components of a Settlement

Every premises liability settlement is built from a few fundamental elements. Sticking with our house analogy, here’s how the pieces come together:

Medical Bills (The Foundation): This covers every cent you’ve spent—or will spend—on medical care because of the injury. From the initial ER visit to future surgeries and physical therapy, these costs form the solid base of your claim.

Lost Wages (The Framework): If your injury kept you out of work, this part covers the income you lost. It also accounts for any future impact on your ability to earn a living. This is the structural framework that supports your financial recovery.

Pain and Suffering (The Finishing Work): This is compensation for the human cost of the injury—the physical pain, the emotional distress, and the loss of enjoyment in your daily life. These are the details that turn a structure into a home, reflecting the real-world impact the accident had on you.

This graphic breaks down how these three core components combine to create the total value of your settlement.

As you can see, a strong claim needs that solid foundation of documented medical expenses, supported by clear proof of lost income and a compelling argument for your pain and suffering.

Why Settlement Ranges Vary So Widely

The final value of a claim isn't just about the injuries themselves; it’s also about where the accident happened. Commercial properties like big-box stores, hotels, and office buildings usually have stricter safety standards and much larger insurance policies than a private residence. This often leads to higher potential settlements.

To give you a clearer picture, here’s a quick look at some general settlement ranges you might see in Florida.

Florida Premises Liability Settlement Ranges at a Glance

Injury Severity | Common Examples | Typical Florida Settlement Range (Commercial Property) | Typical Florida Settlement Range (Residential Property) |

|---|---|---|---|

Minor | Sprains, minor cuts, bruising | $10,000 - $50,000 | $5,000 - $25,000 |

Moderate | Broken bones, torn ligaments, concussion | $50,000 - $250,000 | $25,000 - $75,000 |

Severe | Traumatic brain injury (TBI), spinal cord injury, amputation | $250,000 - $1,500,000+ | $75,000 - $300,000+ (Often limited by policy) |

Keep in mind these are just estimates. Recent data shows that settlements in 2025 can swing dramatically, with commercial properties averaging $100,000 to $1,500,000, while residential cases often land between $25,000 and $200,000. You can explore more data on how property type affects settlement amounts to see just how much this factor matters.

Ultimately, figuring out what your case is truly worth requires a deep dive into every detail. If you were hurt because a property owner dropped the ball, understanding these components is your first step toward getting the compensation you deserve. An experienced attorney can help you put all the pieces together to build the strongest case possible. In pain? Call Caine.

The Building Blocks of Your Settlement Value

Think of your premises liability settlement less like a single jackpot number and more like a detailed invoice for everything you’ve lost. The final amount isn't just pulled out of thin air. Instead, it’s built piece by piece from different categories of losses, which are legally known as damages.

Your attorney's job is to meticulously identify, document, and calculate every single loss you've suffered because of someone else's negligence. These damages are the essential building blocks that give your claim its final value.

Each component has a clear purpose. Some cover the hard, out-of-pocket costs, while others are meant to compensate for the very real human suffering you’ve been forced to endure. Let's break down the three main categories that form the backbone of nearly every premises liability settlement.

Medical Expenses: The Foundation of Your Claim

Medical bills are the concrete foundation of your entire claim. This isn't just about the first trip to the ER; it covers every single dollar you've had to spend on medical care because of your injury. It’s a complete accounting of your entire medical journey back to health.

This is the most black-and-white part of your claim because it’s based on actual bills and receipts. Getting this part right is absolutely critical, as these numbers often serve as a baseline for calculating other parts of your settlement.

Key medical expenses typically include:

Emergency Services: The ambulance ride and initial ER treatment.

Hospital Stays: All costs for inpatient care, including the room, tests, and any surgical procedures.

Follow-Up Care: Every visit with specialists, surgeons, and your primary doctor.

Future Medical Needs: This is a huge, often-missed component. It projects the costs for future surgeries, long-term physical therapy, prescription drugs, or necessary equipment like a wheelchair or home modifications.

Strong, organized medical records are non-negotiable. They are the undeniable proof you need to show just how serious your injuries are and justify the compensation you’re demanding.

Lost Wages and Earning Capacity: The Structural Framework

If medical bills are the foundation, think of lost wages as the framework holding up your financial life. When an injury keeps you from working, that lost income is a direct, recoverable damage. This goes way beyond just the first few days you missed after the accident.

Proving lost wages requires clear proof, like pay stubs, letters from your employer, and tax returns. But what happens if your injuries mean you can never go back to your old job or earn what you used to? That’s where the concept of lost earning capacity comes in.

This compensates you for the future income you’ll lose over your working life because of a permanent or long-term disability. Figuring this out often requires help from vocational experts who can analyze how your injuries will impact your career path and lifetime earnings. You can explore our guide on how to document evidence for a personal injury claim in Florida for more practical tips on getting the right paperwork together.

Pain and Suffering: The Human Cost

This is the most personal and, frankly, the most subjective part of any settlement. While your medical bills and lost wages are considered economic damages (they have a clear price tag), pain and suffering is a non-economic damage. It’s compensation for the physical pain, emotional distress, and the overall drop in your quality of life caused by the injury.

So, how do you put a dollar value on something so abstract? Attorneys and insurance companies usually start with one of two methods:

The Multiplier Method: This involves taking the total economic damages (medical bills + lost wages) and multiplying that number by somewhere between 1.5 and 5. The specific multiplier depends on how severe the injury is, how long recovery will take, and the permanent impact on your life.

The Per Diem Method: This approach assigns a daily dollar amount for your pain and multiplies it by the number of days you're expected to live with the consequences of the injury.

For example, a severe traumatic brain injury requiring lifelong care will command a much higher multiplier than a broken arm that heals completely in a few months. This is the part of the settlement that acknowledges the true human cost—the sleepless nights, the chronic pain, the anxiety, and not being able to enjoy the hobbies and activities you once loved.

A good lawyer knows how to build a compelling story that shows an insurance adjuster or a jury the real extent of your suffering. If you're hurting after an injury, don't try to build this case on your own. In pain? Call Caine.

Key Factors That Influence Your Settlement Amount

While things like medical bills and lost wages create the baseline for your claim, a few other critical factors will ultimately determine what your settlement is really worth. Think of them as the wild cards in the deck. Two people can have nearly identical injuries from a slip and fall, but end up with drastically different settlement amounts because of these key details.

Ultimately, these factors decide what an insurance company is willing to pay to avoid facing a jury. Getting a handle on them is the only way to see the full picture of what your premises liability case could be worth.

The Strength of Your Evidence

This is, without a doubt, the most important factor. A claim without solid proof is like a house of cards—it just won't stand up to scrutiny. Insurance adjusters are paid to poke holes in your story, and a case built on weak evidence gives them all the ammunition they need to deny your claim or throw a lowball offer your way.

To build a case that can't be ignored, you need airtight proof that the property owner was negligent and that their carelessness is the direct reason you were hurt. This isn't negotiable. Your file must include:

Photos and Videos: Clear pictures or videos of the hazard that caused your fall (the puddle on the floor, the broken step, the dark hallway) are invaluable. You need to capture these as soon as you possibly can.

Incident Reports: If you file an official report with the store manager or property owner, it creates a formal paper trail of what happened, when, and where.

Witness Statements: Getting testimony from anyone who saw what happened or can confirm the dangerous condition existed is incredibly powerful.

Medical Records: You need comprehensive medical documentation that clearly links your injuries to the accident itself.

A file packed with strong evidence completely changes the negotiation dynamic. It sends a clear message to the insurance company: we're ready for trial, and we expect to win. That's usually all the motivation they need to offer a fair settlement.

Florida's Comparative Negligence Rule

Here in Florida, the law acknowledges that sometimes, the injured person might share a small part of the blame for an accident. This concept is handled through a rule called modified comparative negligence. What it means is your total settlement can be reduced by your percentage of fault—as long as you are not found to be more than 50% responsible.

Let's say you slip on a wet grocery store floor where there was no warning sign. The store is negligent. But what if their lawyers argue you were texting and not watching where you were going? If a jury decides you were 20% at fault, your final award gets cut by that same percentage.

Total Damages: $100,000

Your Percentage of Fault: 20%

Reduction Amount: $20,000 (20% of $100,000)

Final Recovery: $80,000

Because of this rule, it’s absolutely critical to fight back against any attempt by the defense to unfairly shift blame onto you.

Who You Are Suing

Who the defendant is—and how deep their pockets are—plays a huge role in the potential value of a premises liability settlement. Filing a claim against a massive corporation is a completely different world than suing a private homeowner.

A big-box retailer like Walmart or Target has multi-million dollar commercial liability insurance policies and an army of lawyers. They have the money to pay a large claim, but they also have the resources to fight you tooth and nail. A private homeowner, on the other hand, might only have a $100,000 or $300,000 liability policy. That number becomes the effective cap on what you can recover, no matter how catastrophic your injuries are.

The Skill of Your Legal Team

Successfully managing all these moving parts takes real-world experience and a sharp legal strategy. A lawyer who lives and breathes premises liability law knows exactly what evidence to gather, how to anticipate the defense's next move, and how to shut down flimsy arguments about comparative fault.

That experience creates leverage. The truth is, the risk of a massive jury verdict is what pushes most big companies to settle. Defense attorneys only win at premises liability trials about 61% of the time, which is a big reason why roughly 95% of these personal injury cases are resolved before ever seeing a courtroom. This trend is also fueling a rise in "nuclear verdicts" (over $10 million), which have actually tripled since 2020. You can read more about the liability insurance statistics that shape how these negotiations play out.

A skilled legal team uses this fear of a runaway jury as a tool to get you the maximum recovery possible. They build a case that insurance companies know they can't beat. If you’ve been hurt, don't try to face these complexities on your own. In pain? Call Caine.

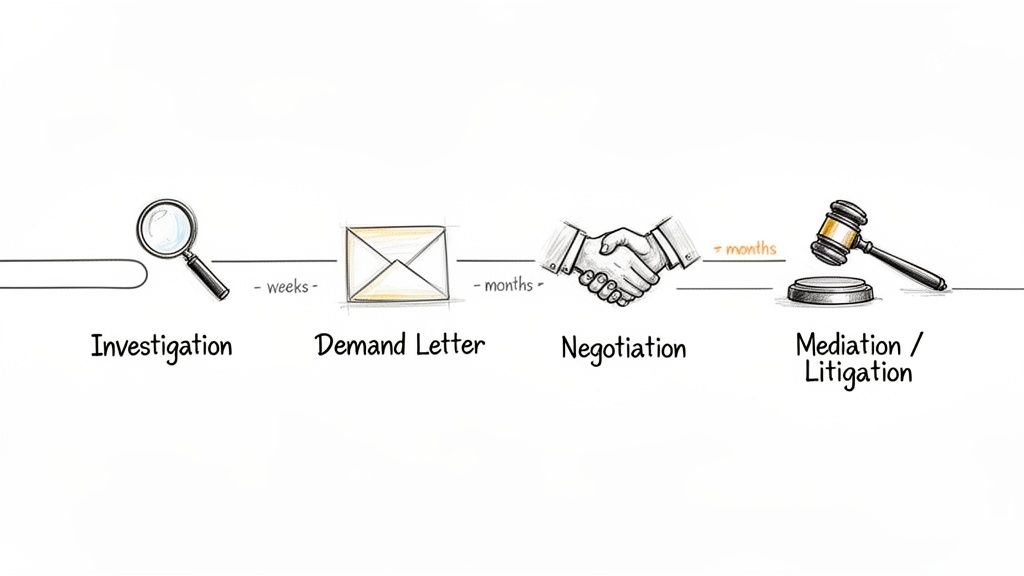

Navigating the Premise Liability Claim Timeline

Knowing what to expect on the journey toward a premises liability settlement can take a lot of the stress out of the equation and help you make smarter decisions along the way. While every case has its own unique twists and turns, the path from injury to resolution generally follows a structured, multi-stage process.

Think of it as a roadmap. Understanding this timeline helps you see what’s ahead, from building the foundation of your claim to the final push for the compensation you deserve. Let's walk through the four main stages you’ll encounter.

Stage 1: The Initial Investigation

This is where the real work begins. Right after you hire an attorney, they’ll launch a deep-dive investigation to gather every scrap of evidence needed to prove the property owner was negligent and to document the full impact the injury has had on your life.

This isn't just a casual look-around; it's a proactive, comprehensive fact-finding mission. The goal is to build an airtight case before we even think about contacting the insurance company. Key steps during this phase usually include:

Preserving Evidence: We immediately send official notices to the property owner, legally requiring them to save crucial evidence like security camera footage before it gets "accidentally" deleted.

Gathering Documentation: This means collecting all police or incident reports, photos you took at the scene, and getting in touch with anyone who saw what happened.

Medical Record Collection: We'll compile your complete medical history related to the injury, from the first ER visit to ongoing physical therapy and specialist appointments.

Stage 2: The Demand Letter

Once the investigation is buttoned up and you’ve reached what’s called Maximum Medical Improvement (MMI)—that's the point where your doctor feels your condition has stabilized—it's time to make our move. Your attorney will put together a detailed demand letter and send it to the other side's insurance company.

This is much more than a simple letter asking for money. It’s a powerful legal document that lays out our entire case, essentially our opening argument. A strong demand letter will:

Clearly explain the facts of what happened and establish why the property owner is legally responsible.

Provide a detailed summary of your injuries, backed up by all the medical records we’ve collected.

Include a complete breakdown of your damages—every medical bill, every dollar of lost income, and a well-reasoned justification for the pain and suffering compensation we’re seeking.

Make a specific, solid monetary demand for settlement.

This letter is what officially kicks off the negotiation process. Its thoroughness and strength set the tone for everything that follows and signal to the insurer that we’ve built a serious, well-documented claim.

Stage 3: The Negotiation Phase

After the insurance company’s adjuster reviews our demand, they’ll almost always come back with a counteroffer—and it’s usually a low one. Don’t be discouraged; this is a standard tactic. It simply marks the beginning of the negotiation phase, a strategic back-and-forth process.

Your attorney will handle all the communication from here. We use the mountain of evidence we’ve gathered to dismantle the adjuster’s arguments and push back against any lowball offers. This phase can take weeks or even months as both sides debate the real value of your claim. Frankly, success here often comes down to your lawyer’s experience and skill at the negotiating table.

Stage 4: Mediation and Litigation

What if negotiations hit a wall and the insurance company just won’t offer a fair number? That’s when we move to the next level. The two main options are mediation and litigation.

Mediation is basically a structured negotiation session. A neutral, third-party mediator steps in to help both sides find some common ground and hopefully reach a settlement everyone can agree on, without the time, cost, and stress of a full-blown trial. In many cases, it’s a required step before a lawsuit can even proceed.

If mediation doesn't work, the final step is litigation—filing a formal lawsuit. This moves your case into the court system and involves more formal processes like discovery, depositions, and eventually, a trial. While the vast majority of premises liability cases settle before ever seeing a courtroom, the credible threat of taking a case to trial is often the leverage needed to get the insurance company to make their best and final offer.

This entire process can feel long and complicated, which is why having a skilled legal advocate in your corner makes all the difference. In pain? Call Caine.

How a Skilled Attorney Strengthens Your Claim

Trying to handle a premises liability claim on your own is a lot like stepping into a boxing ring to face a pro. You're outmatched from the start. On the other side is the property owner's insurance company, and they have a whole team of seasoned adjusters and lawyers whose only job is to protect their company's money by paying you as little as possible.

An experienced attorney doesn't just level the playing field—they give you the advantage. They become your advocate and your shield, protecting you from the pressure and lowball tactics designed to make you settle for far less than you deserve. From day one, they ensure your rights are protected.

It’s About More Than Just Negotiation

A great lawyer does much more than just negotiate. They build a rock-solid case from the ground up, one designed to withstand the other side's attacks and force the insurance company to take your claim seriously.

Here’s what that looks like in practice:

Hiring Crucial Experts: Your attorney will bring in the heavy hitters—accident reconstructionists to prove exactly how you got hurt, medical experts to explain the long-term impact of your injuries, and even vocational specialists to calculate the future wages you'll lose.

Accurately Valuing Your Claim: They look past the immediate medical bills. They calculate the full lifetime cost of your injury, making sure you don't accept a quick settlement that leaves you struggling financially years from now.

Managing All Communication: They take over every phone call, email, and document request. This is critical, as it stops you from accidentally saying something an adjuster can twist and use against your claim.

An attorney’s real power is their ability to build undeniable leverage. By preparing every single case as if it’s going to trial, they send a clear message to the defense: a lowball offer isn't just unfair—it's a losing move for them.

The money involved in these cases can be substantial. Just look at the numbers. In the 2023 fiscal year, personal injury claims against New York City averaged $134,656. But for claims against commercial properties across the country, that number jumped to a staggering $643,099, largely because they carry massive insurance policies.

This is exactly why big property owners are often motivated to settle when they’re up against a well-prepared, professional claim.

Ultimately, hiring the right legal team isn't a cost—it's an investment in your future. It gives you the expertise you need to secure a settlement that truly covers everything you've lost. To see how we can help, learn more about our personal injury legal services.

You don't have to face this fight alone. In pain? Call Caine.

Frequently Asked Questions About Premise Liability

When you’ve been hurt on someone else’s property, the questions start piling up almost immediately. It’s a confusing and stressful time, and you need clear, straightforward answers. Here’s a look at some of the most common questions we hear about Florida premises liability cases to help you understand your rights and what comes next.

How Long Do I Have to File a Claim in Florida?

In Florida, the clock starts ticking the moment you get hurt, and it moves faster than you’d think. The statute of limitations for most premises liability cases is now just two years from the date of the incident.

This isn't a suggestion; it's a hard deadline. If you miss it, you almost certainly lose your right to pursue compensation forever. This recent change makes it absolutely critical to act quickly. Building a strong case—gathering evidence, documenting your injuries, and dealing with insurance companies—takes time. That’s why contacting an attorney right away is the best way to protect your claim.

What Should I Do Immediately After an Accident?

The steps you take in those first few minutes and hours can make or break your ability to recover a fair settlement down the road. Your priorities should be simple and focused.

Seek Medical Attention: Your health is everything. Get to an ER or an urgent care clinic right away, even if you think you’re “okay.” Some injuries aren't obvious at first. This also creates a crucial medical record that officially links your injuries to the incident.

Report the Incident: Find the property owner, a manager, or the landlord and tell them what happened. Always ask for a copy of any incident report they fill out.

Document Everything: Use your smartphone. Take pictures and videos of the exact hazard that caused your injury—the puddle on the floor, the crumbling step, the burnt-out lightbulb in the stairwell. If anyone saw what happened, get their name and phone number.

How Much Does It Cost to Hire a Premise Liability Attorney?

This is a huge source of stress for many people, but it shouldn't be. Most reputable personal injury firms, including ours, work on a contingency fee basis. In plain English, this means you pay absolutely no upfront costs or hourly fees.

We only get paid if we win your case. Our fee is simply a pre-agreed percentage of the settlement or verdict we secure for you. If we don’t recover a dime for you, you don't owe us a dime.

This approach levels the playing field, allowing you to get top-tier legal help without any financial risk. It lets you focus on your recovery while we handle the legal fight. Knowing what to ask an attorney is just as important, which is why we created a guide on the 9 questions to ask your slip and fall attorney before hiring to help you feel prepared.

At CAINE LAW, we're here to give you the answers and the advocacy you need to get back on your feet. If you were injured on someone else's property, don't try to handle it alone. In pain? Call Caine.