In Pain? Call Caine

Examinations under oath: How to prepare and protect your rights

5 Min read

By: Caine Law

Share

An Examination Under Oath, often called an EUO, is a formal interview your insurance company can require as part of its investigation into your claim. This isn't just a casual chat—it’s a serious proceeding where you give sworn testimony that a court reporter transcribes word-for-word.

Understanding The Examination Under Oath

After you file an insurance claim, a formal letter might show up in your mail requesting an EUO. Getting a notice like this can be intimidating, but understanding its purpose is the first step to getting through it smoothly. At its core, an Examination Under Oath is a tool insurers use to dig deeper into a claim, especially if it's complicated, involves a lot of money, or has a few grey areas that need clearing up.

Think of it as being similar to a deposition in a lawsuit. The key difference is that an EUO happens before any lawsuit is filed and is a requirement spelled out in your insurance contract. The insurance company has a few straightforward goals:

Gathering Facts: They want to get your detailed, firsthand account of what happened and the damages you're claiming.

Verifying Claim Details: They're checking to make sure the story you tell under oath matches the information you gave them on your claim forms.

Preventing Fraud: It’s their chance to investigate any red flags or inconsistencies that might point to a fraudulent claim.

The Legal Weight Of Your Statements

Everything you say during an EUO is recorded under oath. That gives it the same legal power as testimony you’d give in a courtroom. Your statements become a permanent part of your claim file, and you can be sure the insurance company will use them to make its final decision. If your claim ever does end up in court, that EUO transcript can and will be used as evidence.

The EUO is a contractual obligation buried in the fine print of most insurance policies. Your duty to cooperate with your insurer includes showing up for an EUO if they ask. Failing to do so can be seen as a breach of your contract, putting your entire claim at risk.

To give you a clearer picture, it's helpful to see how an EUO stacks up against the more common recorded statement that adjusters often ask for over the phone.

EUO vs Recorded Statement: A Quick Comparison

Feature | Examination Under Oath (EUO) | Recorded Statement |

|---|---|---|

Formality | Highly formal, similar to a deposition. | Informal, usually done over the phone. |

Oath | Testimony is given under oath, legally binding. | Not given under oath. |

Participants | You, your attorney, insurer's attorney, court reporter. | Typically just you and the insurance adjuster. |

Location | Usually held at an attorney's office. | Can be done anywhere, often over the phone. |

Legal Power | Transcript can be used as evidence in court. | Less evidentiary weight; can be disputed. |

Questioning | Conducted by the insurer's lawyer. | Conducted by the insurance adjuster. |

The table above highlights a critical point: an EUO is a much more serious proceeding with far higher stakes than a simple recorded statement.

A Longstanding Legal Practice

Requiring policyholders to sit for an EUO isn't some new trick insurers came up with. Examinations under oath have been a pillar of insurance law for well over a century, evolving from legal practices in major markets like the United States and England. Courts have consistently upheld EUO clauses, viewing them as a necessary part of the deal you make when you buy a policy. Comply, or risk having your claim denied. You can delve into the history and legal precedents of EUOs to learn more.

If you’ve been asked to attend an EUO, it’s a clear signal that your claim is under a microscope. Knowing your rights and obligations is absolutely essential. If you feel overwhelmed or aren't sure what to do next, getting legal advice can give you the clarity and protection you need. In pain? Call Caine.

Navigating the EUO Process Step-by-Step

An Examination Under Oath might feel like a daunting, high-pressure event, but it's not a free-for-all. The process actually follows a very predictable path. Once you understand the stages, the whole experience becomes much less mysterious, letting you prepare and proceed with confidence. The entire journey is guided by the fine print in your insurance contract and legal rules that protect both you and the insurer.

It all starts with a formal, written request from the insurance company. This isn't just a friendly phone call; it's an official notice that has to lay out the time, place, and the specific person being questioned. Your policy and Florida law both require the proposed location and date for the examinations under oath to be reasonable. This stops the insurer from trying to make you travel across the state or show up with barely any notice.

The Day of the Examination

When the day arrives, you'll find yourself in a room with the insurance company's lawyer, a court reporter, and hopefully, your own attorney. The setting is usually a conference room in a law office, not a formal courtroom. The first thing you'll do is take an oath, promising to tell the truth. This simple act gives your testimony the same legal power as if you were in court.

From there, the insurance company's attorney will begin asking questions. The conversation will zero in on your claim, the details of the incident that caused your loss, and the specific damages you've reported. A court reporter will be there the whole time, typing down every single word spoken. This creates the official transcript of your testimony.

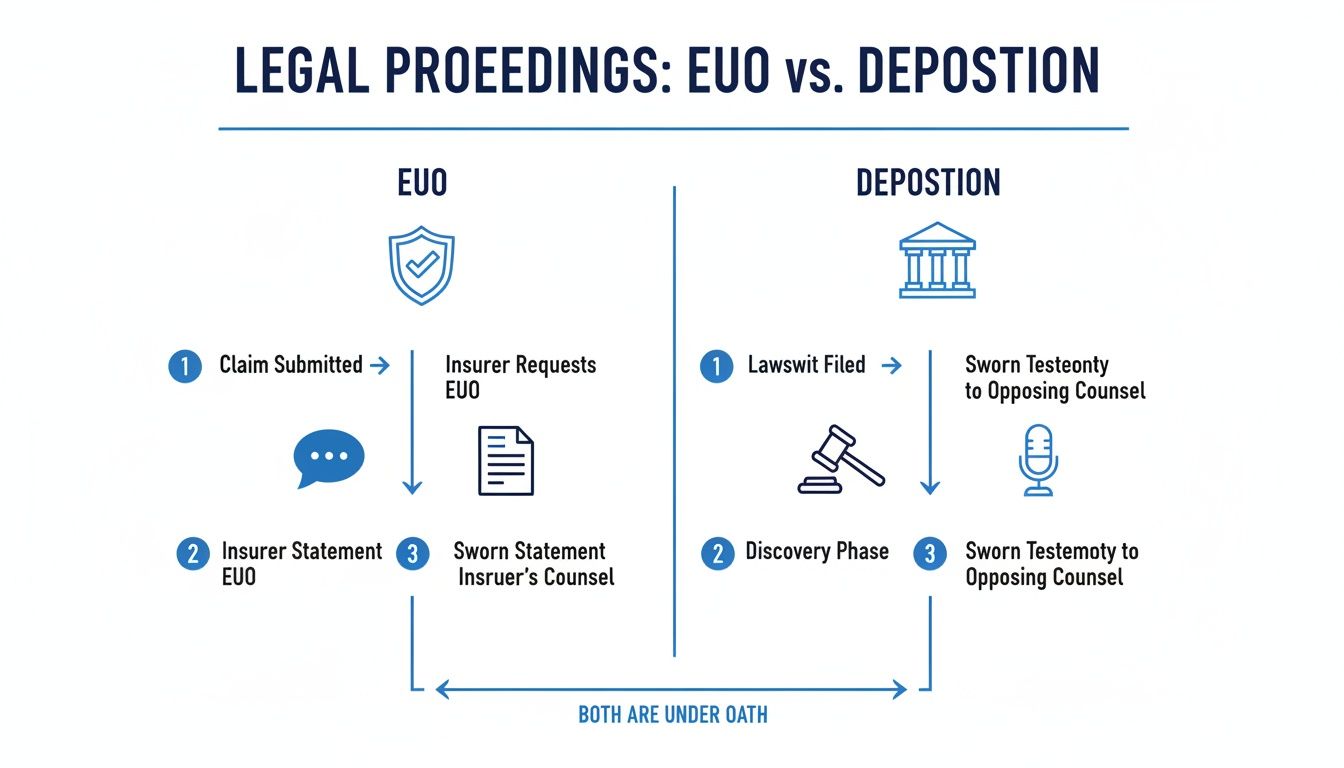

This infographic helps clarify the key differences between an EUO, which comes from your insurance policy, and a deposition, which only happens during a lawsuit.

As you can see, while you're under oath in both situations, an EUO is a contractual obligation to help the insurer investigate your claim. A deposition, on the other hand, is a tool used in the discovery phase after a lawsuit has already been filed.

After the Testimony

Once the last question is asked, the court reporter gets to work preparing a written transcript of everything that was said. You have a legal right to review this document to make sure it's accurate. This is a critical step—it’s your chance to correct any mistakes before you sign it and lock it in as the official record.

That transcript then becomes a central piece of evidence for the insurance company. Their final decision on whether to pay your claim, deny it, or keep investigating will be heavily influenced by what you said under oath.

Remember, the EUO process is a formal, high-stakes part of your insurance claim. The insurance company's lawyer is there to protect the company's interests, not yours.

Trying to handle all of this on your own can be incredibly tough. An experienced attorney can make sure the insurer's demands are fair, get you ready for the tough questions, and stand up for your rights from start to finish. If you’ve received a notice for an EUO and aren't sure what to do, don't go it alone. Get the professional guidance you need. In pain? Call Caine.

How to Prepare for Your Examination Under Oath

Getting a notice for an Examination Under Oath (EUO) can be nerve-wracking, but with the right preparation, you can walk in with confidence. The key isn't about having perfect recall; it's about being organized, truthful, and disciplined in how you present your story. A little bit of methodical prep work goes a long way in making this process feel manageable.

The whole thing starts with a deep dive into your own paperwork. You can bet the insurance company's lawyer has already gone through every document you've sent them with a fine-tooth comb. You need to do the same. This isn't just a quick skim—it's about re-learning the details so that your spoken testimony perfectly matches the facts you've already laid out on paper.

Gather and Review Your Key Documents

Think of your documents as the script for your testimony. Memories can get fuzzy, especially under pressure, but the paperwork provides a solid, unchangeable record. Before you step into that room, pull together and study these items:

Your Insurance Policy: Know exactly what your policy covers and what it requires from you. Find the "cooperation clause"—that's the part of your contract that legally requires you to sit for the EUO.

The Claim Submission: Reread the very first claim you filed. The details you provided there will be the starting point for many of the insurer's questions.

Supporting Evidence: This is everything from photos of the damage and receipts for repairs to medical records and the official police report. Each piece helps build the full picture of what happened.

Repair Estimates and Invoices: Be ready to talk about the costs you're claiming and explain why each one was necessary.

Another fantastic tool is to create a simple timeline of events. Just map it out: what happened, when it happened, and who was there. This little exercise will help lock the sequence of events in your mind, which is absolutely critical for staying consistent when the questions start coming.

The Golden Rules of Testifying

How you act during the EUO is just as important as what you say. The insurance company's lawyer is watching everything—not just your answers, but your demeanor, your confidence, and your consistency. Sticking to a few simple rules can help you avoid common traps.

The number one, non-negotiable rule is to be honest. An EUO is sworn testimony, just like in a courtroom. Lying or even slightly misleading the attorney is perjury. That’s a crime with serious legal consequences, and it guarantees your claim will be denied.

Just as important: never guess. If you don't know the answer, the right thing to say is, "I don't know" or "I don't recall." It's a perfectly acceptable answer. Guessing or speculating can create inaccuracies that the insurance company can use to attack your credibility later on.

Your statements during an EUO are not just a formality; they carry significant weight in any future legal disputes. The testimony you provide is a powerful tool that insurers use to find inconsistencies that could undermine a claim.

In high-value property claims, for example, insurers often use EUOs to fight potential fraud, which is estimated to impact around 10% of all claims in major U.S. markets.

Techniques for Answering Questions Effectively

Listening carefully and responding precisely is a skill, and it's one you can practice. The lawyer's questions are often intentionally narrow, and your answers should be, too.

Here are a few proven techniques to keep in mind:

Listen to the Entire Question: Don't jump in. Let the attorney finish their question completely before you even start thinking about your response.

Pause Before Answering: Take a breath. A short pause gives you a moment to process the question and deliver a clear, accurate answer. It also shows you're being thoughtful.

Answer Only What Is Asked: Fight the urge to over-explain or volunteer extra information. If a question can be answered with a simple "yes" or "no," just say that. If it needs a short explanation, keep it brief and then stop talking.

Ask for Clarification: If a question is confusing, too long, or uses a word you don't understand, just ask them to rephrase it. It is your right to fully understand what is being asked before you answer.

Being prepared is the best way to handle any complex situation, and that includes the aftermath of an accident. For more on that, check out our guide on what to do when accidents happen for essential steps and legal guidance.

Ultimately, being organized, honest, and disciplined will give you the power to handle your examinations under oath effectively. If you're facing an EUO and feel overwhelmed, our team is here to guide you every step of the way. In pain? Call Caine.

Answering questions under oath can be intimidating, to say the least. It’s natural to feel like you’re on the spot. But an Examination Under Oath isn’t about random, trick questions. It’s a structured process designed to get your side of the story on the record.

Knowing what to expect and, more importantly, why the insurer’s lawyer is asking certain things, can take a lot of the pressure off. Their goal is simple: to create a complete, sworn narrative of your claim. They will then take that narrative and hold it up against every other piece of information they have—from the first notice of loss to witness statements and expert reports. Even a small inconsistency can be enough for them to hit the brakes on your claim.

Questions About Your Personal Background

The EUO will almost always kick off with questions about you. This isn't just small talk; it's the attorney laying the groundwork for the entire examination. While the questions might seem basic, they are building a foundation.

You should be prepared to answer questions about:

Your full legal name, plus any other names you've used.

Current and past addresses.

Your education and job history.

Whether you have any criminal convictions.

So, what's the point? First, they're simply verifying who you are. Second, they're fishing for anything that might cast doubt on your credibility, like a history of insurance fraud or other red flags.

Questions About the Incident and Your Claim

This is the main event. Here, the attorney will want you to walk them through the entire incident that led to your claim, often asking for a step-by-step account. Your memory and consistency are being put to the test.

Expect to hear questions like:

"Walk me through exactly what happened on the date of the loss."

"Where were you just before the fire started?"

"Was anyone else there with you?"

"What was the very first thing you did after the accident?"

"Can you tell me when and how you reported this to the insurance company?"

The lawyer’s objective is to lock you into one single, detailed version of events. If your sworn testimony later contradicts what you told the adjuster on the phone or what a witness said, they will use that discrepancy against you. The key is to be truthful and stick to what you actually remember.

Questions About Your Claimed Damages

Once the "what happened" is established, the focus shifts to the "how much." This part of the EUO drills down into the specific damages you’re claiming, whether it's for damaged property, medical expenses, or lost wages. Every single dollar is going to be examined.

The single most important rule to follow in an EUO is to answer only the question that was asked. Don't offer extra details, don't guess, and don't speculate. If you genuinely don't know the answer, "I don't know" or "I don't recall" is a perfectly acceptable and complete response.

This strategy keeps you from accidentally saying something that could be twisted or used to undermine your claim down the road. You’re there to be a factual witness, not to tell a dramatic story.

To help you get a better sense of the insurance company's playbook, let's look at the kinds of questions they ask and what they're really trying to achieve.

Table: Sample EUO Question Categories and Insurer Intent

The table below breaks down the common lines of questioning you'll face in an EUO. Understanding the "why" behind each question can help you provide clear, factual answers without accidentally giving the insurance company ammunition to use against you.

Question Category | Example Question | Potential Insurer Goal |

|---|---|---|

Background & History | "Have you filed any other insurance claims in the last 10 years?" | To identify patterns of claims that could suggest fraud or a "claims-minded" individual. |

Incident Details | "Describe, minute-by-minute, what you did after you noticed the water." | To lock you into a sworn timeline they can compare against other evidence (e.g., phone records, witness statements). |

Claimed Damages | "Where did you purchase this television, and how much did you pay for it?" | To verify the existence, ownership, and value of claimed items and look for potential inflation of the claim. |

Financial Status | "Were you current on your mortgage payments at the time of the fire?" | To uncover a potential financial motive for intentionally causing the loss (e.g., arson). |

Post-Loss Actions | "Who did you speak with immediately after the incident, and what did you say?" | To find inconsistencies between your sworn testimony and what you told others in the immediate aftermath. |

As you can see, every question has a purpose. The insurer's attorney is methodically building a case, and your testimony is the central pillar.

Questions About Your Financial Situation

In some claims, particularly large property losses like a house fire, the questions can get personal and turn to your finances. It might feel like an invasion of privacy, but insurers do this to look for a possible motive for fraud.

They might ask about:

Your current employment and all sources of income.

Whether you're behind on your mortgage, car loan, or other significant debts.

If you've recently declared bankruptcy.

The insurance company's thinking is that someone under extreme financial pressure might be more likely to exaggerate a claim or even cause a loss intentionally. While these questions are uncomfortable, you generally have to answer them if they are relevant to the investigation. This is where having an experienced attorney is crucial—they can step in and object if the questioning goes too far or becomes harassing.

Getting familiar with these question categories is the first step in preparing for your EUO. Knowing the "why" behind the "what" empowers you to give clear, concise answers that protect your claim. If you’re facing an EUO, you don't have to do it alone. In pain? Call Caine.

Why You Must Comply with an EUO Request

When that letter demanding an Examination Under Oath lands in your mailbox, your first reaction might be to ignore it or fight back. The whole thing can feel aggressive, invasive, or just plain unfair. But I can tell you from experience, refusing to attend an EUO is not an option—it’s actually one of the fastest ways to guarantee your claim gets denied.

Your insurance policy is more than just a piece of paper; it's a legally binding contract. Tucked away in the fine print is a "cooperation clause." This clause legally requires you to cooperate with the insurance company's investigation into your claim, and that includes submitting to an examination under oath if they ask for one. Simply not showing up is a material breach of that contract.

It’s a “Condition Precedent” to Getting Paid

In legal speak, complying with an EUO is a condition precedent to coverage. Think of it like a locked door standing between you and the money you're owed for your claim. The EUO is the key. You absolutely must use the key (comply with the EUO) before the door (your insurer's duty to pay) will ever open.

When you refuse to attend, you're essentially breaking your end of the deal. This gives the insurance company a rock-solid, legally defensible reason to deny your claim, no matter how legitimate it is. Their argument will be that your refusal prevented them from completing their investigation, and frankly, courts tend to agree with them.

Complying with an EUO isn't just a suggestion; it’s a non-negotiable requirement of your policy. The consequences for refusing are severe and almost always end with your insurance claim being denied outright.

This idea of using sworn testimony to get to the truth isn't new. It has deep roots in legal history, stretching back to when English law moved away from trials by ordeal. After a major council in 1215 CE banned those practices, the system evolved toward fact-finding by juries, where cross-examination became the tool to test the truthfulness of evidence. You can read more about how these early legal shifts shaped modern evidentiary standards.

You Have Rights, But Refusal Isn't One of Them

Just because you have to comply doesn't mean you have to roll over and accept unreasonable demands. You still have rights, and there are proper channels to address legitimate problems without breaching your contract.

Scheduling Conflicts: If you have a real scheduling conflict, you can ask for a different date or time. The insurer has to be reasonable with accommodations.

Location Issues: The EUO must be held at a reasonable place. You can push back if they demand you travel an absurd distance.

Harassing Demands: If you feel the insurer's document requests are excessive or the questions they plan to ask are irrelevant and harassing, your attorney can object on your behalf.

The right way to handle an unreasonable demand is not to stonewall them. Instead, you need to have your legal counsel communicate with the insurer to negotiate fair terms. An attorney can make sure the process is fair while protecting you from saying or doing something that could void your coverage. If you're dealing with complex insurance disputes, having a professional guide you is crucial.

Trying to dodge the EUO will only backfire and damage your case. The key is to understand that while compliance is mandatory, you are still entitled to a fair and reasonable process.

An experienced lawyer can handle all the back-and-forth with the insurance company, negotiate the time and place, and shield you from improper questioning. This ensures you fulfill your obligations under the policy without giving up your rights. In pain? Call Caine.

How a Lawyer Protects You During an EUO

Walking into an Examination Under Oath (EUO) without your own lawyer is a massive gamble. The insurance company will absolutely have its attorney there, and that lawyer's only job is to protect the company's bottom line—not to look out for you. Having an experienced attorney in your corner is the single most important step you can take to level the playing field and protect your claim.

A good lawyer does far more than just show up. Their real work starts long before the EUO itself, beginning with a deep dive into your entire claim file. They'll anticipate the tough questions, prepare you for the potential traps the insurer's attorney might lay, and make sure your story is presented clearly, consistently, and truthfully.

Defending Your Rights During Questioning

During the EUO, your attorney acts as your shield. It's common for the insurer's lawyer to ask confusing, repetitive, or completely irrelevant questions designed to trip you up. Your lawyer’s job is to police this questioning and protect you from unfair tactics.

This active protection looks like this:

Objecting to Improper Questions: Your attorney will immediately object if a question is harassing, argumentative, or protected by attorney-client privilege.

Seeking Clarification: If a question is vague or intentionally confusing, your lawyer will step in and demand it be rephrased so you can answer accurately.

Preventing Scope Creep: They make sure the questioning stays focused on the facts of your claim and doesn't wander into a fishing expedition about your private life without a good reason.

This kind of intervention is crucial. It stops you from being intimidated or tricked into saying something that could be twisted and used to deny your claim later. Your lawyer ensures the official record reflects the actual facts, not a distorted version created by a skilled opposing attorney. This is especially vital in complex cases, and understanding your rights is a key part of any personal injury claim.

Ensuring a Fair Process and Outcome

Beyond just managing the questions, an attorney ensures the entire EUO process is fair and follows all legal standards. They will negotiate a reasonable time and place for the examination and handle every bit of communication with the insurance company's legal team, taking that stress completely off your plate.

An attorney's presence fundamentally changes the dynamic of an Examination Under Oath. It sends a clear message to the insurance company that you are serious about your claim and will not be pushed around or taken advantage of.

At the end of the day, having professional legal counsel dramatically improves your chances of a fair outcome. With a dedicated advocate by your side, you can focus on one thing: providing truthful, accurate testimony, confident that your rights are being fiercely protected every step of the way. It turns what could be a one-sided interrogation into a balanced legal proceeding.

Don't face the insurance company's lawyers by yourself. Let an experienced attorney stand up for you and safeguard your claim. In pain? Call Caine.

Your Top Questions About EUOs in Florida, Answered

Even after getting a handle on the basics of an Examination Under Oath, you probably still have a few practical questions swirling around. Let's clear the air. This section tackles the most common things policyholders worry about, giving you direct, no-nonsense answers to help you walk into the process with confidence.

Can My Spouse or Family Member Sit In With Me?

Almost certainly not. The insurance company’s lawyer is going to insist on questioning you and you alone. It’s not personal—the goal is to prevent one person's testimony from subconsciously (or consciously) influencing another's.

While your family will have to wait outside, your attorney has every right to be right there by your side for the entire duration.

What if I Realize I Made a Mistake During My Testimony?

It happens. You're under a lot of pressure, and honest mistakes are a part of being human. If you realize you’ve said something that isn’t quite right during the examination under oath, the key is to correct it on the spot. Don't wait.

Simply say, "I need to clarify something I said a few minutes ago." Being upfront is always the best policy.

Later on, you'll get a copy of the transcript to review. This is your last chance to make any corrections on what’s called an errata sheet. Just be prepared for the insurer's lawyer to ask why your story changed, so having a clear, honest reason is crucial.

How Long is This Going to Take?

The honest answer? It depends entirely on your claim. A simple, straightforward claim might wrap up in just an hour or two.

But for a more complex situation—think major fire damage, questions about the cause of the loss, or suspicions of fraud—you could be looking at a session that lasts for several hours. In some cases, it might even need to be continued on a second day.

The insurance company is entitled to ask questions until they feel they have all the facts material to their investigation. While your lawyer can and will object if the questioning becomes harassing or needlessly repetitive, you are obligated to stay until they are finished.

Do I Really Have to Bring All These Documents They’re Asking For?

Yes, provided the request is reasonable. The notice scheduling your EUO will usually come with a list of documents they want you to produce. This could be anything from bank statements and repair receipts to your phone records.

Failing to turn over requested documents can be seen as a failure to cooperate, which is just as serious as refusing to show up for the EUO itself. It can put your entire claim in jeopardy.

This is an area where a good lawyer is worth their weight in gold. An experienced attorney can review the document request to see if it's overly broad or asks for things that are completely irrelevant. They can then negotiate the scope with the insurance company, making sure you meet your obligations without handing over your entire private life on a silver platter.

At CAINE LAW, we know that an Examination Under Oath can be the most intimidating part of your entire insurance claim. You don’t have to face it alone. Our team will prepare you for the questions, stand by you to protect your rights, and fight to make sure you are treated fairly from start to finish. In pain? Call Caine. Learn more about how we can help at https://cainelegal.com.