In Pain? Call Caine

neighbor tree fell on my property? What you should do first

5 Min read

By: Caine Law

Share

Right after a neighbor’s tree crashes onto your property, the smartest move in Florida is usually to reach for your homeowner’s insurance policy. Unless you can prove your neighbor was negligent, Florida law typically holds the owner of the damaged land responsible for repairs.

Your First Steps After A Neighbor's Tree Falls

The crack of wood and the sudden thud can send anyone reeling. In those first chaotic moments, every decision counts. You want to shift gears from shock to action—fast.

Keeping your family safe and preserving evidence for your claim sets the stage for a smoother recovery down the road.

Prioritize Safety Above All Else

Nobody wants a second disaster on top of the first. Before you rush out:

Downed Power Lines: Treat any fallen wires as live. Stay at least 30 feet away, keep others back, and dial 911 right away.

Unstable Structures: Listen for creaks or watch for sagging roofs and walls. If your home feels unsafe, step outside and stay clear until a professional inspects it.

Gas Leaks: A whiff of rotten eggs is a red flag. Exit immediately without flipping switches or using your phone indoors, and call the gas company from a safe distance.

Once you’re sure there are no immediate dangers, rope off the area so no one wanders into harm’s way.

Document Everything Before It’s Moved

This is your insurance claim’s lifeline. Before hauling away a single branch or scheduling a removal crew, create a complete visual record of the scene.

Start with broad shots that include the fallen tree, your home’s exterior, and the point where the tree came down on your neighbor’s land.

Then zoom in on the damage: missing shingles, a shattered fence, cracked windows, dented siding or ruined outdoor furniture.

Capture every angle and keep timestamps visible on your phone or camera.

For a broader overview of handling unexpected incidents, check our guide on essential steps to take when accidents happen: https://cainelegal.com/blogs/what-to-do-when-accidents-happen-essential-steps-and-legal-guidance

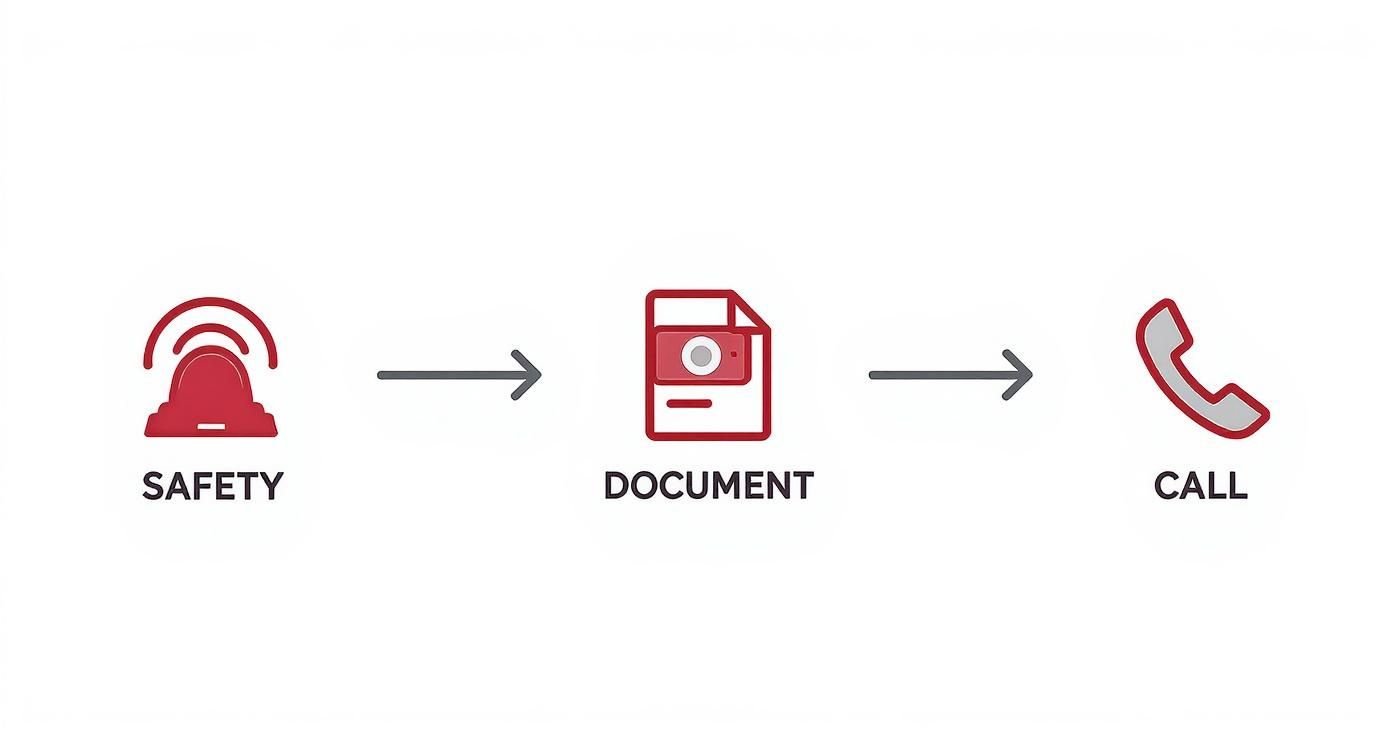

This visual process flow shows the critical sequence of actions to take immediately after a neighbor's tree falls on your property.

“Safety, documentation, then calls—nail those three in order, and you’ll protect your loved ones and your claim.”

Immediate Response Checklist

Below is a quick-reference guide for the critical first actions to take.

Action Item | Why It's Critical | Key Contact |

|---|---|---|

Perform Visual Safety Sweep | Spot hidden hazards before approaching scene | Local Fire Department (911) |

Photograph Entire Scene | Creates evidence for scope of damage | Your Insurance Agent |

Note Neighbor’s Property Line | Establishes origin of fallen tree | Your Neighbor |

Secure Perimeter | Prevents injuries and preserves evidence | Yourself or Local Police |

Call Utility Providers | Handles live wires or gas leaks safely | Electric/Gas Company Hotline |

Keep this checklist handy so you tackle the initial chaos with confidence.

Make The Right Calls In The Right Order

With the area secured and photographed, reach out to your insurance agent first. Tell them a neighbor’s tree fell on your property—they’ll assign an adjuster and outline any temporary repairs you should authorize to stave off further damage.

Next, have a calm, factual conversation with your neighbor. Let them know you’ve filed your claim and share any obvious details. This isn’t about finger-pointing; it’s a heads-up that keeps the atmosphere friendly and avoids misunderstandings.

If disputes arise or your insurer pushes back, remember there are other paths forward—settlement negotiations or even litigation. And if you need a legal ally, Caine is just a call away. In pain? Call Caine.

Who Actually Pays for the Damage and Debris Removal?

After the initial shock of seeing a massive tree lying across your yard or, worse, on your roof, one question cuts through the chaos: who’s going to pay for this?

The answer, surprisingly, is usually you—at least at first.

Even though the tree came from your neighbor's yard, Florida law generally places the initial financial responsibility on your own homeowner's insurance policy. It feels backward, I know. But from an insurer's perspective, they don't care where the tree came from; they only care that your property sustained damage. If an "Act of God" like a hurricane or a simple windstorm brought it down, your policy is where you start.

Your Homeowner's Policy Coverage

Your standard homeowner's policy is built for this kind of thing. It's designed to be your first call when a neighbor's tree damages your property.

Generally, your coverage will kick in for repairs to your house itself—a busted roof, a smashed-in wall, or shattered windows. It also typically covers other structures on your property, like a detached garage, a shed, or the fence that got flattened. If the tree took out your patio set or grill, that's where your personal property coverage comes into play.

But here’s where many homeowners get a nasty surprise: debris removal. Most policies put a surprisingly low cap on how much they'll pay to get that massive tree off your property, often just $500 to $1,000. Anyone who's hired a professional tree removal service knows that's barely a drop in the bucket. A big job can easily run into thousands of dollars, leaving you to cover the difference.

The Critical Exception: Negligence

Now, let's talk about the game-changer. The entire financial picture flips if you can prove your neighbor was negligent. This is the key that can shift the financial burden from your shoulders to theirs.

Simply put, negligence means your neighbor knew—or reasonably should have known—their tree was a danger, and they did nothing about it.

Negligence isn't just about a tree falling during a storm. It’s about a foreseeable hazard that was ignored. If you can demonstrate this, you have a strong case for holding your neighbor financially responsible.

This isn't about blaming your neighbor for a random act of nature. It’s about holding them accountable for failing to maintain their property in a way that keeps others safe. When you can prove negligence, you can go after them (or their insurance) to recover costs your policy didn't cover, including that frustrating deductible.

Real-World Scenarios of Negligence

So what does negligence actually look like? It’s more than just an unfortunate accident; it's a pattern of documented inaction.

Here are a few scenarios I've seen play out:

The Diseased Tree: For months, you watched dead branches fall from your neighbor’s huge oak. You could see fungus growing on the trunk from your kitchen window. You even sent them a certified letter with photos expressing your concern, but they never had an arborist look at it.

The Heavy Lean: After the last tropical storm, their tall pine tree started leaning precariously over your driveway. It was an obvious, ticking time bomb. You mentioned it to them several times, but they shrugged it off.

The Arborist’s Warning: You paid for an arborist to inspect a tree on your property, and the report noted your neighbor's tree was infested with termites and a high-fall risk. You gave them a copy of the report, but they took no action before it came crashing down on your garage.

In all these cases, the disaster was foreseeable. Your neighbor had a "duty of care" to deal with a known hazard, and their failure to act is the foundation of a negligence claim. Proving it often means diving into complex insurance disputes, but it can make all the difference to your bottom line.

If your insurance company is giving you the runaround or you're convinced your neighbor's negligence is the real cause of your problems, you don't have to take them on by yourself. We’ll help you build your case and fight to get the full compensation you deserve. In pain? Call Caine.

How To Prove Your Neighbor Was Negligent

It’s one thing to feel your neighbor dropped the ball by letting their tree topple onto your lawn. It’s another to show, under Florida law, that the collapse was avoidable. When Mother Nature isn’t the only culprit, the onus shifts to you to prove they ignored a foreseeable danger.

Building a strong negligence claim means more than assigning blame. You’ll need to demonstrate that your neighbor knew—or should have known—about a hazardous tree and disregarded it. That’s the heart of any successful case.

Defining A Dangerous Tree Condition

Florida doesn’t demand that property owners predict the future. Still, it expects them to act reasonably. A tree crosses into dangerous condition territory when signs of decay or instability are plainly visible to anyone passing by.

In practice, you don’t need a degree in botany. If rot, cracks or leaning were obvious enough for a casual observer, the owner had a duty to remedy the problem before disaster struck.

Spotting The Signs Of A Hazardous Tree

Think of yourself as an investigator. Insurance adjusters and judges look for unmistakable red flags—nothing subtle or hidden.

Watch for:

Dead Limbs: Branches stripped of foliage, especially high up, often snap off in gusty weather.

Fungal Growth: Mushrooms or large fungi on the trunk or at the base point straight to internal rot.

Significant Leaning: A tree that’s tilting more each week signals root distress.

Cracks and Splits: Deep fissures in the trunk compromise strength and invite collapse.

Root Decay: Uplifted soil or brittle, dead roots around the trunk are a clear danger sign.

Capturing time-stamped photos of these issues before the fall is your strongest proof of negligence.

“Negligence isn’t about forecasting storms—it’s about fixing obvious decay before it becomes a catastrophe. Showing they ignored this duty protects your wallet.”

Your Evidence Gathering Checklist

Before you press your neighbor or their insurer, gather every piece of proof that tells the story of a neglected hazard. A methodical collection of docs and snapshots turns a “he said, she said” into an ironclad argument.

"Before" Photos: Scan your old vacation snaps or party pics—anything that shows the tree’s unhealthy state. Time-stamped images trump memory any day.

Written Communication: Emails, texts or certified letters warning your neighbor about the tree’s decay prove you provided clear notice.

Witness Statements: A signed note from another neighbor who voiced the same concerns adds serious credibility.

A Certified Arborist’s Report: An expert opinion on the tree’s condition pre-fall can dismantle any “Act of God” defense.

Taking these steps transforms your claim from anecdote to evidence-backed narrative. If you hit a wall with an insurer or suspect unfair denial, you don’t have to go it alone. In pain? Call Caine.

Navigating Conversations with Your Neighbor and Insurers

When a neighbor's tree comes crashing down on your property, the damage isn't just to your roof or fence. It puts an immediate strain on your neighborly relationship and kicks off a complicated dance between you, your neighbor, and at least one insurance company—maybe two.

Handling these conversations with a clear, calm head is absolutely critical. Your goal is to be firm, fair, and incredibly well-documented. A business-like approach will almost always get you better results than an emotional one.

Opening the Dialogue with Your Neighbor

That first conversation is key. Keep it simple and direct. It's best to assume they don't know the full extent of the situation until you've had a chance to speak with them. Approach them to inform, not to blame.

Start by calmly stating the facts. Something as straightforward as, "Hi, I wanted to let you know your large oak tree fell and caused some damage to our roof. I've already called my insurance company to get the process started," works perfectly. It tells them what happened without immediately pointing fingers.

From there, you can politely ask for their insurance details. Explain that your insurer will likely need to coordinate with theirs, especially if there's any question about whether the tree was a known hazard beforehand.

A Sample Letter if You Can't Talk in Person

If a face-to-face chat feels too confrontational, or if your neighbor simply isn't around, a short, polite letter or email is a great alternative.

Subject: Fallen Tree at [Your Address]

Dear [Neighbor's Name],

I hope you are doing okay. I’m writing to let you know that your tree fell onto our property today, [Date], and unfortunately, it has damaged our [e.g., fence and shed].

We have already started a claim with our homeowner's insurance carrier, [Your Insurance Company Name]. As part of their standard process, they have requested your homeowner's insurance information.

Could you please provide the name of your insurance company and your policy number when you have a moment? This will help make sure the claims process goes smoothly for everyone involved.

Thank you,

[Your Name]

[Your Phone Number/Email]

This approach is non-accusatory and keeps the entire interaction professional. It frames your request as just another procedural step, which is exactly what it is.

Interacting with Insurance Adjusters

Once you file a claim, you'll be speaking with at least one insurance adjuster—yours. And if you've alleged your neighbor was negligent, you might hear from their adjuster, too. It’s important to remember they each have a different objective.

Your own adjuster works for your insurance company. While they are there to help, their job is still to close the claim for the lowest amount possible based on your policy. Be cooperative, but be thorough. Give them every piece of documentation you've gathered—the "before" and "after" photos, any arborist reports, and copies of your communication with your neighbor.

When you're on the phone with any adjuster:

Keep a Log: Document every single call. Write down the date, time, the adjuster's name, and a quick summary of what you talked about.

Follow Up in Writing: After a phone call, send a quick follow-up email confirming the main points. This creates a paper trail and prevents any "misunderstandings" down the road.

Don't Give a Recorded Statement Lightly: You have no obligation to give a recorded statement to your neighbor's insurance company. It's often a tactic used to find inconsistencies in your story or get you to say something that hurts your claim.

It’s easy to underestimate how emotionally charged and expensive these disputes can become. Research shows that simple arguments over trees can escalate into major legal battles involving millions of dollars. In rare but shocking cases, they've even led to violence, which really underscores the high stakes when property rights and negligence collide. You can read the full research on tree-related neighbor conflicts to understand just how serious these situations can get.

If you feel an adjuster is delaying, downplaying the damage, or trying to pressure you into a quick, lowball settlement, that’s a major red flag. You don’t have to accept an unfair offer.

When conversations break down or the insurance companies simply refuse to be fair, that's the time to get a legal professional to step in and fight for you. In pain? Call Caine.

Recognizing When You Need A Property Damage Attorney

At first glance, tackling tree damage on your own can feel empowering. You snap photos, file paperwork, and brace yourself for the next step. Yet when responses stall or you hit a wall of resistance, you realize that DIY isn’t always enough.

Spotting the warning signs early can save you frustration—and money. Delay too long, and your arguments lose strength. By acting at the first hint of trouble, you shift from reactive stress to proactive control.

When Your Insurer’s Offer Feels Too Low

In my experience, a stingy settlement is the clearest sign you need backup. You wait weeks for a check that doesn’t even cover your lowest repair estimate.

Look out for these red flags:

Offer below your lowest bid. If three estimates start at $5,000 and they send $3,800, something’s off.

No detailed breakdown. You deserve to see how each dollar was calculated. Silence usually means they’re hiding something.

Pressure to sign fast. “This expires in 48 hours,” they warn. Why rush you? Because the ticking clock often forces homeowners to accept.

When Your Claim Is Denied Unfairly

Nothing hurts more than a flat-out denial. Insurers might blame a pre-existing issue or brand the incident an “Act of God,” even when negligence is obvious.

Remember, you pay premiums for moments like this. A denial letter isn’t set in stone. An attorney can dissect that rejection, comb through your policy, and build an appeal under Florida law. Our team thrives on these challenges—learn more about our specific legal services.

When Your Neighbor Refuses To Cooperate

Imagine this: you have photos of a decaying trunk, copies of warning emails, and still—no response. No insurance details, no admission of fault, just silence.

A seasoned property damage attorney can break through the wall of silence. Suddenly, ignored emails get answered, and evasive neighbors become communicative.

While the odds of a fatal tree strike hover around 1 in 20,000,000, property damage disputes are far more frequent. For deeper context, explore the statistical risks of falling trees on Naturenet.

Fighting a complex claim or a stubborn insurer alone is like navigating rough seas without a life vest. When you need balance, expert legal support levels the playing field. In pain? Call Caine.

Common Questions About Fallen Trees in Florida

When a neighbor's tree smashes onto your property, the initial shock wears off fast, replaced by a flood of tricky, specific questions. You've secured the area, you've called your insurer, but the unique circumstances of your situation can create confusion and bring your recovery to a screeching halt.

This section is all about tackling those common "what if" scenarios head-on. Here are direct, practical answers to the questions we hear most from Florida homeowners trying to navigate the aftermath of a fallen tree.

What Happens if the Tree Was on the Property Line?

A tree that straddles a property line—often called a "boundary tree"—is legally considered the property of both homeowners. That means you and your neighbor share ownership and are jointly responsible for its care and upkeep.

So, if a healthy boundary tree comes down in a hurricane and damages your house, you still file the claim under your own homeowner's policy. It’s treated just like a tree that was entirely on your neighbor's land.

But here’s where it gets complicated. If that tree was visibly diseased or decaying and neither of you did anything about it, you could both be seen as negligent. An insurance company might argue you shared the duty to remove the hazard, which can really muddy the waters on a liability claim. In these situations, any records of communication and shared maintenance are your best defense.

Who Pays for Debris Removal if No Structures Were Damaged?

This is a frustratingly common scenario. A huge oak crashes into your yard, narrowly missing your house, fence, and shed. It's a massive mess, but because there's no technical structural damage, there's often nothing to file a claim against.

In most cases, if no insured structure is damaged, you are on the hook for the cost of debris removal. Standard homeowner's policies typically won't cover tree removal unless that tree first damages a covered structure like your roof or fence.

Some policies have a small debris removal allowance, often around $500, but that's rarely triggered if only your lawn or garden is affected.

If a fallen tree doesn't damage your house or fence, the cleanup bill usually falls to you. The exception is if it blocks your driveway or a ramp necessary for handicapped access, in which case some policies may offer coverage.

Will My Insurance Rates Go Up After Filing This Claim?

Filing a single claim for an "Act of God," like a tree getting knocked over in a hurricane, shouldn't automatically cause your rates to skyrocket. Insurers in Florida expect these kinds of weather-related claims. In fact, they are prohibited from dropping you for a single storm-related claim.

However, a pattern of claims—say, three claims in three years—can absolutely flag you as a higher risk. That's when you might face a non-renewal or a significant premium increase down the road.

It's always smart to weigh the cost of the damage against your deductible and the potential long-term hit to your rates. For minor damage, paying out-of-pocket might just be the better financial move.

How the "Act of God" Defense Works with Florida Hurricanes

The "Act of God" defense is the go-to argument for insurers and neighbors trying to avoid liability. Their claim is simple: the event, whether a hurricane or a violent thunderstorm, was so powerful and unforeseeable that no amount of reasonable care could have prevented the tree from falling.

It's a strong defense, but it's not invincible.

To beat it, you have to prove the tree's fall wasn't just because of the storm but also because of a pre-existing, neglected condition.

For example, a healthy, well-maintained tree getting uprooted by a Category 4 hurricane is a textbook Act of God. But if a visibly rotten, termite-infested tree snaps during a tropical storm with 50 mph winds? Now you have a powerful argument that your neighbor's negligence was the real cause. Your evidence showing the tree's poor health before the storm is what ultimately dismantles this defense.

When your neighbor's negligence or your insurer's unfair tactics are causing you financial harm, you need an experienced advocate on your side. The team at CAINE LAW understands how to build a case that stands up to an "Act of God" defense and holds the right parties accountable. In pain? Call Caine. Learn more about how we can fight for you at https://cainelegal.com.