In Pain? Call Caine

How Do You Sue an Insurance Company in Florida: A Complete Guide

5 Min read

By: Caine Law

Share

Suing an insurance company isn't the first step you take. It's the move you make when your insurer forces your hand. You've filed a valid claim, but they've responded with unreasonable delays, a lowball offer, or an outright denial.

Filing a formal complaint in court is how you hold them accountable. This legal action forces the company to stop hiding behind adjusters and formally defend their decision, allowing you to fight for the full compensation you’re entitled to under the law.

Recognizing When It's Time to Sue Your Insurance Company

You pay your insurance premiums on time, every time. You trust that when disaster strikes—a hurricane rips through your home or a serious car accident upends your life—your provider will be there for you.

But what happens when they’re not?

The hard truth is that insurance companies are massive for-profit businesses. Their bottom line often depends on paying out as little as possible. This inherent conflict of interest can lead to incredibly frustrating and unfair outcomes for policyholders right here in Florida.

Deciding to sue isn't about being overly aggressive. It's about enforcing the contract you paid for. It becomes a necessary tool when your insurer’s behavior crosses the line from a simple disagreement over value to actions that show a clear disregard for your rights.

Understanding Insurance Bad Faith

In Florida, every insurance policy comes with an unspoken promise called the "covenant of good faith and fair dealing." This is a legal duty that requires your insurer to treat you honestly and fairly when you file a claim.

Insurance bad faith is the legal term for when an insurer breaks that promise. It's more than just denying a claim; it's about denying it without a reasonable basis, failing to conduct a proper investigation, or putting their own profits ahead of their contractual obligations to you.

It's crucial to know what bad faith looks like in the real world. Many policyholders don't realize their insurer's frustrating tactics are actually legally questionable.

Signs Your Insurer May Be Acting in Bad Faith

Insurer's Action | What It Looks Like in Practice | Why It's a Red Flag |

|---|---|---|

Unreasonable Delays | Your claim sits "under review" for months with no updates or clear reason. The adjuster won't return your calls. | They're hoping you'll get tired and either give up or accept a lower offer out of desperation. |

Insufficient Investigation | The insurer makes a decision without inspecting the property, talking to witnesses, or reviewing police reports. | A fair decision requires a thorough look at the facts. A rushed or lazy investigation is a sign they aren't looking for the truth. |

Lowball Settlement Offers | They offer you $5,000 for a claim with $50,000 in documented medical bills and repair estimates. | This is a pressure tactic. The offer is so low it's insulting, designed to see if you'll cave instead of fighting for what's fair. |

Misrepresenting the Policy | An adjuster tells you, "Your policy doesn't cover that," when the language in your contract says it does. | They are banking on the fact that you haven't memorized your policy. This is a deliberate attempt to mislead you. |

These are just a few examples. If your gut tells you something is wrong with how your claim is being handled, you're probably right.

When Disagreements Become Lawsuits

Look, not every denied claim is grounds for a lawsuit. Sometimes, there are legitimate disagreements about the value of damages or how a policy applies. A lawsuit is a major step.

However, when the insurer shows a pattern of unfairness, refuses to negotiate reasonably, or just stonewalls you completely, it's time to escalate.

The numbers tell the story. The global insurance litigation market is on track to hit $12.5 billion by 2025, driven by increasingly complex claims and disputes. With around 40 million lawsuits filed in the U.S. annually, this is a world where insurance companies have armies of lawyers on standby. You need to be just as prepared. You can read the full research about insurance litigation trends to get a better sense of the landscape.

The bottom line is about fairness. When an insurer puts its own financial interests ahead of its duty to you, the policyholder, it may be acting in bad faith. That’s the legal trigger that makes a lawsuit not just an option, but a necessity.

If you even suspect your insurer is acting in bad faith, start documenting everything. Every phone call, every email, every letter. Then, seek legal advice immediately. A trial attorney who deals with these companies every day can quickly tell you if their conduct has crossed the legal line.

In pain? Call Caine.

Critical Steps to Take Before You Ever File a Lawsuit

Before you even think about setting foot in a courtroom, the groundwork you lay can make or break your entire case. Taking a few strategic, methodical steps before filing a formal complaint can often force an insurer’s hand, leading to a fair settlement without the fight.

Think of this phase as building your case brick by brick. Rushing into a lawsuit unprepared is one of the biggest mistakes you can make. Insurance companies have teams of lawyers ready to poke holes in any weakness they can find. Your goal is to build a case so airtight that they see a trial as a bad bet for them.

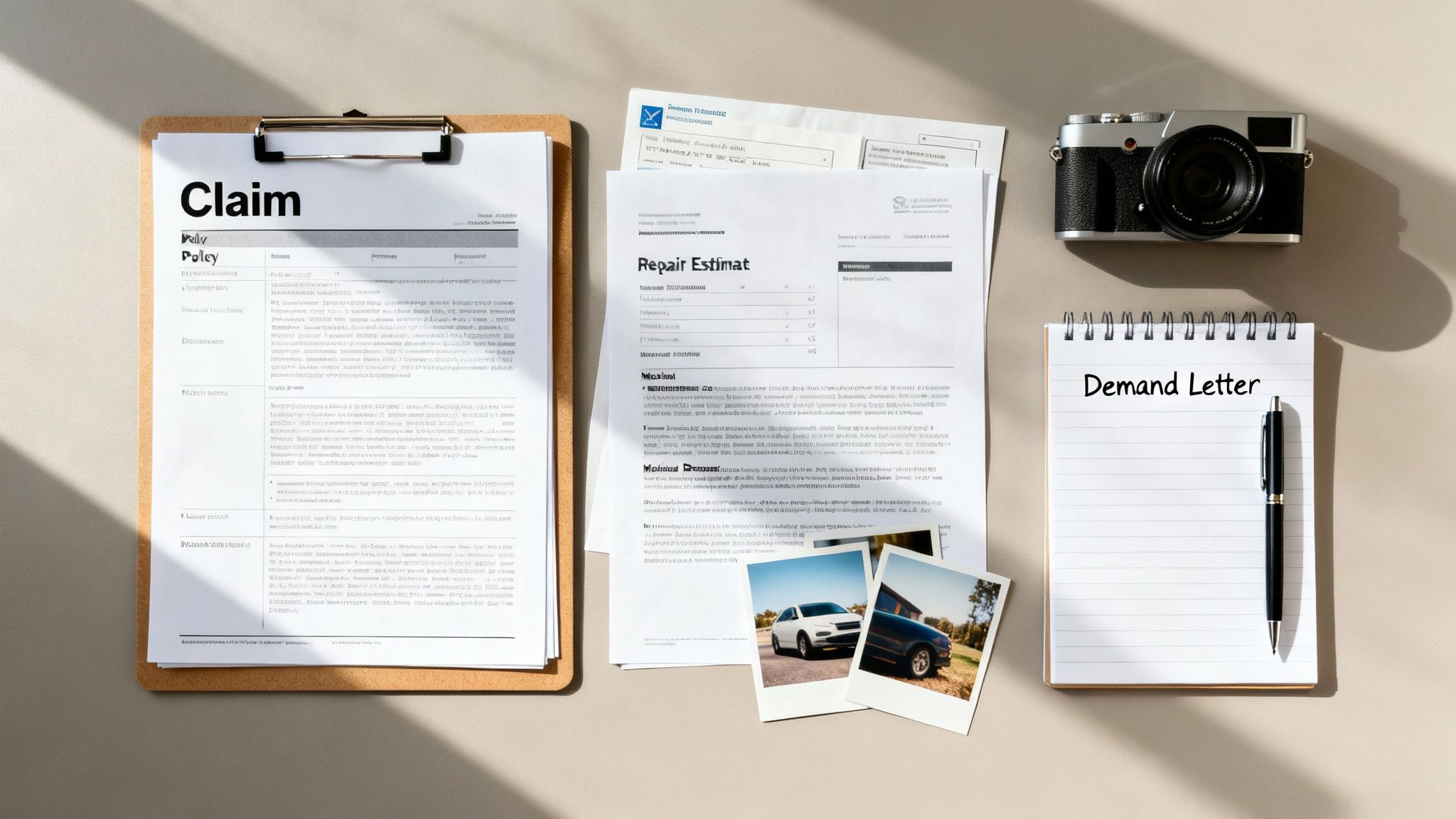

Assemble Your Arsenal of Evidence

The single most powerful weapon you have is documentation. Period. Before you can argue that your insurer dropped the ball, you need every piece of evidence organized and ready to go. This isn't just about shuffling paperwork; it's about building an undeniable timeline of your claim and their response (or lack thereof).

Your success really hinges on your ability to prove your case with cold, hard facts—not just your word against theirs.

Here’s what your evidence file absolutely must include:

The Complete Insurance Policy: I don't mean just the declarations page. You need the entire policy document, including all the endorsements and riders. This is the contract, the very foundation of your legal rights.

All Communications: Every single email, letter, and text message between you and the insurance adjuster. If you had phone calls, you need detailed notes with the date, time, and a summary of what was said.

Proof of Damages: This means photos and videos of the damage to your property or your injuries, multiple repair estimates from contractors, and a complete set of your medical records and bills. For a rundown of what to do right after an incident, it helps to understand the essential steps to take when accidents happen.

Your Original Claim Submission: Keep a perfect copy of everything you first sent to the insurer. This proves you gave them all the necessary information from day one.

When you put all this together, it tells a clear story and exposes any shady delays, contradictions, or unreasonable behavior from the insurance company.

File a Civil Remedy Notice in Florida

Here in Florida, you generally can't just sue an insurance company for bad faith out of the blue. The law requires you to give them one final, formal chance to make things right. This is done by filing a Civil Remedy Notice (CRN) with the Florida Department of Financial Services.

This notice is a mandatory prerequisite for any bad faith lawsuit. It officially puts the insurer on notice, spelling out exactly how you believe they violated Florida law and the terms of your policy.

Once you file it, the clock starts on a 60-day "cure" period. During this time, the insurer can pay what they owe, fix their mistake, or simply do nothing at all.

This 60-day window is a critical moment. The insurer's response—or their silence—becomes a powerful piece of evidence in a future bad faith lawsuit. It demonstrates to a judge and jury that you gave the company every reasonable opportunity to do the right thing before you were forced to sue.

Craft a Strategic Demand Letter

While the CRN is a legal requirement, a powerful demand letter sent by your attorney is a strategic one-two punch. This isn't just a simple request for payment. It's a full-blown legal argument in writing, laying out your entire case in a clear and compelling way.

A strong demand letter will:

Summarize the Facts: It presents a clear, no-nonsense timeline of the incident and your claim.

Cite Policy Language: It points to the specific sections of your own insurance policy that cover the damages.

Outline the Bad Faith Actions: It methodically details the insurer's unreasonable delays, lowball offers, or failure to investigate properly.

Make a Clear Demand: It states a specific, reasonable settlement amount that will resolve the claim without dragging everyone to court.

This letter sends a clear message: you are serious, you are organized, and you are fully prepared to go to trial. More often than not, a well-written demand from an experienced trial lawyer is what it takes to bring the insurance company back to the negotiating table with a realistic offer.

If they still refuse to act fairly, these pre-suit steps will have perfectly positioned you to file your lawsuit from a position of undeniable strength.

In pain? Call Caine.

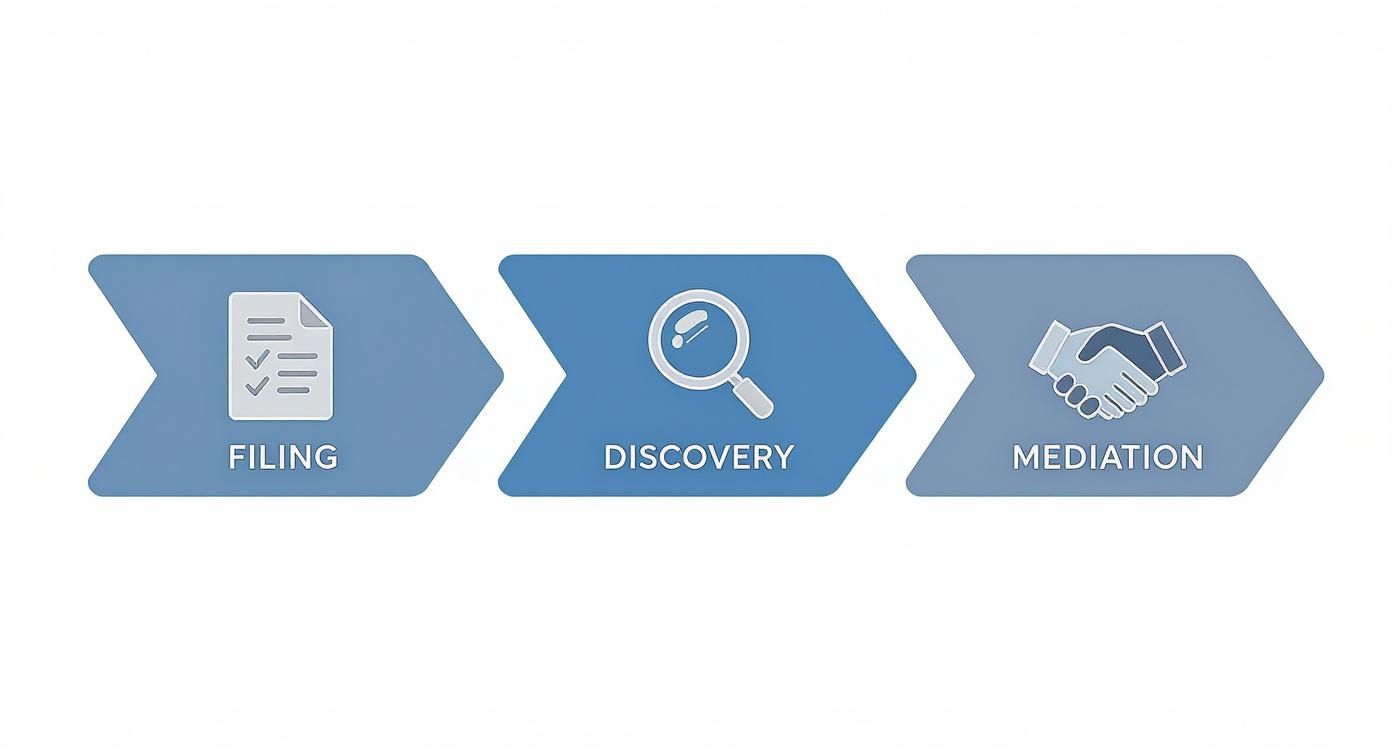

Navigating the Florida Insurance Lawsuit Process

So, you’ve sent the demand letters, provided all the documentation, and played by the rules. But the insurance company still won't do the right thing. When all pre-suit options have been exhausted and the carrier refuses to pay what’s fair, it’s time to escalate the fight. This is the point where you officially ask the legal system to step in and compel them to act.

Filing a lawsuit might sound intimidating, but once you have a roadmap, the process is far more predictable than you'd think. This is how you transition from informal demands to a structured legal battleground where rules and evidence matter more than an adjuster's opinion. It forces the insurance company to stop hiding behind internal bureaucracy and start answering to a judge and, potentially, a jury.

Kicking Off the Lawsuit: The Complaint and Service

The first real shot across the bow in an insurance lawsuit is filing a document called a "Complaint." This is the formal legal document that officially starts the case. Think of it as the opening chapter of your story, told to the court in a very specific way.

Your attorney will draft the Complaint to lay out a few critical elements:

The Parties Involved: This clearly identifies you (the Plaintiff) and the insurance company you are suing (the Defendant).

The Factual Background: A straightforward, concise history of what happened—the incident, the policy you paid for, the claim you filed, and the insurer's wrongful denial or lowball offer.

The Legal Claims: These are the specific legal arguments, or "counts," against the insurer. The most common is "Breach of Contract" for failing to honor the policy. Depending on the circumstances, we might also include a count for "Bad Faith" based on their unfair handling of your claim.

Once the Complaint is filed with the correct Florida court, it has to be legally delivered to the insurance company. This is called "service of process." It's a formal, non-negotiable step that puts them on official notice of the lawsuit. From that moment on, they are legally required to respond.

The Discovery Phase: Uncovering the Truth

After the insurer files their formal "Answer" to your Complaint, the case moves into what we call discovery. This is, without a doubt, one of the most critical phases of any lawsuit. It’s where each side gets to demand information, documents, and evidence from the other.

This isn't a chaotic free-for-all; it's a highly structured exchange governed by strict rules of civil procedure. The entire point is to prevent "trial by ambush," making sure both sides know all the relevant facts long before anyone steps foot in a courtroom.

Discovery is where we pull back the curtain. It's our chance to get our hands on the insurance company's internal claim file—the adjuster's private notes, emails between managers, and the real reasons they decided to deny your claim, not just the official excuses they gave you.

We use several powerful tools to get this information:

Interrogatories: These are written questions that the insurance company must answer in writing, under oath. For instance, we might ask them to identify every single person who had a hand in the decision to deny your claim.

Requests for Production: We demand they turn over specific documents. This could be anything from the adjuster’s training manuals and internal emails about your claim to records of how they’ve handled other, similar claims.

Depositions: This is where things get really interesting. It’s live, sworn testimony taken outside of court. Your attorney will question the insurance adjuster and other company employees under oath while a court reporter transcribes every single word. This is our chance to lock them into their story and expose any inconsistencies.

Mediation: The Mandatory Negotiation Table

In Florida, most civil cases—including insurance disputes—are required to go through mediation before they can proceed to a trial. You can think of it as a supercharged settlement negotiation, guided by a neutral third-party mediator.

Everyone with the power to settle the case must be there: you, your attorney, the insurer's lawyer, and a representative from the insurance company. The mediator’s job isn’t to declare a winner but to help both sides see the risks of trial and find a middle ground for a voluntary resolution.

This is a huge opportunity. It’s often the very first time that the insurance company's decision-makers hear the full story directly from your attorney, without the spin of their own adjusters. A successful mediation can resolve your case months, or even years, sooner than waiting for a trial date. To get a better sense of how these cases are managed from start to finish, you can learn more about our firm's approach to Florida insurance disputes.

If an agreement is reached, it’s drafted into a legally binding settlement contract, and the lawsuit is officially over. If you can’t reach a deal, the next and final step is preparing for trial.

Even if mediation doesn't end in a settlement, the preparation itself is crucial. Insurance companies are far more likely to make a fair offer when they see you are organized, armed with evidence, and fully prepared to present a powerful case to a jury. That readiness gives you maximum leverage at every single stage of the fight.

In pain? Call Caine.

Anticipating the Insurance Company's Defense Strategy

When you decide to sue your insurance company, you're not just filing paperwork. You're stepping into the ring against a well-funded opponent with a whole playbook of tactics designed to wear you down and pay you as little as possible.

Winning isn't just about proving you're right; it's about seeing their moves before they make them. You have to be ready to dismantle their arguments from day one. By knowing what’s coming, you and your attorney can build a powerful counter-strategy that stops their defenses in their tracks.

Common Defense Tactic: Material Misrepresentation

One of the first things an insurer will do is pull out your original application and hunt for any mistake, no matter how small. They call this "material misrepresentation."

Maybe you slightly misjudged your annual mileage on a car insurance form five years ago. They’ll seize on that, arguing you intentionally misled them to get a lower premium. The goal? To void your entire policy and deny the claim.

The key word here is "material." For this defense to hold up, the insurance company has to prove that whatever they found was so significant they wouldn't have issued the policy at all, or would have charged far more for it.

A simple, honest mistake isn't grounds for denial. This defense often falls apart once we show the error was unintentional and didn't actually affect the risk they agreed to cover in the first place.

The "Failure to Cooperate" Argument

Another classic move is to accuse you of "failing to cooperate" with their investigation. Yes, your policy requires you to provide documents and answer questions. But some adjusters and lawyers twist this clause into a weapon.

They might send you endless, overlapping requests for documents, some of which are completely irrelevant. They’re hoping you’ll get overwhelmed and miss something. The second you do, they pounce, claiming your "failure" to produce some minor document is a breach of the policy that justifies denying your claim. It’s a way to shift the blame from their bad faith to your supposed lack of compliance.

This is exactly why keeping meticulous records is non-negotiable. A clean paper trail showing you made every reasonable effort to comply is the perfect antidote to this tactic.

The entire legal process is the battlefield where these strategies play out.

From filing the lawsuit through the discovery phase and into mediation, we'll be fighting their defenses every step of the way.

Blaming Pre-Existing Conditions and Digging for Policy Exclusions

In any case involving a personal injury, you can bet the insurer’s go-to defense will be blaming a pre-existing condition. If you had even a minor history of back pain, they'll argue your current injury from a car crash has nothing to do with them. They will hire their own doctors—who are paid to find reasons to deny claims—to say your need for treatment isn't related to the accident.

They also lean heavily on policy exclusions. Insurance policies are packed with confusing, technical language for a reason. They will find a vague exclusion and claim it applies squarely to your situation, banking on the hope you won't have the legal firepower to challenge their self-serving interpretation.

Unfortunately, the broader legal environment can make this even tougher. One analysis found that over the last decade, legal system abuse has added between $231.6 billion and $281.2 billion to what insurance companies pay out, mainly from huge jury verdicts. This makes them fight even harder on every claim. You can discover more insights about these litigation trends and see how it's affecting cases like yours.

An experienced trial lawyer knows exactly how to push back. We use your medical records, testimony from your own doctors, and solid legal arguments to prove the accident caused your injuries and to show that the company's reading of its own policy is just an excuse.

Knowing their playbook is half the battle. To give you a clearer picture, here’s a breakdown of their common tactics and how we prepare to shut them down.

Insurer Defense vs. Your Counter-Strategy

Insurer's Defense Tactic | What It Means | How to Prepare a Strong Rebuttal |

|---|---|---|

Material Misrepresentation | They claim you lied or made a significant error on your initial insurance application to get a better rate. | Provide evidence that any mistake was unintentional and not "material" to the risk. Show a history of honest dealings. |

Failure to Cooperate | They accuse you of not providing documents or information they requested during their investigation. | Keep meticulous records of all communications. Document every document sent and every request answered to prove compliance. |

Pre-Existing Condition | They argue your injury was caused by a prior health issue, not the recent accident or event. | Gather medical records before and after the incident. Obtain expert medical opinions that link the injury directly to the covered event. |

Policy Exclusion | They point to fine print in your policy that they claim excludes your specific type of loss from coverage. | Conduct a thorough legal analysis of the policy language. Argue that their interpretation is unreasonable or that the exclusion is ambiguous. |

Late Notice | They allege you waited too long to report the claim, which prejudiced their ability to investigate. | Show that you reported the claim as soon as was reasonably possible. Argue that any delay did not harm the insurer's investigation. |

By anticipating these moves, we can build a case that exposes their tactics for what they are—excuses to avoid paying what they owe.

In pain? Call Caine.

How You Can Afford to Fight an Insurance Company

When an insurance company denies your claim, the injustice hits you first. Right after that, a second, more practical thought almost always follows: the cost.

How can an ordinary person possibly take on a billion-dollar corporation with a whole army of lawyers on retainer? It’s a real fear, and it's one insurers absolutely count on.

They want you to feel outmatched and intimidated. But here in Florida, the legal system has some powerful tools designed to level this exact playing field. The bottom line is this: you can afford to fight for what you're owed, and it won't cost you a single dollar out of your pocket to get started.

This is all possible because most reputable insurance dispute lawyers in Florida work on a contingency fee basis. The idea is simple but incredibly powerful: we only get paid if we win your case.

The No Win, No Fee Promise

A contingency fee agreement means you pay zero upfront attorney's fees. Your lawyer puts their own time, resources, and experience into building and fighting your case from start to finish.

Their payment is simply a pre-agreed-upon percentage of the money they get for you, whether that comes from a settlement or a verdict at trial.

This system puts your attorney’s interests directly in line with yours. We are completely motivated to get you the best possible result because our success is tied directly to your success. If we don’t win money for you, we don’t get paid. Period.

This is the "no win, no fee" promise that makes justice accessible. It removes the financial roadblock, allowing you to challenge a powerful insurance company without putting your own finances on the line.

Understanding Fees Versus Costs

It's also important to know the difference between attorney's fees and litigation costs. They aren't the same thing.

Fees: This is what you pay your lawyer for their time and legal skill. On a contingency agreement, this is the percentage taken from the final recovery.

Costs: These are the out-of-pocket expenses needed to keep a lawsuit moving. This includes things like court filing fees, hiring expert witnesses (like engineers or doctors), paying for deposition transcripts, and mediation fees.

Many firms, including ours, will advance these litigation costs for you. That means we cover these expenses as they pop up. They are then simply reimbursed from the settlement or verdict at the end of the case, after the attorney's fees are calculated.

Florida Law Can Make the Insurer Pay Your Legal Bills

This is where Florida law gives policyholders an incredible advantage. Specific Florida Statutes were written to hold insurance companies accountable when they wrongfully deny or underpay a claim.

If you have to sue your own insurance company and you win, the law can force the insurer to pay your attorney’s fees and costs in addition to the money they owed you on your claim in the first place. This is a game-changer. It means the insurance company doesn't just have to pay what they originally owed, but they also have to foot the bill for the legal fight they forced you into.

This provision is a massive deterrent. It discourages insurers from issuing bad-faith denials, because they know a legal battle could end up costing them far more than just paying the claim properly.

This financial reality is what makes suing an insurance company a manageable and realistic path forward. It's especially important today, as rising litigation expenses and "social inflation" have complicated the legal environment. In fact, U.S. commercial casualty insurance losses soared to $143 billion in 2023 over the past five years, driven largely by aggressive litigation and bigger jury awards. You can learn more about how litigation costs impact insurance claims to see how the stakes are rising for everyone involved.

Don't let the fear of legal bills stop you from getting the justice you deserve. The system is designed to give you a fighting chance.

In pain? Call Caine.

Why an Experienced Trial Attorney Is Your Greatest Asset

Trying to take on an insurance giant by yourself is a battle you simply can’t afford to lose. While you can technically sue an insurer on your own, it’s like stepping into the ring for a professional prize fight with zero training.

Think about it: the insurance company has an entire team of seasoned lawyers. Their one and only job is to dismantle claims like yours and pay out as little as possible. They know every procedural rule, every legal loophole, and every delay tactic in the book designed to wear you down until you give up.

Without a real expert in your corner, you’re at a massive disadvantage. It’s far too easy to make a critical misstep that could gut an otherwise valid case.

The Specialist Advantage

Let’s be clear—not all lawyers are created equal. An attorney who handles a little bit of everything is no match for a true trial lawyer who lives and breathes Florida insurance disputes. This is their entire world.

A specialist brings a level of focus that a general practitioner just can't match. They can:

Accurately Value Your Claim: They know how to calculate the full value of your case, from future medical bills and lost earning capacity to the pain and suffering damages the insurer is hoping you'll completely overlook.

Bring in the Big Guns: Top trial attorneys have a trusted network of medical professionals, accident reconstructionists, and financial experts on speed dial, ready to provide the powerful evidence needed to prove your damages.

Negotiate from a Position of Strength: Insurance companies keep tabs on law firms. They know which attorneys settle every case and which ones aren’t afraid to go to trial. That reputation alone completely changes the dynamic of settlement talks.

An experienced trial lawyer’s reputation walks into the room before they do. When they file a lawsuit, the insurance company knows the threat of a jury is real, which often forces them to the table with a much more serious settlement offer.

Hiring the right attorney is the single most important decision you'll make in this process. It’s not just about knowing the law; it’s about having the experience and courtroom credibility to make a billion-dollar corporation treat you fairly. The same logic applies to other complex cases, like those involving commercial trucks, where understanding why to hire the best truck accident attorney can be the key to a successful outcome.

Don't get lost in this legal maze alone.

In pain? Call Caine.

Common Questions We Hear About Florida Insurance Lawsuits

When you're squaring off with your insurance company, a thousand questions run through your head. You need straight answers, and you need them now. Here are some of the most pressing concerns we hear from Florida policyholders who are thinking about filing a lawsuit.

How Long Do I Have to Sue My Insurance Company in Florida?

This is one of the most critical questions, because the clock is ticking. After an insurer denies your claim or refuses to pay what you’re owed, you don't have forever to act. Florida law has very strict deadlines, known as the statute of limitations. If you miss that window, you lose your right to sue, period.

For most insurance fights, there are two deadlines you need to know:

Breach of Contract: When the insurance company fails to hold up its end of the bargain—your policy—you generally have five years from the date they broke that promise to file a lawsuit.

Bad Faith Claims: The timeline for a bad faith case is also often five years, but this can get tricky. The specific facts of your situation can absolutely change these deadlines, which is why you can't afford to wait.

These cutoffs are non-negotiable. It’s why getting legal advice quickly isn't just a good idea; it's essential.

Can My Insurer Drop Me Just for Suing Them?

We get this question all the time. It’s a completely valid fear. You’re worried that if you stand up for your rights, you’ll suddenly be left high and dry without any coverage.

Let me put your mind at ease: it is illegal for an insurance company to cancel your policy in the middle of the term just because you filed a legitimate claim or a lawsuit. That’s retaliation, plain and simple, and it's a classic example of bad faith.

Now, they can choose not to renew your policy when it expires for valid underwriting reasons, but they cannot punish you for making them pay what they owe.

What Is My Insurance Lawsuit Actually Worth?

There's no simple calculator for this. Anyone who tells you otherwise isn't being straight with you. Figuring out what a case is worth is a detailed process that boils down to the unique facts of your situation.

The true value of your case isn't just about the check the insurer refused to write. It’s about all the harm their denial caused. In a strong bad faith case, that can sometimes push the final recovery well beyond the original policy limits.

An experienced trial lawyer will dig into several key factors:

Your Policy Limits: This is our starting line—the maximum amount of coverage you paid for.

Your Documented Damages: This is everything you've lost. Repair costs for your property, medical bills, lost income because you couldn't work—it all gets tallied up.

The Strength of the Bad Faith Evidence: If we can prove the insurer acted dishonestly, unfairly, or without a reasonable basis, the door opens to recovering damages far beyond what the policy itself covers.

A skilled attorney knows how to analyze these pieces to give you a clear-eyed valuation and then build a strategy to go after every single dollar you're entitled to.

At CAINE LAW, we know the insurance company’s playbook inside and out. We know how to take it apart and fight for the compensation you deserve. You don’t have to do this alone. In pain? Call Caine.