In Pain? Call Caine

Florida Guide: how do i sue an insurance company in court

5 Min read

By: Caine Law

Share

So, your insurance company took your money for years and then, when you needed them most, they slammed the door in your face. It’s a frustrating, all-too-common story. When your insurer denies, delays, or lowballs a valid claim, you might feel powerless. But in Florida, you have options.

This isn't just about getting what you're owed; it's about holding a powerful corporation accountable. This guide will walk you through the real-world steps of how to sue an insurance company that has failed to uphold its end of the bargain.

Let's be clear: going up against a massive insurance carrier is daunting. They have entire legal departments dedicated to protecting their profits, which often means paying you as little as possible. Our goal here is to level that playing field, arming you with the knowledge to fight back effectively.

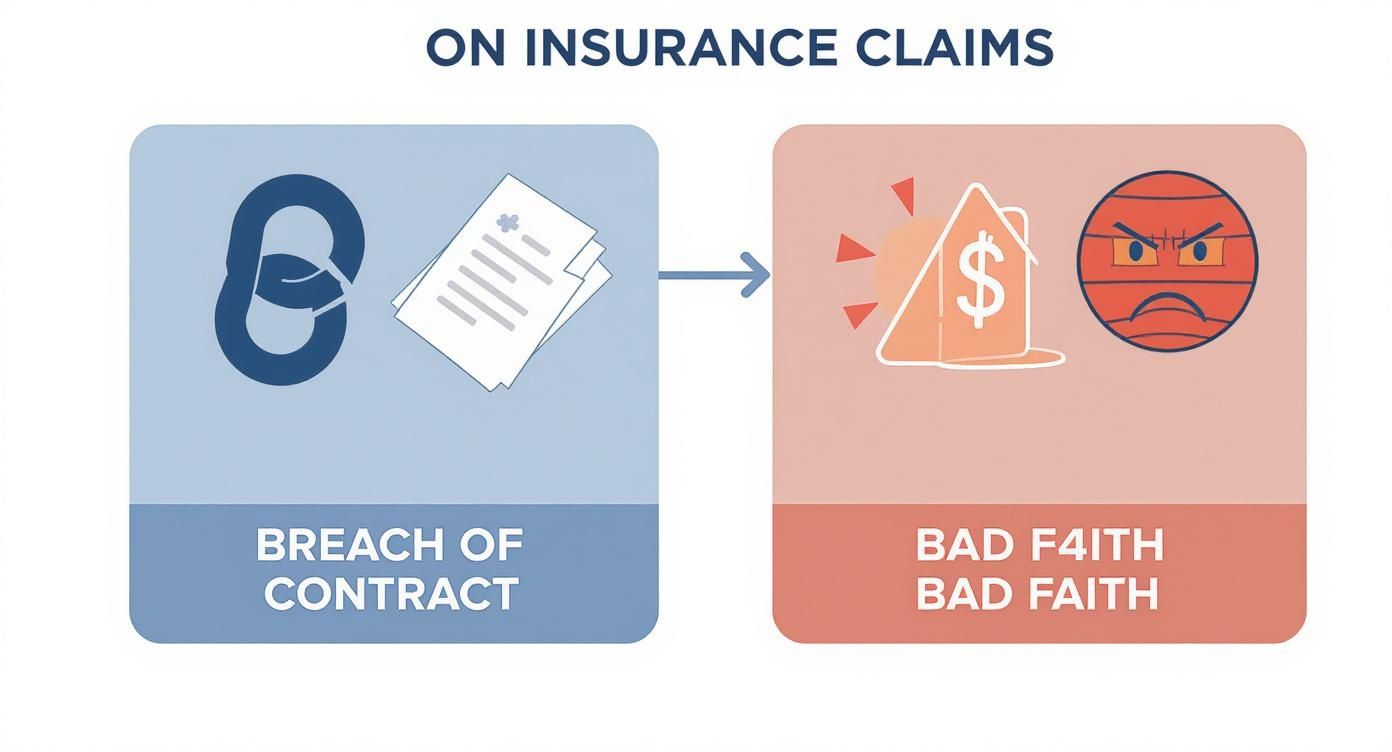

What's Your Legal Footing?

Before you can even think about a lawsuit, you need a solid legal reason—what lawyers call a "cause of action." When it comes to insurance disputes here in Florida, your fight will almost always center on one of two key legal claims. Getting this right is the foundation of your entire case.

Your main legal arguments will typically be:

Breach of Contract: This is the most straightforward claim. You had a contract (your policy), you upheld your end (paid your premiums), and they didn't. For instance, if your policy explicitly covers water damage from a burst pipe, but they refuse to pay for the repairs, they’ve likely breached the contract.

Bad Faith: This is where things get serious. A bad faith claim goes beyond a simple contract dispute. It argues the insurance company acted unfairly and dishonestly. This could mean they never bothered to properly investigate your claim, intentionally misrepresented what your policy covers, or used shady tactics to avoid paying.

A denied claim isn't an automatic green light for a lawsuit. But if your insurer shot down a legitimate claim without a good reason, dragged their feet for months, or played games, it's probably time to start thinking about your legal options.

The first few hours and days after your insurance company denies or underpays your claim are absolutely crucial. What you do next can make or break your ability to recover what you're owed down the road. It's easy to get angry and make a rash decision—or do nothing at all. Resist that urge. The table below outlines the immediate, methodical steps you should take.

Immediate Actions When Your Insurance Claim Is Denied

Action Item | Why It's Important | Real-World Scenario |

|---|---|---|

Demand a Written Explanation | A phone call isn't enough. You need their official reason for the denial in writing, citing the exact policy language they are relying on. This document is a critical piece of evidence. | Your adjuster calls to say your roof leak isn't covered. You should immediately follow up with a certified letter or email requesting a formal denial letter that specifies which policy exclusion applies. |

Gather All Your Documents | This is your evidence locker. You need a complete copy of your policy, every email and letter, all photos/videos of the damage, and any quotes from contractors. Organization is key. | After a kitchen fire, you create a dedicated folder with the full insurance policy, photos from the day of the fire, the fire department's report, and the two repair estimates you received. |

Document Everything Moving Forward | Keep a log of every phone call—who you spoke to, the date, and what was said. This creates a timeline that can expose unreasonable delays or conflicting statements. | The insurer keeps giving you the runaround. You start a simple notebook, jotting down: "May 10, 2:15 PM - Spoke to Jane Doe, claims dept. She said she'd call back by EOD. She did not." |

Consult a Qualified Attorney | Don't wait. An experienced insurance attorney can review the denial letter and your policy to see if the insurer is acting improperly. An early consultation can set the right strategy from day one. | Your claim for hurricane damage was underpaid by $50,000. You immediately contact a law firm that offers a free consultation to see if you have a strong case for bad faith. |

Taking these steps shows the insurance company you're organized, serious, and not going away. It lays the groundwork for a powerful, well-documented challenge to their decision. If you're feeling overwhelmed and unsure how to proceed, expert legal help is available. In pain? Call Caine.

Building a Rock-Solid Case Before You File

A lawsuit against an insurance company isn't won in a dramatic courtroom showdown; it's won long before you ever step foot inside. The real victory is built on a foundation of meticulous preparation and irrefutable evidence.

Think of it this way: you're building a fortress of facts. Every document, every photo, and every email is another stone in your wall.

This process isn't just about collecting a few receipts. It's about creating a comprehensive timeline that tells the undeniable story of your loss—and the insurer’s failure to make you whole. Nailing this stage sets the entire tone for the legal fight ahead. It's everything.

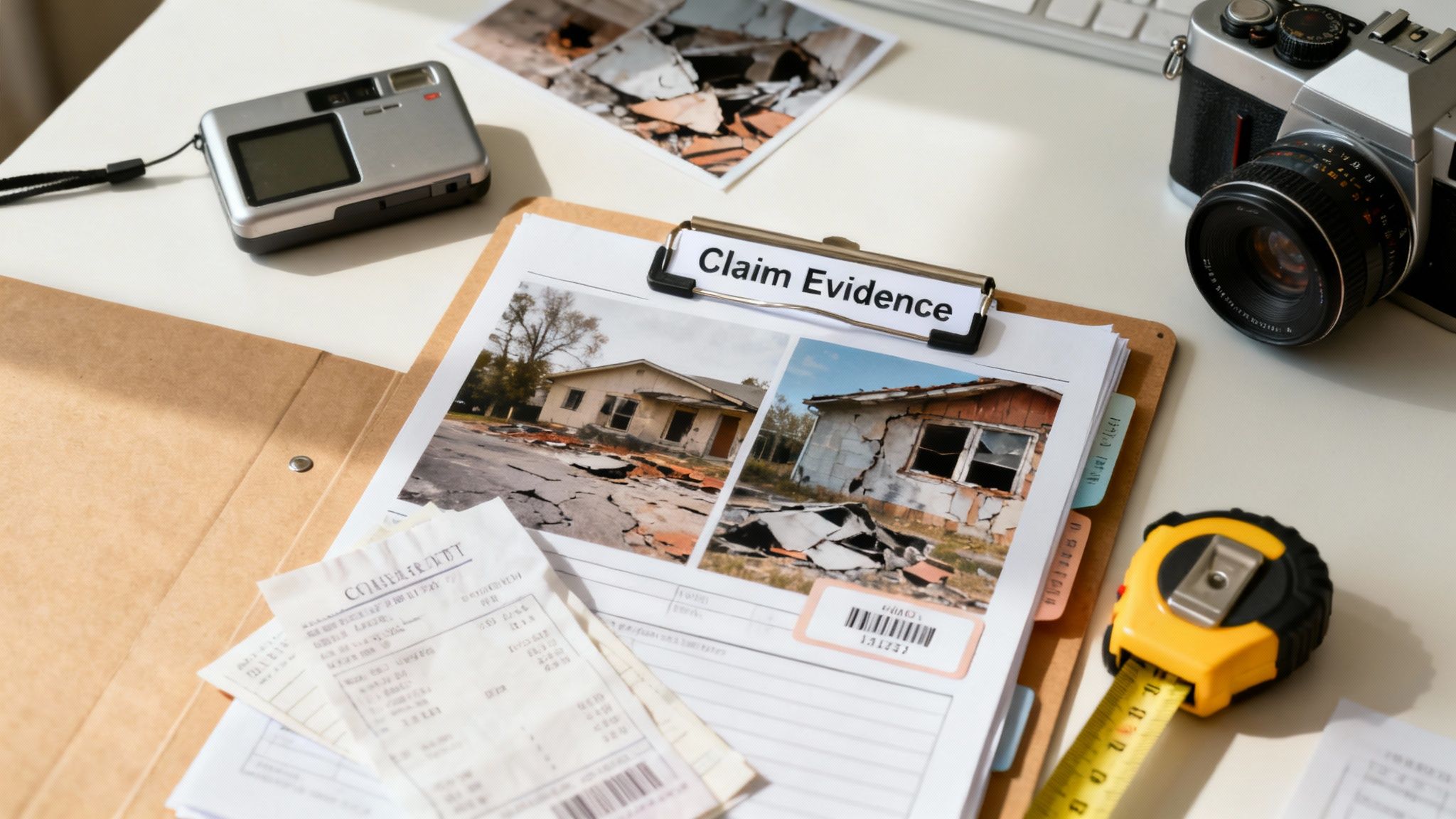

Your Essential Evidence Checklist

Before you even think about filing a lawsuit, you have to assemble your arsenal of proof. Insurance companies have teams of lawyers on standby; your documentation is the great equalizer. Start by gathering absolutely everything related to your claim.

Here’s a practical checklist of what you need to pull together:

Your Complete Insurance Policy: Don't just grab the summary pages. You need a certified, complete copy of your policy, including every single declaration, endorsement, and rider. This is the contract at the very heart of your dispute.

All Written Correspondence: This means every email, certified letter, and formal notice you've exchanged with the insurance company. Put it all in a chronological file to track the conversation and easily spot any delays or conflicting statements.

A Detailed Communication Log: For every single phone call, you need to jot down the date, the time, the full name of the person you spoke with, and a summary of what was said. Details like, "Adjuster promised a callback by 5 PM but never called" can become powerful evidence of unreasonable delays.

From my experience, insurance lawsuits often boil down to who has the better records. The policyholder who can produce a dated photograph, a saved email, or a logged phone call has a massive advantage over someone who’s just relying on memory.

Organizing this information is just as crucial as gathering it. Get a dedicated folder—whether it's a physical one or digital—and sort everything by date. This isn't just about helping your attorney build a stronger case; it shows the insurer from day one that you are serious and prepared.

Documenting Your Damages and Getting a Second Opinion

Your word about how bad the damage is, unfortunately, isn't enough. You must provide concrete, undeniable proof that is difficult for the insurance company to argue with. In my experience, nothing is more persuasive than visual evidence.

Go out and take dozens, if not hundreds, of high-resolution photos and videos of the damage from every possible angle. Get close-ups of specific issues and then pull back for wider shots that show the full context. If your home flooded, for instance, you need to document the water lines on the walls, every piece of ruined furniture, and the torn-up flooring. For a more detailed look at early evidence collection, you can explore some of our advice on what to do when accidents happen.

It's also absolutely critical to get an independent assessment of the repair costs. Never rely solely on the estimate provided by the contractor the insurance company sent out. Their loyalty often lies with the insurer who gives them steady work, not with you.

Seek Independent Estimates: Get at least two detailed, itemized estimates from reputable, licensed contractors in your area.

Ensure Estimates Are Thorough: These quotes need to break down the costs of both labor and materials and clearly specify the full scope of work needed to get your property back to its pre-loss condition.

When an insurer’s estimate for a new roof comes in at $12,000, but two independent local roofers quote the exact same job at $22,000, that $10,000 gap isn't just a disagreement. It becomes a powerful piece of evidence proving they underpaid your claim.

Understanding Florida's Pre-Suit Requirements

Here in Florida, you usually can't just storm into court and file a lawsuit, especially if you're alleging bad faith. The state has specific rules designed to give the insurance company one last chance to do the right thing. If you don't follow these procedures to the letter, your case can be thrown out before it even starts.

For a bad faith claim, the most important pre-suit step is filing a Civil Remedy Notice (CRN) with the Florida Department of Financial Services. This is a formal document that puts both the state and your insurer on notice about the alleged violation.

Once the CRN is filed, the clock starts ticking. The insurance company gets a 60-day "safe harbor" period to "cure" the problem—which means they have an opportunity to pay what they owe or otherwise fix the issue.

If they still fail to act within those 60 days, the door is now open for you to proceed with your bad faith lawsuit. This notice is a mandatory first step and a powerful tool that often forces an insurer to finally take a claim seriously. If you've reached this point, the complexity of the situation demands professional legal guidance. In pain? Call Caine.

Understanding Breach of Contract vs. Bad Faith Claims

When you take the step to sue your insurance company, you can’t just walk into court and say they were "unfair." In Florida, a lawsuit has to be built on solid legal ground. The two main avenues are breach of contract and bad faith, and understanding the difference is absolutely critical to your case strategy.

Think of it this way: a breach of contract claim is all about what the insurance company did (or failed to do) based on the black-and-white text of your policy. A bad faith claim, on the other hand, is about how and why they did it—it targets their unreasonable, dishonest, and unethical conduct.

Breach of Contract: The Foundational Claim

This is the most common and straightforward type of insurance lawsuit. At its core, a breach of contract claim says the insurance company simply didn't hold up its end of the deal. You paid your premiums faithfully, you filed a legitimate claim covered by your policy, and they refused to pay what they owed you.

This kind of dispute is centered entirely on the contractual agreement. You don’t have to prove the adjuster had it out for you; you just need to show that the company violated the specific terms of the policy.

Here are a few classic examples I see all the time:

Misinterpreting Policy Language: The insurer points to a vague or confusing exclusion in your policy to deny coverage for water damage that should clearly have been covered.

Underpaying a Claim: A hurricane rips your roof off. You get two independent quotes from reputable roofers, and both come in around $30,000. Your insurance company sends you a check for $18,000, completely ignoring the actual market rates for labor and materials in your area.

Wrongful Denial: Your car gets stolen—a textbook covered event under your comprehensive auto policy—but the insurance company denies the claim without giving you a single valid reason based on the policy.

In each of these situations, the argument is simple: the contract says one thing, but the insurance company did another. The goal of the lawsuit is to make the insurer pay the policy benefits you were owed from the very beginning.

Bad Faith: A More Serious Accusation

Now, a bad faith claim is a whole different animal—and it's a far more serious charge. It goes way beyond a simple disagreement over a claim's value. It accuses the insurer of acting dishonestly or so unreasonably that it defies all logic, all without a legitimate reason. Florida law is clear: insurance companies have a duty to act in good faith and deal fairly with their policyholders. When they don't, you might just have a bad faith case on your hands.

Bad faith isn't just about losing a dispute or having your claim denied. It’s about the insurance company having no reasonable basis for denying your benefits in the first place or deliberately failing to conduct a proper, thorough investigation. It's about them putting their own profits ahead of their legal duty to you.

This type of claim is powerful because it allows you to seek damages that go beyond what your policy was worth. That's a huge difference from a standard breach of contract case. For a closer look at these complex cases, you can learn more about how our firm handles insurance disputes in Florida.

Key Differences at a Glance

So, which path is right for your situation? It all comes down to the insurer’s conduct.

Aspect | Breach of Contract | Bad Faith |

|---|---|---|

The Core Issue | The insurer failed to pay what the policy required. | The insurer acted unreasonably and without a proper cause. |

Real-World Example | Denying a claim based on a debatable interpretation of a policy exclusion. | Refusing to even investigate a claim or creating endless, intentional delays. |

Potential Damages | You can recover the policy benefits you were originally owed. | You can recover policy benefits plus interest, attorney's fees, and even punitive damages. |

Taking on an insurance company can feel overwhelming. It's easy to see why when you consider that roughly 40 million lawsuits are filed annually in the U.S. alone. The landscape is getting even tougher, with a recent surge in "nuclear verdicts"—jury awards exceeding $10 million—which have nearly tripled since 2020. This puts incredible pressure on everyone involved. You can read more about the impact of large verdicts on the insurance industry on munichre.com.

Figuring out whether your case is a straightforward contract dispute or involves genuine insurer misconduct is the first and most important step. If you have a gut feeling that your insurer has crossed the line from a simple denial to outright bad faith, it’s time to get an expert opinion. In pain? Call Caine.

Navigating the Lawsuit From Filing to Trial

Making the decision to sue your insurance company is a huge step. But what actually happens after you file? The legal journey that follows isn’t like the high-drama scenes you see in movies. It's a methodical, structured process with several key phases, moving from initial paperwork to, if necessary, the courtroom.

It all kicks off when we draft and file a formal Complaint with the court. This is the official starting gun for your lawsuit. The complaint lays out who you're suing, the facts of your dispute, and the legal reasons for your claims—like breach of contract or bad faith.

Once that's filed, the insurance company has to be officially notified they're being sued. This is called service of process, and it involves having a copy of the complaint and a summons legally delivered to them. This puts the insurer on the clock; in Florida, they generally have about 20 days to respond.

The Critical Discovery Phase

After the initial back-and-forth filings, your case moves into what is arguably the most important stage: discovery. This is the pre-trial phase where both sides are legally required to swap information and evidence. It’s our chance to pull back the curtain and see exactly what the insurer was thinking and why they made the decisions they did.

We have a few powerful tools at our disposal to get to the truth:

Interrogatories: These are basically written questions we send to the insurance company that they must answer under oath. For example, we might ask, "Identify every single person involved in the decision to deny the claimant's roof claim."

Requests for Production: Here, we demand that the insurer hand over specific documents. This isn't just a few papers—we're talking about the adjuster’s entire claim file, internal emails about your case, company training manuals, and any reports from engineers or so-called "experts" they hired.

Depositions: This is where things get personal. A deposition is a formal interview, done out of court, where we get to question key people—like the adjuster who denied your claim—under oath. A court reporter records every word, and that testimony can be used as powerful evidence at trial.

Discovery is where the insurer’s flimsy excuses start to fall apart. It's often where we find the "smoking gun"—that internal email admitting your claim had merit or the adjuster's note revealing they never even bothered to read a critical report before sending a denial letter.

Bit by bit, we use this process to build a mountain of evidence. We expose the weak spots in their defense and make your case stronger for whatever comes next. It's usually during discovery, when an insurer sees its bad behavior laid bare, that they suddenly become a lot more interested in negotiating a fair settlement.

The flowchart below shows the two main legal paths a lawsuit can take, illustrating how a simple contract dispute can escalate into a much more serious bad faith claim.

As you can see, a breach of contract is about the insurer failing to pay what they owe. A bad faith claim goes deeper, focusing on how they handled the claim and their unreasonable conduct along the way.

Settlement Negotiations and Mediation

Here's a reality check: the vast majority of insurance lawsuits—well over 90%—never actually see the inside of a courtroom. Most are resolved through settlement negotiations or a formal process called mediation.

Mediation is a confidential meeting where we, you, the insurance company, and their lawyers sit down with a neutral third-party mediator. The mediator’s job isn’t to pick a winner. Their goal is to facilitate a productive conversation and help both sides find some common ground to reach a settlement everyone can agree on. Think of it as a structured negotiation designed to resolve the case without the cost, time, and sheer uncertainty of a trial.

This process is more important than ever as the costs of going to court keep rising. A 2024 study showed that factors like soaring litigation expenses and massive jury awards have caused liability claims to jump by 57% over the last decade. This "social inflation" has driven U.S. commercial casualty insurance losses up an average of 11% each year for the past five years, hitting a staggering $143 billion in 2023. These numbers give insurers a powerful financial reason to settle legitimate claims. You can read more about these litigation cost trends from the Swiss Re Institute.

What to Expect if You Go to Trial

So what happens if the insurance company digs in its heels and refuses to offer a fair settlement? The final step is taking your case to trial. This is where we lay out all the evidence, testimony, and expert opinions we've gathered in front of a judge and jury.

During the trial, we'll tell your side of the story through witnesses and documents. The insurance company's lawyers will try to do the same for their side. In the end, the jury is in charge of deciding the facts, and the judge rules on the legal issues.

Going to trial can be a long, draining, and stressful process, but sometimes it is the only path to justice. Having an experienced trial lawyer who isn't afraid to step into the ring and fight for you can make all the difference. The legal system is complicated, but you don't have to navigate it on your own. In pain? Call Caine.

What You Can Recover in an Insurance Lawsuit

After the long, hard fight of a lawsuit, the single most important question is this: what can you actually get if you win? When you successfully sue an insurance company in Florida, you aren't just getting a check—you are recovering specific types of financial awards known as damages.

It's crucial to understand these potential recoveries because they address the different ways an insurer’s actions harmed you. The goal isn't just to get the money you were originally owed; it's to be made whole for all the losses their denial or delay created.

Compensatory and Consequential Damages

The foundation of any recovery is compensatory damages. This is simply the money the insurance company should have paid you in the first place under your policy. If your home sustained $75,000 in hurricane damage and they wrongfully denied the claim, that amount is the core of what you're fighting for.

But the real-world harm often snowballs far beyond that initial number. That's where consequential damages come in. These are the additional, foreseeable losses you suffered because the insurance company breached its contract with you.

Let’s say your small business suffered a fire. The insurer wrongfully delayed your payment for six months. In that time, maybe:

You had to take out a high-interest loan just to start repairs.

You lost thousands in business income because you couldn't reopen.

Your business's reputation suffered from the prolonged closure.

These extra financial hits—the loan interest, the lost profits—are all consequential damages. They happened as a direct result of the insurer’s failure to pay on time, and in Florida, you have the right to recover them.

Punitive Damages in Bad Faith Cases

In cases involving insurer bad faith, the potential recovery can be much, much greater. If we can prove the insurance company's conduct was particularly outrageous or showed a reckless disregard for your rights, you may be awarded punitive damages.

Punitive damages aren't about compensating you for a specific loss. Their purpose is to punish the insurance company for its harmful behavior and to deter it—and other insurers—from ever doing it again.

This is reserved for the most serious situations, like when an insurer intentionally alters an expert's report to manufacture a denial or engages in a pattern of deceptive practices across many claims. These awards can be significant, sometimes multiples of the original policy benefits.

The Power of Attorney's Fees and Costs

Here is where Florida law gives policyholders a massive advantage. Under Florida Statute 627.428, if you have to sue your insurance company and you win, the court will typically order the insurer to pay your attorney’s fees and legal costs.

This is a complete game-changer. It means an average person can stand up to a multi-billion-dollar corporation without paying a single dollar in legal fees out of their own pocket upfront. Most property insurance lawyers, including our firm, work on a contingency fee basis. Our fee is a percentage of the money we recover for you. If we don't win, you don't pay.

When you combine that with the fee-shifting statute, it's a potent combination. You can keep your full recovery, and the insurer is forced to foot the bill for the legal fight they caused. It’s a critical tool for leveling a very uneven playing field.

Unfortunately, aggressive litigation tactics have contributed to rising insurance costs for everyone. A 2025 analysis showed that legal system abuse has inflated liability insurance losses by $231.6 billion to $281.2 billion over the last ten years, far beyond normal economic inflation. You can discover more insights about these insurance loss trends on iii.org.

If an insurer has left you with the financial burden of a denied claim, you don't have to carry it alone. In pain? Call Caine.

Common Questions About Suing Your Insurer in Florida

Going up against a huge insurance company can feel overwhelming. It’s natural to have a ton of questions and a good bit of uncertainty. Getting clear, straightforward answers is the first step toward taking back control. Let's walk through some of the most common concerns we hear from our clients right here in Florida.

How Long Do I Have to Sue an Insurance Company in Florida

This is probably the most critical question we get, because if you miss the deadline, your claim is gone for good. The timeline is governed by Florida's statute of limitations.

For a straightforward breach of contract claim—meaning the insurer simply didn't hold up their end of the policy—you generally have five years to file a lawsuit. That clock usually starts ticking from the date they broke the contract, like the day you received a wrongful denial letter.

A bad faith claim is a different beast. The deadline is more complex and often depends on how the original contract dispute plays out. Because these time limits are so rigid, you absolutely must talk to a lawyer the moment you think something is wrong. Don't wait.

Can I Sue My Insurance Company for Emotional Distress

In a simple breach of contract case, suing for emotional distress is a long shot. It's just not typically part of the deal.

However, things change dramatically in a first-party bad faith action. If you can prove the insurance company's behavior was so outrageous and beyond the pale that it caused you severe mental anguish, you may be able to recover damages for it.

We're not just talking about being frustrated or angry. To have a real shot at this, you need compelling proof—like notes from a therapist or testimony from a psychiatrist—that directly connects your severe emotional distress to the insurance company’s terrible conduct.

This is exactly why keeping a detailed log of every frustrating phone call and its impact on your life is so important.

What if the Insurer Makes a Low Settlement Offer After I Sue

Don't be surprised if a lowball offer lands in your lap right after you file a lawsuit. It's a classic move. They're testing you, hoping you’re tired of the fight and will just take a quick, cheap check to make it all go away.

You are under no obligation to accept an offer that doesn't make you whole.

Here’s what a good attorney does next:

Sizes Up the Offer: They'll immediately compare it to the full, actual value of your claim, accounting for every single loss you've suffered.

Checks the Evidence: They'll weigh the offer against the strength of your case and your odds of winning big at trial.

Pushes Back Hard: They will fire back with a strong counter-negotiation or advise you to reject it and keep moving toward trial.

Think of a low offer not as an insult, but as the opening bell for the real negotiations.

Do I Really Need a Lawyer to Sue an Insurance Company

Legally, you can represent yourself (it's called going "pro se"). But practically speaking, it's like stepping into the ring with a heavyweight champion without any training.

Insurance companies have entire floors of experienced lawyers who know every loophole, every procedural trick, and every delay tactic in the book. The legal system is a minefield of deadlines and complex rules that can easily trip you up.

Hiring a lawyer who lives and breathes insurance law completely levels the playing field. They know the carrier's playbook, how to use discovery to dig up damning evidence, and how to frame a case for maximum recovery. When you're thinking about who to hire, it helps to go in prepared. Many of the same principles in these questions to ask your slip and fall attorney before hiring are just as relevant here.

The best part? Most of us work on a contingency fee. That means you pay nothing upfront. The attorney only gets paid if they win for you, so there's zero financial risk in getting an expert on your side.

At CAINE LAW, we have the experience and resources to stand up to the biggest insurance companies in the country. You don't have to face this fight alone. If your insurer has denied, delayed, or underpaid your valid claim, contact us today for a free, no-obligation consultation to understand your legal options. In pain? Call Caine.