In Pain? Call Caine

how long to settle car accident claim: Timeline & Tips

5 Min read

By: Caine Law

Share

When someone asks me, "how long to settle a car accident claim?" my honest answer is always the same: it depends. There’s simply no magic number. A straightforward case might wrap up in a few months, while a complex claim involving serious injuries can easily stretch to two years or more. The key isn't to focus on a date on the calendar, but to understand the milestones that truly drive the timeline of your case.

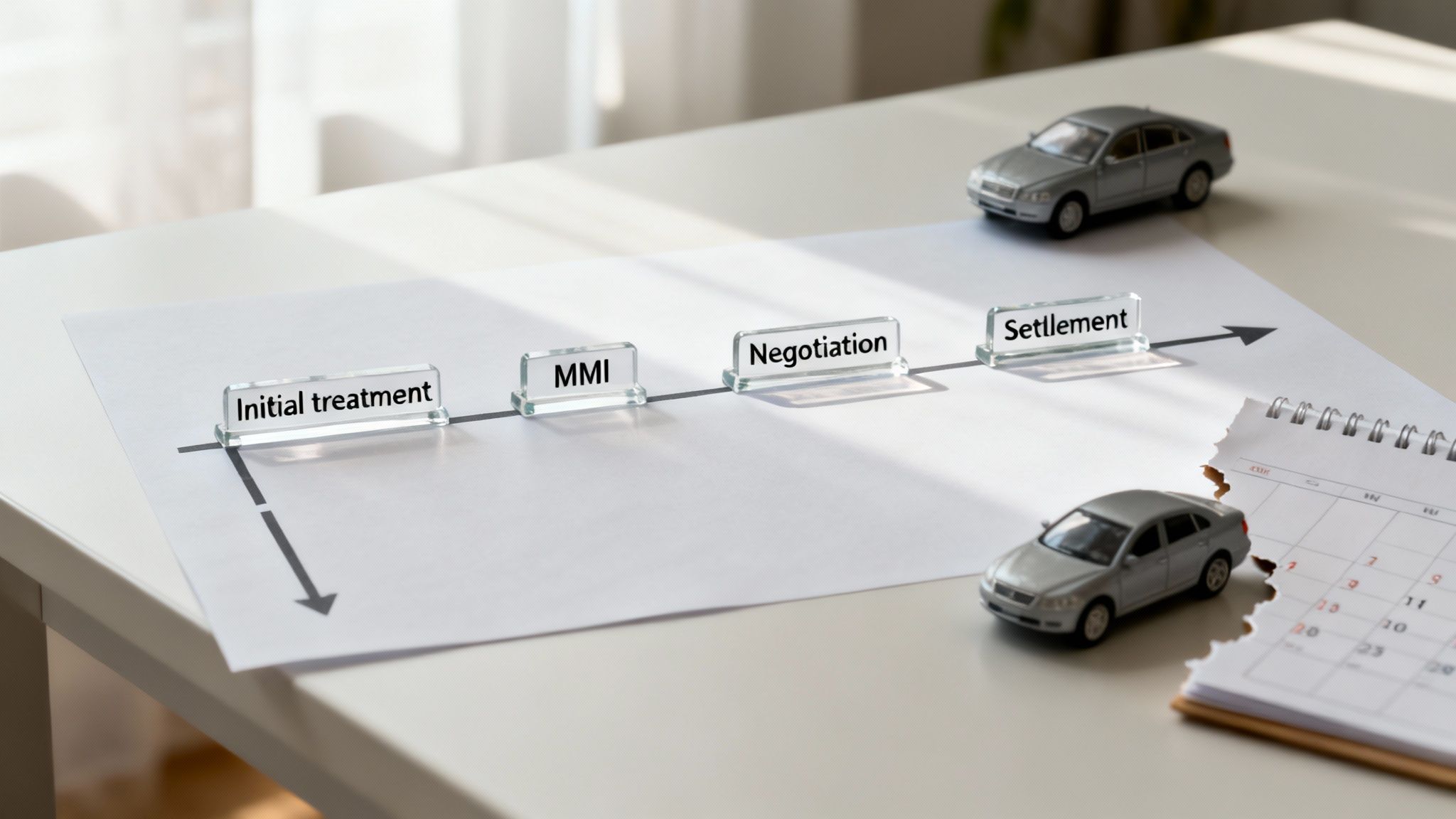

Your Car Accident Settlement Timeline at a Glance

Trying to guess a car accident settlement timeline can feel like trying to predict the weather—it’s full of variables. But just like meteorologists use patterns to make forecasts, the legal process follows a generally predictable path. The timeline isn't random; it’s shaped by clear factors, from how obvious the fault is to how severe your injuries are.

Think of it as a roadmap. A simple fender-bender is a quick trip across town, often resolving in a few months. But a multi-car pileup with life-altering injuries? That’s a cross-country journey with many necessary stops along the way.

The Most Critical Milestone: Maximum Medical Improvement

One of the most important concepts dictating your settlement timeline is Maximum Medical Improvement (MMI). This is the point when your doctor says your medical condition is as good as it’s going to get. You've either fully recovered or reached a plateau where more treatment won't lead to further improvement.

Reaching MMI is a critical turning point. It's only then that you and your attorney can grasp the full, long-term cost of your injuries. Settling before you hit MMI is a huge risk—you could be leaving money on the table for future surgeries, ongoing therapy, or permanent impairments, forcing you to pay for those costs yourself.

The infographic below gives you a good visual of the typical settlement windows for different types of claims.

As you can see, the complexity of your injuries and the facts of the accident directly control how long your claim will take.

To give you a clearer picture, here’s a quick breakdown of what to expect for different types of claims.

Estimated Settlement Timelines by Claim Type

Claim Type | Typical Settlement Timeline | Key Factors |

|---|---|---|

Property Damage Only | 1-3 Months | Speed of insurance adjuster's appraisal and clear liability. |

Minor Injuries | 3-9 Months | Time needed to complete short-term medical treatment and reach MMI. |

Serious Injuries | 12-24+ Months | Lengthy recovery, need for specialist opinions, potential for litigation. |

Wrongful Death | 1-3+ Years | Complex legal requirements, estate setup, high stakes negotiations. |

These timelines are just estimates, of course. Every case has its own unique twists and turns that can speed things up or slow them down.

Setting Realistic Expectations

Generally speaking, most car accident claims in the United States settle somewhere in the 3 to 18-month range. Minor accidents with undisputed fault are often on the faster end, wrapping up in just 3 to 6 months. This usually involves a few months for medical treatment, a few weeks to draft a demand letter, and another month or two for negotiations. But if a lawsuit becomes necessary, that can easily add another 9 to 18 months to the clock.

Knowing what to do right after a crash is also critical for setting your claim up for success from day one. If you're hurt and facing a long road to recovery, never let an insurance adjuster rush you into a quick settlement. Your only job is to focus on getting better, not haggling over dollars and cents. In pain? Call Caine.

The Five Key Stages of a Car Accident Claim

Figuring out how long it takes to settle a car accident claim is a lot easier when you see it for what it is: a series of distinct steps, not just one long, frustrating wait. Think of it like building a house—you have to pour the foundation before you can put up the walls. The claims process works the same way.

Each stage has to be completed before the next one can really get started. This methodical approach makes sure every detail is accounted for, from the initial police report all the way to the final check. Let's pull back the curtain on these five stages so you know exactly what’s happening with your case and why it takes time to do it right.

Stage 1: Initial Investigation and Medical Treatment

This is where it all begins. Starting from the moment of the crash, this foundational stage can last anywhere from a few weeks to several months, and the timeline is almost entirely dictated by your physical recovery. The two big goals here are getting medical care and gathering the initial facts.

Your health is priority number one. In Florida, it's critical to see a doctor within 14 days of the accident to be eligible for your Personal Injury Protection (PIP) benefits. This treatment phase continues until your doctor says you’ve reached Maximum Medical Improvement (MMI)—the point where your condition has stabilized as much as it’s going to.

While you're focusing on healing, your legal team gets to work on a deep-dive investigation to build the strongest possible case. This isn't just a quick once-over.

We're talking about a comprehensive effort that includes:

Getting the official police report to lock down the basic facts.

Tracking down and interviewing witnesses while the details are still fresh in their minds.

Photographing everything—the scene, the vehicle damage, and your injuries.

Gathering all your medical records to create a clear, documented picture of your injuries and treatment path.

This stage sets the groundwork for everything else. Without solid evidence and a full understanding of your medical outcome, you simply can't know what your claim is truly worth.

Stage 2: Building the Demand Package

Once you’ve reached MMI and we’ve collected all the initial evidence, it’s time to build the demand package. This usually takes a few weeks. Think of it as the complete, documented story of your accident, packaged professionally for the insurance company.

This is far more than just a letter asking for money. A well-crafted demand package is a powerful legal document that lays out:

A detailed narrative of the accident, making it crystal clear why the other driver was at fault.

An itemized list of every single medical bill, from the ER to physical therapy.

Proof of your lost wages, backed up by pay stubs and a letter from your employer.

A compelling account of your pain and suffering, explaining the real-world impact the injuries have had on your life.

Copies of all the evidence we’ve gathered—medical records, the police report, witness statements, you name it.

The demand package finishes with a specific dollar amount—the settlement figure your attorney has calculated as full and fair compensation for everything you've been through. This package officially kicks off formal negotiations.

Stage 3: The Negotiation Phase

After we send the demand package, the ball is in the insurance company’s court. This back-and-forth negotiation can last anywhere from one to three months, sometimes longer. The adjuster will review everything, run their own numbers, and come back with a response.

And that response is almost never an acceptance of our demand. You can expect a counteroffer, usually for a fraction of what you’ve asked for. This is where having a skilled negotiator in your corner becomes absolutely essential.

Negotiation is a strategic dance. Your lawyer will push back against their lowball offers with firm, evidence-based arguments, constantly pointing back to the proof in the demand package. This process continues until one of two things happens: we reach a fair agreement, or it becomes obvious the insurer isn’t willing to play ball.

Stage 4: Filing a Lawsuit and Discovery

If negotiations hit a wall, the next move is to file a lawsuit. Now, this doesn't mean you’re automatically heading to a dramatic courtroom showdown. In reality, more than 95% of personal injury cases settle long before a trial ever begins.

Filing a lawsuit is a strategic step that shows the insurance company you mean business. More importantly, it opens up a powerful legal process called discovery. This phase can take many months and allows both sides to formally request information from each other using tools like:

Interrogatories: A list of written questions the other side must answer under oath.

Requests for Production: Formal requests for documents, photos, and other evidence.

Depositions: In-person, sworn testimony from witnesses, experts, and the parties involved.

Discovery often turns up new facts that make your case even stronger, ratcheting up the pressure on the insurance company to finally make a fair offer.

Stage 5: Mediation or Trial

As discovery wraps up, most cases move toward a final resolution through either mediation or, in rare cases, a trial. Mediation is basically a supercharged settlement meeting. A neutral, third-party mediator works with both sides to find a middle ground and hammer out an agreement. It's highly effective and resolves the vast majority of cases without the stress and expense of a trial.

If mediation doesn’t work, the last resort is to take your case to a judge and jury. Going to trial can add a year or more to your timeline, but sometimes it’s the only way to get the full compensation you deserve when an insurance company simply refuses to do the right thing. Having an attorney who is ready and able to win in court is critical at this stage.

Each of these five stages is a necessary part of the journey. If you have questions about where your claim stands or feel like things are dragging on, don't hesitate to get expert legal advice. In pain? Call Caine.

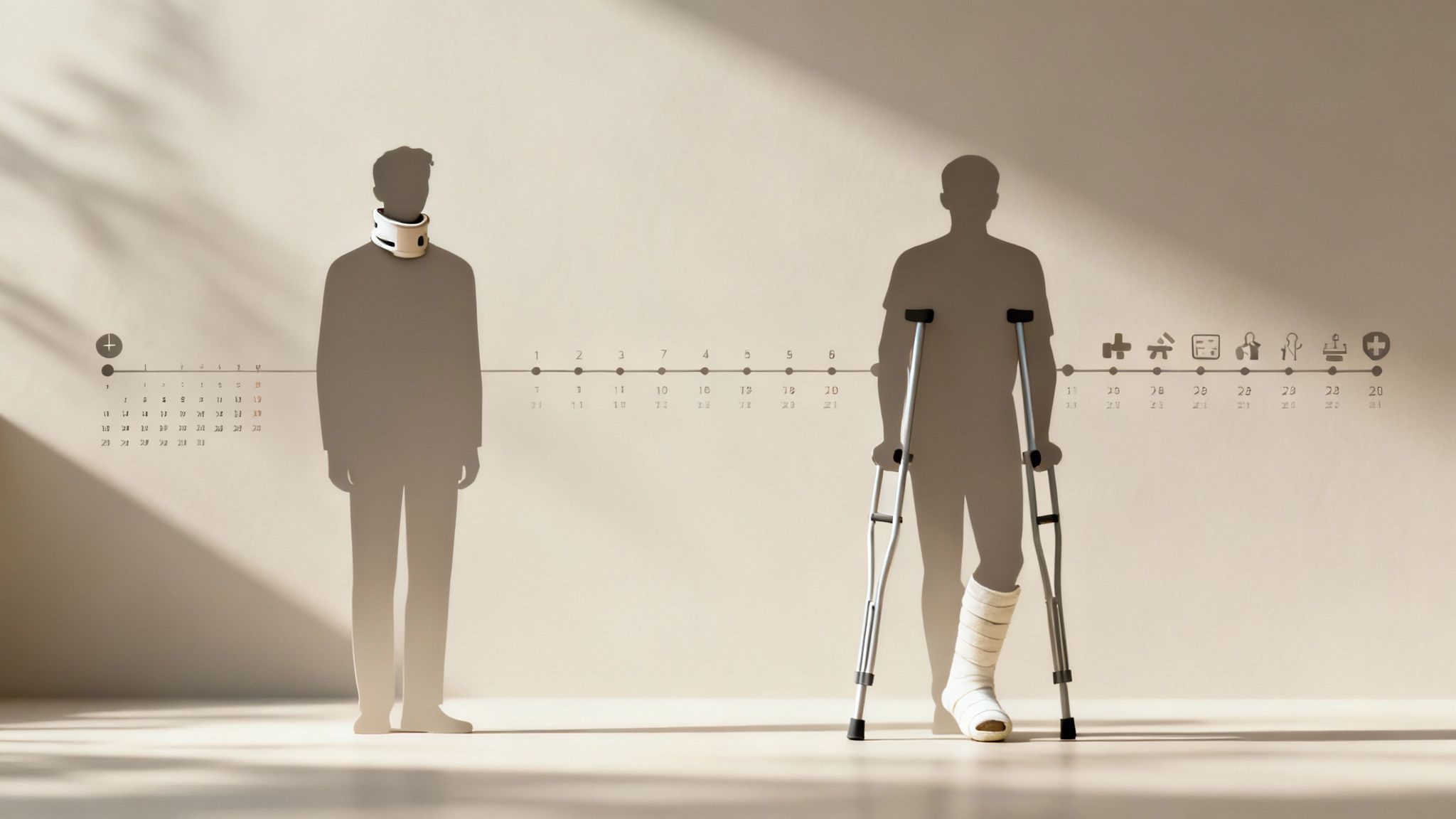

When you're trying to figure out how long it’ll take to settle a car accident claim, one thing matters more than anything else: how badly you were hurt. Your physical recovery is tied directly to your financial recovery. The more serious your injuries, the longer and more winding the road is to both healing and getting your settlement.

Think of it like selling a house. You wouldn't put your home on the market before you’ve fixed a leaky roof or a cracked foundation. If you did, you’d have to take a lowball offer because no one knows the true cost of the repairs. Your car accident claim works the exact same way.

The Importance of Maximum Medical Improvement

The biggest milestone in this whole process is reaching what we call Maximum Medical Improvement (MMI). This is the point when your doctors say your condition has stabilized. It means you've either made a full recovery, or your injury has plateaued and isn't expected to get significantly better, even with more treatment.

Hitting MMI is the green light for us to get serious about negotiating your settlement. Why? Because only then do we know the full story. We can finally add up all your damages—not just the medical bills you already have, but the estimated costs for future care, permanent impairments, and how this will affect your life for years to come.

Settling a claim before you reach MMI is one of the biggest mistakes you can make. You risk accepting a number that won’t cover future surgeries, ongoing physical therapy, or chronic pain management, leaving you to pay for it all out of your own pocket.

How Different Injuries Change the Timeline

It’s easy to see the direct line between the type of injury and how long a settlement takes. A minor whiplash case might just mean a few months of chiropractic visits, which could allow the claim to wrap up in under a year. On the other hand, an injury that needs surgery sets a much longer timeline in motion.

Let's look at a few common scenarios:

Minor Soft Tissue Injuries: A case with whiplash or muscle strains might involve a few months of physical therapy. A claim like this could settle within 6 to 12 months after your treatment is finished.

Broken Bones: A fracture that needs a cast and rehab is going to take longer. These cases often take 12 to 24 months to resolve, giving your body time to heal and allowing us to see if you'll have any long-term limitations.

Serious or Catastrophic Injuries: A claim involving a traumatic brain injury (TBI), spinal cord damage, or an amputation is in a different league. These cases frequently take two years or more to settle. They require extensive medical treatment, life care planning, and expert testimony to prove the full extent of your future needs.

This isn't just our experience; the data backs it up. A global analysis of claims shows that soft tissue injury cases often settle within 12 to 18 months, while those with broken bones can take 12 to 24 months. For the most severe injuries like amputations, the timeline can stretch to 24 to 36 months, simply because it takes that long to document everything and plan for a lifetime of recovery. You can dive deeper into these timeframes in this detailed legal overview.

Ultimately, patience isn't just a virtue in a personal injury claim—it's a strategy. Rushing things to get a quick check almost always means leaving a lot of money on the table. The only way to make sure your settlement truly covers everything you’ve lost is to let your medical journey play out first. If you're recovering from an injury and the insurance company is pressuring you, it’s time to get an expert in your corner. In pain? Call Caine.

Factors That Speed Up or Slow Down Your Claim

While the severity of your injuries is the main engine driving your settlement timeline, plenty of other variables act like traffic lights, turning your claim’s journey green or red. Getting a handle on these factors is crucial for setting realistic expectations for how long it will take to settle your car accident claim.

Think of it like this: some elements will give you a clear path forward, while others will bring everything to a grinding halt. The more "green light" factors you have on your side, the smoother and quicker the ride. But every "red light" adds a potential detour, easily stretching the timeline by weeks or even months.

Let's break down what helps and what hurts.

Green Light Factors That Speed Up Your Claim

Some situations just make it easier for an insurance company to size up a claim and put a fair offer on the table. When the facts are crystal clear and the damages are easy to calculate, there’s simply less to argue about.

Here are a few things that can really get the ball rolling:

Clear-Cut Liability: If fault is undeniable—think of a classic rear-end collision—the insurer has no room to argue. A police report that clearly points the finger is a powerful accelerator.

Prompt and Consistent Medical Treatment: Getting checked out right away and sticking to your doctor's plan creates a clean, credible record of your injuries. It shuts down the insurance company's favorite argument that you "must not have been hurt that badly."

Well-Organized Records: When you have all your documents—medical bills, proof of lost wages, repair estimates—neatly organized from day one, you avoid the frustrating back-and-forth caused by missing paperwork.

It really boils down to this: clarity and documentation speed things up. When an adjuster can easily see who was at fault and add up your losses, the whole negotiation process becomes far more efficient.

Red Light Factors That Slow Down Your Claim

Unfortunately, a lot of cases aren't so simple. Many have complicating factors that hit the brakes on the whole settlement process. These issues create uncertainty and give insurance companies an excuse to delay, dispute, and deny, forcing a much longer and more heated negotiation.

Spotting these red flags in your own case can help you prepare for a longer wait.

Disputed Fault

This is one of the most common reasons a claim gets stuck in the mud. If the other driver denies they were responsible or, even worse, tries to blame you, the insurance company will kick off a long investigation. This means re-interviewing witnesses, maybe even hiring accident reconstruction experts, and fighting over every single detail. This alone can add months to your timeline.

Multiple Parties Involved

Accidents with more than two cars or several injured people are just naturally more complex. Every person might have their own lawyer and their own story. Just trying to coordinate phone calls, depositions, and settlement talks between all those parties is a logistical nightmare that slows everything down.

Pre-Existing Conditions

If you had a previous injury to the same part of your body, you can bet the insurance company will try to use it against you. They'll argue the accident didn't cause your current pain and will demand years of your old medical records to prove it. Fighting back requires detailed evidence from your doctors and expert opinions, which takes a lot of time to gather.

Insurance Company Delay Tactics

Finally, some insurance companies just drag their feet on purpose. It's a strategy. They might throw out a ridiculously low offer, demand pointless paperwork, or just stop responding to your calls. These bad faith tactics are designed to wear you down and frustrate you into taking less than your claim is worth. Knowing they do this is the first step, but it often takes a lawyer to make them play fair. Understanding your rights is critical, which is why learning about navigating insurance disputes can be so valuable.

If your case is piling up red light factors, it’s a strong signal you might be in for a long haul. Having an experienced attorney in your corner to manage these headaches can make all the difference. In pain? Call Caine.

Of all the factors that influence your settlement timeline, nothing plays a bigger role than the laws of the state where the crash happened. If your accident was in Florida, you’re dealing with a unique set of rules that can absolutely stretch out the process.

Think of it like playing a card game where the house has its own set of rules you've never seen before. The insurance company knows these Florida-specific laws by heart and will use them to their full advantage. Understanding them yourself is crucial for setting realistic expectations for your claim.

Florida's No-Fault System and PIP Coverage

First off, Florida is a "no-fault" state. This creates an immediate first step that doesn't exist in many other places. It means that, no matter who was at fault for the accident, your own Personal Injury Protection (PIP) insurance is the first to pay for your initial medical bills and lost wages, up to a $10,000 limit.

While PIP is designed to get you quick access to benefits, it adds another layer to the process. For starters, you have to get medical treatment within 14 days of the crash just to be eligible for your own PIP coverage. After that, you're dealing with your own insurer first, and only then can you go after the at-fault driver's insurance for anything beyond what your PIP covers. It adds steps, and therefore, time.

The Statute of Limitations: A Clock That Doesn’t Stop

Every state has a hard deadline for filing a lawsuit, known as the statute of limitations. Florida's rules on this just changed. For any accident that happened on or after March 24, 2023, you now have only two years from the date of the crash to file a lawsuit.

That two-year clock is ticking, and it’s non-negotiable. If you miss that deadline, you lose your right to go to court and seek compensation—forever. This puts a ton of pressure on the timeline, because all the investigation, medical treatment, and negotiations have to happen with that final date looming over everything.

Comparative Negligence and the Fight Over Fault

Finally, Florida uses a "modified comparative negligence" rule. In simple terms, this means if you're found to be partially at fault for the crash, your final settlement gets reduced by your percentage of blame. And if a jury decides you were more than 50% responsible, you get absolutely nothing.

This rule is an open invitation for insurance companies to argue about who was at fault, even when it seems obvious. They'll look for any reason to shift blame onto you—claiming you were speeding, distracted, or didn't swerve in time—all to lower what they have to pay. These arguments can drag out negotiations for months, as proving fault becomes a major point of contention.

Navigating these state-specific laws isn't just a small part of the process; it's central to it. Having an expert on your side who lives and breathes the local legal system isn't just helpful—it’s often essential to getting a fair result in a reasonable amount of time. In pain? Call Caine.

When to Contact a Car Accident Attorney

Trying to handle a car accident claim by yourself is a tough road, especially when you should be focusing on getting better. While not every little fender-bender needs a lawyer, there are some definite red flags that tell you it’s time to call in a professional. The whole point is to level the playing field against a huge insurance company that has a team of people working against you.

Deciding when to get an attorney involved can make a massive difference in how long it takes to settle your car accident claim and, just as importantly, the final check you receive. If the stakes are high, you simply shouldn't go it alone.

Clear Signs You Need an Attorney

You should really think about calling a lawyer if your crash involves any of these situations. This is where an experienced attorney’s guidance becomes absolutely critical, especially for anyone involved in Florida auto and motorcycle accidents.

Serious or Long-Term Injuries: If you have anything more than a few minor bumps and bruises, you need an advocate. A good lawyer makes sure your future medical bills are properly calculated and included in your settlement, so you aren't left paying out-of-pocket years down the road.

Disputed Fault: The other driver or their insurance company is trying to blame you for the wreck? That's an immediate sign you need backup. A lawyer will protect your rights and get to work proving the other party’s negligence.

Lowball Settlement Offers: Insurance adjusters are trained professionals whose job is to pay you as little as possible. If their first offer feels like an insult, it probably is. An attorney can step in and negotiate a fair amount based on the actual evidence.

Complex Paperwork and Deadlines: The claims process is a maze of strict deadlines and confusing forms. One wrong move can tank your claim. An attorney handles all of this for you, so you can avoid costly mistakes.

A skilled lawyer takes the entire burden off your shoulders—from gathering police reports and medical records to dealing with adjusters and filing a lawsuit if they refuse to be fair. This not only shields you from the insurance company's tactics but can actually speed up the path to a just resolution.

Don't let an insurance company decide what your health and future are worth. If you feel lost, pressured, or just unsure about what to do next, getting professional legal advice is the most powerful move you can make. In pain? Call Caine.

Frequently Asked Questions About Settlement Timelines

When you're trying to heal after a car crash, it’s completely normal to have questions about how the settlement process works. The timeline can feel like a mystery, but getting answers to a few common questions can help you know what to expect on the road ahead.

Here are some direct answers to the things people worry about most when it comes to how long it takes to settle a car accident claim.

Will My Case Settle Faster If I Accept The First Offer?

Yes, grabbing that first offer is almost always the quickest way to close your claim—but it’s almost never the smartest move. That initial offer from the insurance company isn't their best; it's just a starting point designed to be low.

Rushing to accept it means you're likely leaving serious money behind. You could be giving up the compensation you’ll need for future medical treatments, lost income down the line, and your full pain and suffering. A patient, evidence-driven approach is the only way to get a fair result that truly covers everything you’ve lost.

Does Filing A Lawsuit Mean My Case Will Go To Trial?

Not at all. This is one of the biggest myths in personal injury law. The reality is that the vast majority of car accident lawsuits—well over 95%—settle out of court long before a trial is necessary.

Filing a lawsuit is often a strategic and necessary step. It protects your right to sue before the deadline and shows the insurance company you’re serious. This move kicks off the "discovery" phase, where both sides have to share information, which usually pushes them toward a reasonable settlement.

Can I Do Anything To Speed Up My Car Accident Claim?

While a lot of the timeline is out of your hands, you can absolutely take steps to prevent needless delays. The best thing you can do is be proactive and organized. It helps your case move forward as smoothly as possible.

You can help your attorney by:

Getting medical attention right away and sticking to your doctor’s treatment plan.

Keeping detailed records of every medical bill, out-of-pocket cost, and day you miss from work.

Responding quickly when your legal team asks for information or documents.

Solid documentation and clear communication are your best tools for avoiding delays you can control. It ensures your attorney has everything they need to build a powerful case for you.

At CAINE LAW, we manage the entire process so you can focus on healing. If you have questions about your claim, we have answers. In pain? Call Caine. Contact us today for a free, no-obligation consultation at https://cainelegal.com.