In Pain? Call Caine

Understanding do i need uninsured motorist coverage florida for Florida drivers

5 Min read

By: Caine Law

Share

If you're asking, "do I need uninsured motorist coverage in Florida," the short answer is an emphatic yes. While the state doesn't legally force you to buy it, skipping this coverage is a massive gamble with your financial future and your health.

Think of Uninsured Motorist (UM) coverage as your personal safety net, protecting you from the irresponsible choices of other drivers.

The High Stakes of Driving Unprotected in Florida

It’s a common mistake to think your basic auto policy has you covered. But here’s the scary truth: Florida’s minimum insurance requirements leave a huge gap. The only coverages the state mandates are Personal Injury Protection (PIP) and Property Damage Liability.

Notice what’s missing? Bodily Injury (BI) liability—the very coverage that pays for your injuries when someone else is at fault—is completely optional for Florida drivers.

This creates a truly dangerous scenario. If a driver with no BI coverage crashes into you and causes serious injuries, you could be left drowning in medical debt, unable to work, and dealing with chronic pain. With no insurance to go after, you have little to no way of holding them financially responsible.

Florida's Uninsured Driver Problem

This isn't just a theoretical risk; it's a daily reality on every road in Florida. Our state has one of the highest rates of uninsured drivers in the entire country, which turns every drive to work or the grocery store into a potential financial nightmare.

To give you a quick rundown of the essential facts, here’s a table summarizing the key points about UM coverage in Florida.

Florida Uninsured Motorist Coverage at a Glance

Key Question | Short Answer |

|---|---|

Is it required in Florida? | No, but it is critically important to have. |

Why do I need it? | Roughly 1 in 5 Florida drivers has no insurance to cover your injuries. |

What does it cover? | Your medical bills, lost wages, and pain and suffering if an uninsured driver hits you. |

Is it expensive? | It's one of the most affordable and valuable parts of an auto policy. |

As you can see, the data paints a pretty clear picture.

An estimated 20.6% of Florida drivers were uninsured, placing the state among the top in the nation. This startling figure is significantly higher than the national average of just 12.6%.

That means roughly one out of every five cars you pass on the highway might not have a penny of insurance to cover your medical bills if they cause a wreck. You can dive deeper into the numbers behind Florida's uninsured driver statistics to see just how serious this problem is.

This is exactly why Uninsured Motorist (UM) coverage is your personal shield. It's the policy that steps in to pay for your medical care, lost income, and pain and suffering when the at-fault driver can't.

Without it, you are left to pick up the pieces and pay the price for someone else's negligence. If you've been hurt by an uninsured driver, don't try to fight the insurance companies by yourself. In pain? Call Caine.

What Uninsured Motorist Coverage Actually Does for You

It’s easy to get lost in all the insurance jargon. Let’s cut through the noise. Think of Uninsured Motorist (UM) coverage as insurance you buy for yourself to protect against other people’s bad choices. It’s not some complex financial product; it’s your personal safety net in a state filled with drivers who just don't have the right coverage.

Your required Personal Injury Protection (PIP) is just a starting point. It's designed to cover only a small slice of your initial medical bills and absolutely nothing for your pain and suffering. UM coverage is what steps in to fill the massive financial holes that PIP leaves behind.

What UM Specifically Pays For

When a driver with little or no insurance injures you, your UM policy essentially stands in for the at-fault driver's insurance—the policy they should have had. It’s there to make you whole again by covering the devastating losses PIP won't even touch.

Your UM coverage can pay for things like:

Medical Bills: We’re talking about everything from the ambulance ride and ER visit to surgery, physical therapy, and any future medical care your doctors say you’ll need down the road.

Lost Wages: If your injuries keep you out of work, UM can replace that lost income. It also covers what’s called "diminished earning capacity" if you can no longer do your job the way you could before the crash.

Pain and Suffering: This is compensation for the physical agony, emotional distress, and the simple loss of enjoyment of life that comes after a serious accident. Florida law recognizes these are very real damages, and UM is your way to recover them.

Without UM, these costs would land squarely on your shoulders. You can get a better sense of how these damages are calculated by learning more about our approach to personal injury cases.

Stacked vs. Non-Stacked UM Explained

When you buy UM coverage in Florida, you'll face two options: "stacked" and "non-stacked." Understanding the difference is critical, as it directly controls how much protection you actually have.

Think of it like this:

Non-Stacked UM: This coverage is tied to one specific car. If you have a $50,000 non-stacked policy on your sedan, that’s your limit, period. It doesn't matter if you own three other vehicles.

Stacked UM: This is where you get real power. Stacked coverage lets you combine—or "stack"—the UM limits for every vehicle on your policy. If you have two cars, each with $50,000 in stacked UM, you now have a $100,000 safety net available if you get hurt.

Yes, stacked coverage costs a bit more. But it provides dramatically more protection for you and any family members living with you, no matter whose car you're in—or even if you’re hit as a pedestrian. It’s a powerful way to maximize your financial security.

If you've been injured because of someone else’s negligence, you need an advocate on your side. In pain? Call Caine.

Understanding Why PIP Is Not Enough

So many Florida drivers share a dangerous misunderstanding: they think their mandatory Personal Injury Protection (PIP) is all the insurance they’ll ever need after a crash. I see the devastating results of this belief all the time. It couldn’t be further from the truth.

Relying only on PIP is like trying to put out a house fire with a Dixie cup. It might feel like you're doing something, but it's nowhere near enough to handle a real crisis.

PIP was only ever designed to get you quick, no-fault access to a small amount of cash for your immediate medical bills. But "small" is the key word here. Your standard Florida PIP policy maxes out at just $10,000. Worse yet, it only covers 80% of your initial medical costs and 60% of your lost wages—and only until that tiny limit is gone.

Think about that. A single trip to the ER after a serious collision can burn through your entire $10,000 PIP benefit in a matter of hours. After that, you're on your own, paying for everything else out-of-pocket. Most importantly, PIP provides absolutely nothing for your pain, your suffering, or the long-term financial hit you're about to take.

This is exactly where Uninsured Motorist (UM) coverage steps in to become your financial lifeline.

Where PIP Ends and UM Begins

Uninsured Motorist coverage picks up right where PIP falls short. If PIP is the small bandage you get at the scene, UM is the comprehensive medical care and financial support you need to actually recover. It’s built to cover the massive expenses that pile up when an uninsured or underinsured driver causes your accident.

What does that include? Things like ongoing physical therapy, future surgeries, rehabilitation, and the full scope of your lost income—not just a measly percentage. Critically, it’s the only way to get compensation for the very real human cost of the accident: your physical pain and emotional trauma.

This isn’t just a theoretical problem. Florida’s roads are filled with uninsured drivers, making this a constant, daily threat. UM is there to cover what at-fault, uninsured drivers can't: your injuries, your pain, and the income you’ve lost that goes far beyond PIP's meager limits.

The risk is so serious, in fact, that Florida law actually requires you to formally reject this coverage in writing. The state's uninsured rate keeps climbing, making this protection more critical than ever. You can see the latest numbers and learn more about Florida's uninsured motorist rate directly from the state.

To put it as plainly as possible, let’s compare the two side-by-side.

Comparing Florida PIP vs Uninsured Motorist (UM) Coverage

The differences between these two coverages aren't subtle; they are worlds apart in what they are designed to do for you after an accident. One is a tiny, temporary patch, while the other is true protection.

Coverage Aspect | Personal Injury Protection (PIP) | Uninsured Motorist (UM) |

|---|---|---|

Primary Purpose | Provides immediate, no-fault medical and wage loss benefits up to a small limit. | Covers your long-term bodily injury damages when an at-fault driver has no insurance. |

Fault Requirement | No-fault; it pays out regardless of who caused the accident. | Fault-based; it only pays if the other driver was at fault. |

Coverage Limit | Typically capped at $10,000. | You choose your limits, often $100,000 or much higher. |

Pain & Suffering | Does not cover pain and suffering at all. | A primary source for compensating you for pain, suffering, and emotional distress. |

This table makes the answer to "do I need uninsured motorist coverage Florida" obvious. Going without it is a gamble you simply can't afford to take. If you’re struggling after a crash and the bills are starting to overwhelm you, don't wait another minute. In pain? Call Caine.

Real-World Scenarios Where UM Is a Financial Lifesaver

Talking about insurance policies in the abstract can make your eyes glaze over. To really get why asking "do I need uninsured motorist coverage in Florida?" is so important, let's walk through a few situations that play out on our roads every single day. These stories bring to life how UM coverage becomes your financial shield exactly when you need it most.

Picture this: you’re caught in rush hour traffic on I-95 when a car a few lengths ahead makes a reckless lane change. It sets off a chain reaction, and a moment later, you’re slammed from behind. Your car is a total wreck, and you're being rushed to the hospital with serious neck and back injuries.

The driver who caused it all? They don't have a dime of Bodily Injury liability insurance. Your own $10,000 PIP benefit is completely wiped out by just the ambulance ride and the initial ER visit. Without UM coverage, you're now staring down a mountain of medical debt, months of physical therapy, and lost income from being unable to work—with no way to get a penny from the person who caused this nightmare.

With UM coverage, however, your own policy steps in to fill the gap. It essentially becomes the insurance the other driver should have had, covering your medical bills, lost wages, and compensating you for your pain and suffering. It lets you focus on getting better, not on going broke.

The Hit-and-Run in the Parking Lot

Let's look at another all-too-common scenario. You’re leaving the grocery store and as you back out of your spot, a driver speeds down the lane, sideswipes your car, and just keeps going. The impact is jarring, and you end up with a painful shoulder injury that will need surgery.

You have no license plate, no description of the driver—nothing. It’s a classic hit-and-run. In the eyes of the law, that at-fault driver is considered uninsured. Your PIP will cover the first $10,000 in medical bills, but what about the surgery? The follow-up appointments? The time you'll be forced to miss from your job while you recover?

Without UM coverage, there’s simply no path to getting compensated for those extra costs. You’re left holding the bag for an anonymous driver's recklessness. But with UM, your own policy is there to cover your bodily injuries, making sure you can get the care you need without draining your savings.

When the Other Driver Is Underinsured

Finally, let's explore a situation that is incredibly common here in Florida. You’re driving through an intersection with a green light when another driver blows through their red and T-bones your car. Your injuries are severe, leading to a long hospital stay and months of tough rehabilitation.

The at-fault driver actually has insurance, but it’s a bare-bones policy with just a $10,000 Bodily Injury liability limit. Your medical bills quickly climb past $150,000. The other driver’s insurance company writes you a check for their $10,000 policy limit, and that’s all they can do. You’re now left with a $140,000 gap, and that doesn't even touch on your lost income or the immense suffering you've endured.

This is exactly where your Underinsured Motorist (UIM) coverage—which is part of your UM policy—saves the day. It bridges the gap between your total damages and the other driver's pathetic policy limits. These situations happen far too often, and having a skilled lawyer to handle complex auto and motorcycle accidents is crucial. Without that UIM protection, you could be financially ruined by someone else's choice to carry the cheapest insurance possible.

These aren't just hypothetical stories; they are the financial reality for thousands of Florida drivers every year. If you've been hurt and are facing a similar struggle, you don't have to go through it alone. In pain? Call Caine.

How to Select the Right UM Coverage Limits

Choosing your Uninsured Motorist (UM) coverage limits is one of the most critical decisions you'll make for your financial security. A common rule of thumb you’ll hear is to just match your UM limits to your Bodily Injury (BI) liability limits. While that’s a decent start, it’s often not nearly enough to truly protect you.

Instead, I want you to think about what it would actually cost to put your life back together after a devastating crash. You need to consider your health insurance deductible, your annual income, and your family's daily living expenses. A single catastrophic injury can easily run up hundreds of thousands of dollars in medical bills and lost wages—an amount that will blow past a basic policy limit.

What might surprise you is that boosting your protection from a minimal amount to a substantial six-figure safety net often costs very little. A small bump in your monthly premium can literally double or even triple your coverage, giving you invaluable peace of mind.

Understanding the Rejection Form

This coverage is so important that Florida law won’t let you just ignore it. Because UM coverage is your lifeline for bodily injuries when an at-fault driver has little or no insurance, the stakes are incredibly high. The law actually requires you to formally reject this coverage in writing on a state-approved form.

That form explicitly warns you about the risks of facing massive medical bills and lost wages all on your own. You can learn more about why this requirement exists in Florida's auto insurance best practices.

Before you sign anything, stop and really think about what you are giving up. Signing that rejection form is a binding legal decision. It leaves you and your family completely exposed to financial ruin if an uninsured driver hurts you.

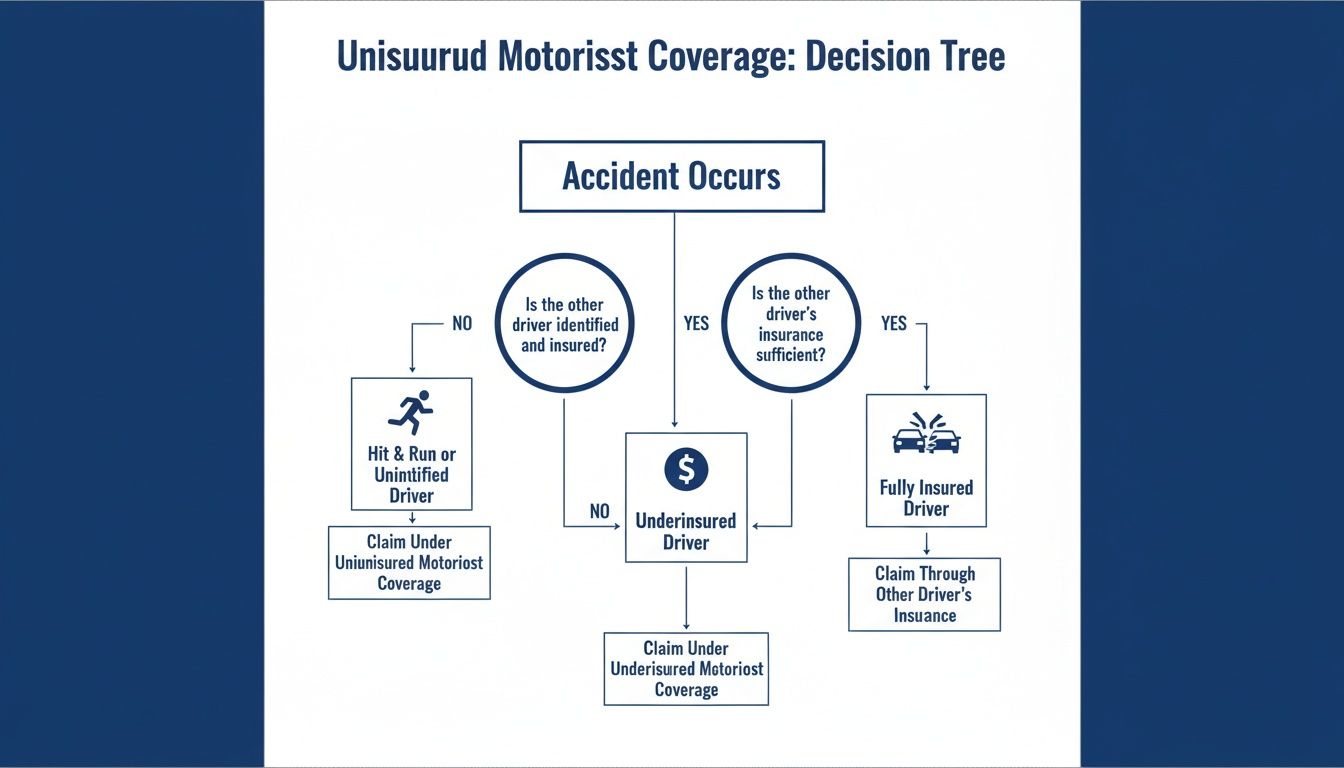

This decision tree shows you exactly what I'm talking about. It walks through common nightmare scenarios—like multi-car pile-ups, hit-and-runs, and crashes with underinsured drivers—where UM coverage becomes absolutely essential.

As the infographic makes plain, in almost every serious accident caused by an irresponsible driver, your UM coverage is the main—and sometimes only—path to getting the financial help you need to recover.

Have a real conversation with your insurance agent. Ask for quotes on different coverage levels, like $100,000, $250,000, or even more. Once you see how affordable true protection actually is, the answer to "do I need uninsured motorist coverage in Florida" becomes crystal clear.

Don't let an agent rush you through the paperwork. Take the time to secure the coverage your family deserves. And if you’re already fighting an insurer after a crash, don't do it alone. In pain? Call Caine.

Steps to Take After an Accident With an Uninsured Driver

The moments right after a crash are chaotic and stressful, especially when you find out the other driver has no insurance. What you do next can make a world of difference for your health and your financial future.

Your first priority, always, is safety. Check on yourself and anyone else involved, then call 911 immediately. Getting police and medical help on the way is non-negotiable, and the official police report is vital for any insurance claim you'll file later.

While waiting for help to arrive, and only if you’re able, start gathering as much information as you can.

Document Everything at the Scene

Even if the other driver admits they don’t have insurance, you still need their details. Get their name, phone number, and address. Then, use your phone to become a detective, taking photos and videos of everything:

The damage to all vehicles from every possible angle.

The positions of the cars on the road and in relation to each other.

Any skid marks, shattered glass, or other debris on the pavement.

The other driver’s license plate and, if they'll let you, their driver’s license.

If there are any witnesses, ask for their names and phone numbers. An independent account of what they saw can be incredibly valuable down the road.

The single most critical step is to get checked out by a doctor right away, even if you feel fine. Adrenaline is a powerful pain-masker, and waiting to seek treatment can seriously harm both your health and your insurance claim.

Once you’ve seen a doctor, notify your own insurance company to open a claim. You’ll need to open one under your Personal Injury Protection (PIP) and another under your Uninsured Motorist (UM) coverage. For a more detailed breakdown of post-crash procedures, check out our guide on essential steps to take when accidents happen.

Before you give a recorded statement to any insurance adjuster—even your own—it is crucial to speak with an experienced car accident attorney. Your insurance company might look for ways to minimize your payout. A lawyer’s job is to protect your rights, manage the complex UM claims process, and make sure you get the fair compensation you deserve.

In pain? Call Caine.

Florida UM Coverage: Your Questions Answered

Even after getting the basics down, you probably still have a few questions about how Uninsured Motorist (UM) coverage works in the real world. That’s completely normal. Let's walk through some of the most common questions I hear from clients to clear things up.

How Does UM Work in a Hit-and-Run Accident?

This is one of the classic situations where UM coverage becomes your financial lifeline. When a driver hits you and flees the scene, they are, for all practical purposes, an uninsured motorist. You don't know who they are, so you can't file a claim against their insurance.

This is where your own UM policy steps in. It essentially acts as the insurance the hit-and-run driver should have had. It becomes your primary tool for recovering money for your injuries—think medical bills, lost income from being out of work, and compensation for your pain and suffering—that your basic PIP benefits won't touch. Without it, you’d be left holding the bag.

Does Uninsured Motorist Coverage Fix My Car?

This is a huge point of confusion for a lot of people, and it's a great question. The answer is no. In Florida, standard Uninsured Motorist coverage is strictly for bodily injuries. It's designed to pay for the human cost of an accident, not property damage.

If you want your car repaired after being hit by an uninsured or hit-and-run driver, you need a separate coverage called Collision. Collision is what pays to fix or replace your vehicle after a crash, no matter who was at fault.

Is Adding UM Coverage Expensive?

I get it—no one wants to pay more for car insurance. But when you look at what you get for the cost, UM coverage is arguably the best bargain on your entire policy.

The small bump in your premium is nothing compared to the catastrophic financial risk of a serious injury caused by an uninsured driver. A single accident can easily result in medical bills and lost wages in the hundreds of thousands of dollars, a debt that would fall squarely on your shoulders.

Don't just take my word for it. The best way to understand the value is to ask your insurance agent for a quote. You’ll probably be surprised at how little it costs to add this critical layer of protection and the peace of mind that comes with it.

If you've been hurt in a crash and are getting the runaround from an insurance company, you don't have to face them alone. The team at CAINE LAW knows their tactics inside and out and will fight for the full compensation you deserve. In pain? Call Caine. Learn more about how we can help at cainelegal.com.