In Pain? Call Caine

car accident lawsuit florida: A clear guide to compensation

5 Min read

By: Caine Law

Share

If you've been hurt in a car crash, the very first question on your mind is probably, "Do I even have a case?" It's a critical one. Figuring out if you have a valid car accident lawsuit in Florida is the most important first step you can take.

A strong case isn't just about being in an accident. It’s about being able to prove who was responsible and showing just how much you've lost because of it. Understanding the core legal requirements will give you a much clearer picture of whether you can seek compensation that goes beyond what the basic insurance policies cover.

Do You Have a Strong Case for a Lawsuit?

After the shock and confusion of a crash, the road to recovery can feel overwhelming. To know if you have a real shot at a lawsuit, I often tell my clients to think of it like a three-legged stool. If any one of those legs is weak or missing, the whole thing comes crashing down.

Every single successful personal injury claim in Florida is built on three pillars: Negligence, Causation, and Damages. Let’s break down what these legal terms actually mean for you.

The Three Pillars of a Successful Claim

Negligence: This is the starting point. You have to prove the other driver was careless or broke a safety rule. Think texting and driving, speeding through a school zone, or blowing past a red light. Their actions (or sometimes, their failure to act) fell short of what any reasonably careful person would do behind the wheel.

Causation: This is all about connecting the dots. You must draw a direct, undeniable line from the other driver's carelessness to your injuries. For example, the other driver ran a stop sign, and that directly caused the T-bone crash that shattered your wrist. It can't just be a coincidence.

Damages: Finally, you have to show you've suffered real, tangible harm. This includes the obvious things you can add up with a calculator—medical bills, lost paychecks from time off work, and the cost to repair your car. But it also includes the very real, but harder to price, harm like your pain and suffering or emotional trauma.

A huge mistake people make is thinking that just because there was an accident, a lawsuit is a sure thing. The truth is, without solid proof of all three elements—negligence, causation, and damages—even a truly terrible crash might not hold up in court.

Florida’s Serious Injury Threshold

Now, Florida’s "no-fault" insurance system throws another hurdle in your path. Before you can even step outside that system to sue the at-fault driver for your pain and suffering, your injury has to meet a specific legal standard. We call it the "serious injury threshold."

This isn't some vague idea; it's spelled out clearly in the law. Your injury must be diagnosed as one of the following:

Significant and permanent loss of an important bodily function.

Permanent injury within a reasonable degree of medical probability.

Significant and permanent scarring or disfigurement.

Death.

Things like minor whiplash or some bruising usually won't clear this bar—that’s what your own PIP insurance is for. But injuries that require surgery, cause herniated discs, or leave you with a long-term disability often qualify, opening the door for a lawsuit.

An experienced attorney can dig into your medical records to determine if your condition meets this critical requirement. If you're not sure where you stand, don't leave it to chance. In pain? Call Caine.

Critical Deadlines You Cannot Afford to Miss

After a car wreck, it’s easy to feel like time stands still while you focus on healing. But in the world of a car accident lawsuit in Florida, multiple legal clocks start ticking the moment the crash happens.

Missing these deadlines isn’t a minor mistake. It can permanently slam the door on your right to compensation. Think of them as expiration dates on your legal rights—once they pass, your opportunity is gone for good, no matter how strong your case is.

The 14-Day Rule for PIP Benefits

The very first, most urgent deadline you’ll face involves your own insurance. Florida is a “no-fault” state, which means your Personal Injury Protection (PIP) coverage is your first stop for medical bills, covering up to $10,000.

But there’s a huge catch. To even qualify for these benefits, you must get medical treatment within 14 days of the accident. This isn't a suggestion; it's a hard-and-fast rule under Florida law.

Wait until day 15 to see a doctor, and your insurance company can legally deny your PIP claim entirely. Suddenly, you're on the hook for all your initial medical bills.

The 14-day rule is a critical first hurdle. Putting off a doctor’s visit doesn’t just risk your health—it can sabotage the financial foundation of your entire injury claim before it even gets off the ground.

The Statute of Limitations for Your Lawsuit

While the 14-day rule covers your immediate medical needs, a much bigger clock is also ticking: the statute of limitations. This is the final, non-negotiable deadline for formally filing a lawsuit against the at-fault driver.

In Florida, you have a limited window for most negligence claims stemming from a car accident. If you miss this deadline, the court will almost certainly throw out your case. It doesn't matter how severe your injuries are or how clear the other driver's fault is. The deadline is the deadline.

It's also crucial to know this timeframe can change based on the specifics, like who you are suing (for example, a government entity). This is why reviewing essential steps and legal guidance after an accident is so important. You can't afford to guess.

Here’s a quick overview of the timeframes you need to be aware of.

Key Deadlines for Florida Car Accident Claims

Action Required | Deadline | Why It Matters |

|---|---|---|

Seek Initial Medical Care | Within 14 days of the accident | This is required to be eligible for your $10,000 in PIP (no-fault) benefits. |

File a Negligence Lawsuit | Within 2 years of the accident | This is your final chance to sue the at-fault party for personal injuries. Miss it, and your claim is barred forever. |

File a Wrongful Death Lawsuit | Within 2 years of the date of death | If a loved one passed away due to the accident, this is the timeframe for the family to seek justice. |

File a Lawsuit Against a Government Entity | Notice within 3 years; shorter lawsuit deadline | Suing a city, county, or state agency has complex notice requirements and a tighter timeline. |

These deadlines are firm and unforgiving. The legal system doesn't make exceptions for those who wait too long.

Why You Cannot Afford to Wait

Procrastination is the enemy of a successful injury claim. Evidence disappears, memories fade, and those legal clocks tick down faster than you think.

Evidence Vanishes: Skid marks wash away in the rain. Damaged vehicles get repaired or sent to the scrap yard. Nearby security camera footage? It’s often erased within days. The sooner we can investigate, the more we can preserve.

Witnesses Forget: A witness interviewed a week after a crash will remember crucial details. That same person, asked to recall events two years later, might have a completely fuzzy memory. Fresh testimony is credible testimony.

Medical Links Weaken: Seeing a doctor right away creates a clear, undeniable paper trail linking your injuries to the crash. Delays give the insurance company an opening to argue your injuries came from something else.

If you've been injured, don't let a technicality on a calendar prevent you from getting the justice you deserve. The single best way to protect yourself is to speak with an experienced attorney right away. In pain? Call Caine.

How Fault and Negligence Impact Your Compensation

When it comes to a car wreck, figuring out who was at fault is rarely a simple case of one driver being totally right and the other totally wrong. The reality is usually a lot messier, and in a car accident lawsuit in Florida, this complexity directly shapes how much compensation you can actually get.

Florida operates under a legal rule called “pure comparative negligence.” It sounds a bit technical, but the core idea is pretty straightforward: your financial recovery is reduced by whatever percentage of fault you share for the accident.

Think of it like a pie. If a jury decides your total damages—medical bills, lost income, pain, and suffering—add up to a $100,000 pie but finds you were 20% responsible for causing the crash, your slice of that pie gets smaller. You’d be able to recover $80,000, not the full amount.

Understanding Pure Comparative Negligence

Some states have a harsh rule that says if you're 50% or more to blame, you get nothing. Florida is different. Our “pure” rule lets you recover damages even if you were 99% at fault. In that extreme case, you could still claim 1% of your total damages. It’s a system designed to hold every party accountable for their exact share of the blame.

Let’s walk through a common scenario to see how this plays out.

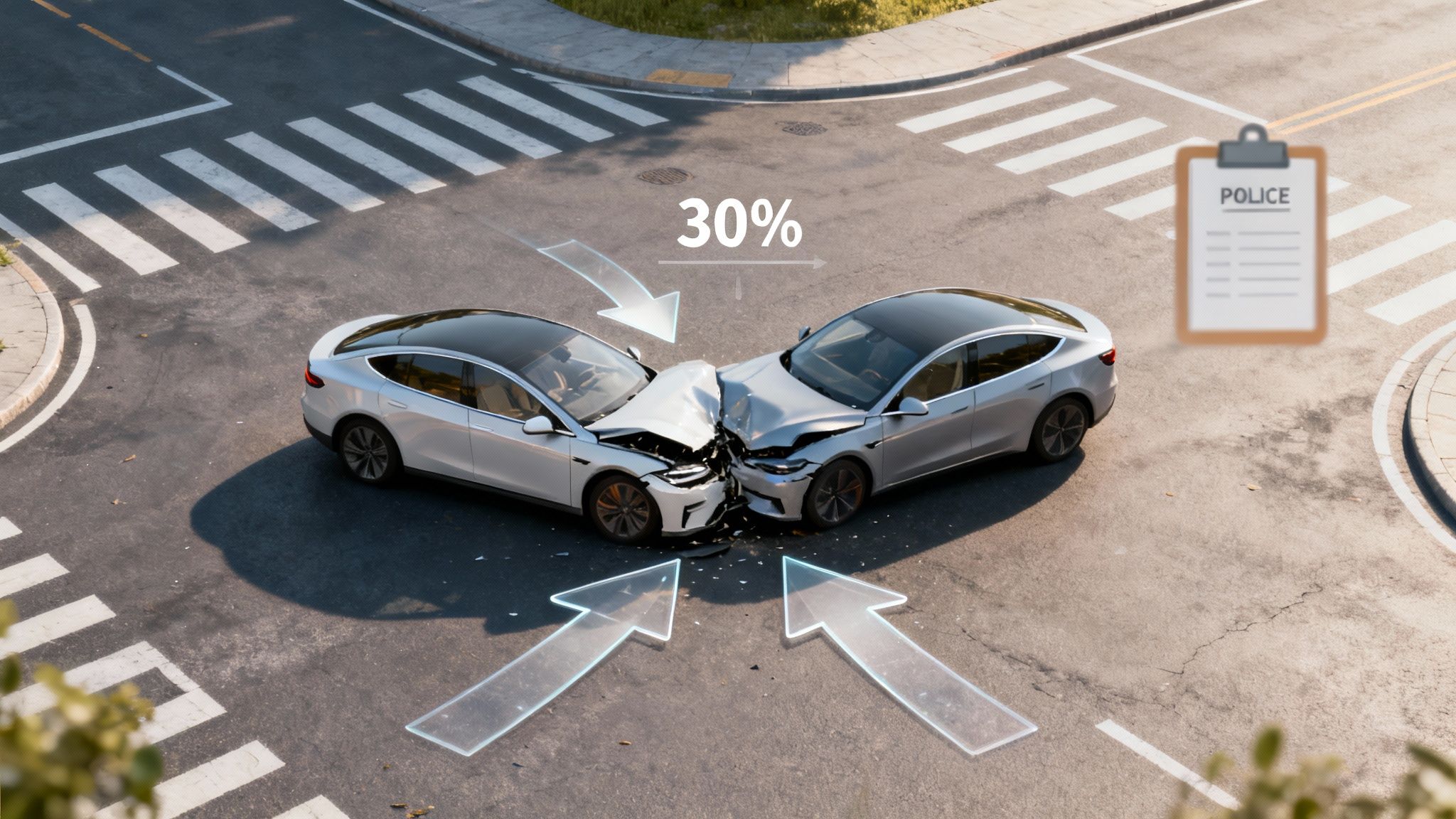

Example of Comparative Fault: Imagine you’re driving just 5 mph over the speed limit. Suddenly, another driver pulls out from a side street and T-bones you. They are clearly the main one at fault. But the insurance company, or even a jury, might argue that if you’d been going the speed limit, you could have stopped or swerved in time.

Total Damages: A jury awards you $200,000.

Fault Assignment: They decide the other driver was 85% at fault for failing to yield, but you were 15% at fault for speeding.

Your Final Award: Your $200,000 award is cut by your 15% share ($30,000). You would walk away with $170,000.

This is precisely why insurance adjusters fight so hard to pin even a tiny bit of blame on you. Every single percentage point they can shift in your direction is money they get to keep in their pockets.

How Is Fault Proven in a Florida Accident?

Because fault is so critical to what your case is worth, building a strong claim is all about gathering powerful evidence to prove the other driver’s negligence. It’s not enough to just say what happened—you have to show it.

Key evidence in these cases often includes:

The Official Police Report: This is the starting point, containing the officer’s on-scene observations, witness statements, and sometimes a preliminary conclusion about who caused the crash.

Traffic Camera and Dashcam Footage: There’s nothing more powerful than video. It can show exactly how a collision happened, leaving little room for argument.

Photos and Videos from the Scene: Pictures of where the cars ended up, skid marks, property damage, and road conditions help accident reconstruction experts put the puzzle together.

Witness Testimony: Independent eyewitnesses with no stake in the outcome can offer a credible, unbiased account of what they saw.

Cell Phone Records: If you suspect the other driver was distracted, their phone records can be subpoenaed to show if they were texting or talking at the moment of impact.

The strength of your evidence directly correlates to the strength of your negotiating position. An airtight case showing the other driver's clear negligence leaves the insurance company with little room to argue and often leads to a more favorable settlement offer.

This is huge, because the vast majority of car accident claims in Florida are resolved through settlements, not trials. Legal experts estimate that only about 1% to 5% of personal injury cases ever make it to a courtroom. Discover more insights about Florida car accident settlements and see why having a rock-solid case is so vital for negotiations.

Ultimately, navigating the tricky waters of comparative fault requires a skilled legal strategy. If you’re worried about how your own actions might affect your claim, getting professional advice is the best way to protect yourself. In pain? Call Caine.

Calculating the Full Value of Your Claim

After a wreck, it's easy to get tunnel vision. Your focus narrows to the most immediate problems, like the emergency room bill piling up or the estimate to fix your mangled car. But the true cost of an accident—the full financial and personal impact—goes so much deeper. If you're considering a car accident lawsuit in Florida, you have to account for every single loss, both the ones with a clear price tag and those that are much harder to quantify.

Failing to calculate the total scope of your damages is one of the biggest and most common mistakes people make. It's like planning a long road trip but only putting enough gas in the tank to get a few miles down the highway. You won't reach your destination, and you'll be left stranded without the resources you need to truly recover.

To make sure this doesn't happen, Florida law breaks damages down into two distinct categories. Getting a handle on both is the key to understanding what a genuinely fair settlement looks like, and it gives you the power to fight for the full compensation you deserve.

Economic Damages: The Tangible Costs

Economic damages are the bedrock of your claim. These are the straightforward, calculable losses you can prove with a paper trail of receipts, bills, and pay stubs. Think of these as the concrete financial hits you've taken because of someone else's carelessness.

It is absolutely vital that you keep meticulous records of every single expense. These typically include:

All Medical Expenses: This goes far beyond the initial hospital visit. We're talking about surgery, physical therapy, prescription medications, chiropractic care, future medical treatments your doctor anticipates, and even the cost of gas for driving to and from your appointments.

Lost Wages and Income: If you missed work while laid up, you can claim those lost paychecks. This also covers any hit to your ability to earn a living in the future if your injuries cause a long-term or permanent disability.

Property Damage: This is mainly the cost to repair or replace your vehicle. It also includes any personal items inside that were wrecked in the crash, like a laptop, cell phone, or car seat.

These numbers add up shockingly fast. A single day in a Florida hospital can run into the thousands, and a serious injury can easily sideline you from work, leading to tens of thousands in lost income. Diligently tracking these figures is the first step in building a powerful case.

Non-Economic Damages: The Human Cost

This is where the law acknowledges the true, personal toll an accident takes on a human being. Non-economic damages are meant to compensate you for the intangible, yet very real, suffering you’ve been forced to endure. While there’s no receipt for pain or a bill for trauma, these losses are just as legitimate and often make up a huge part of a final settlement.

Your life is more than a collection of bills. Non-economic damages acknowledge the profound impact an injury has on your quality of life, your emotional well-being, and your ability to enjoy the simple things you once took for granted.

These damages are unique to every person and every case, but they generally fall into a few key areas:

Pain and Suffering: This covers the physical pain and discomfort you experience, from the violent moment of the crash all the way through your long recovery.

Emotional Distress: This accounts for the psychological fallout, like anxiety, depression, a new fear of driving, or even Post-Traumatic Stress Disorder (PTSD).

Loss of Enjoyment of Life: If your injuries stop you from playing with your kids, going fishing, or participating in hobbies you once loved, you can be compensated for that profound loss.

Permanent Scarring or Disfigurement: This recognizes the lasting physical and emotional impact that visible injuries can have on a person's confidence and self-image.

Because these damages are subjective, insurance companies love to downplay their value or dismiss them entirely. This is where having an experienced attorney in your corner becomes absolutely critical. Pushing back against these lowball tactics is essential, especially when you're facing complicated insurance disputes.

Settlement values in Florida can swing dramatically based on the severity of all these combined damages. A minor whiplash case might settle for somewhere between $1,000 and $30,000. On the other end of the spectrum, catastrophic injuries like a traumatic brain injury can lead to settlements ranging from $100,000 to well over $1 million.

Don't underestimate the total value of what was taken from you. You only get one shot to get the compensation you need to put your life back together. Make sure you account for everything. In pain? Call Caine.

Navigating the Florida Car Accident Lawsuit Process

Filing a car accident lawsuit in Florida can feel like you’re stepping into a world with its own language and rules. I get it. But the good news is, the process follows a logical, predictable path. Once you understand each phase, the journey becomes much clearer, and you can feel more in control of your case.

Think of it as a roadmap. There might be some twists and turns, but every step is there for a reason—to move your case toward a fair resolution. Let's walk through the key stages of a typical lawsuit timeline so you know exactly what to expect.

Pre-Suit Investigation and Demand

Long before a lawsuit is ever filed, a mountain of work happens behind the scenes. This is the pre-suit phase, and it’s where your attorney builds the entire foundation for your case. It’s a make-or-break period for gathering evidence and showing just how strong your claim really is.

During this time, your legal team will be busy:

Investigating the Accident: This means collecting police reports, photographing the scene, tracking down and interviewing witnesses, and securing any video footage we can find.

Documenting Your Damages: We meticulously gather every medical record, bill, and pay stub to calculate the full, real-world cost of your economic losses.

Consulting Experts: In complex cases, we might bring in accident reconstruction specialists or medical experts to provide professional opinions that hammer home the facts.

Once all this evidence is locked down, your attorney drafts a formal demand letter. This isn't just a simple note; it's a detailed document sent to the at-fault driver's insurance company that lays out the facts, proves their driver was liable, and demands a specific amount to settle the claim. The insurer then has to review it and decide whether to pay, say no, or come back with a counteroffer. This is where negotiations kick off.

Filing the Lawsuit and Discovery

If those pre-suit negotiations don't lead to a fair settlement offer, it’s time to file a lawsuit with the court. This officially starts the litigation phase. The first documents—the Complaint and Summons—let the defendant know in no uncertain terms that they are being sued.

This then kicks off a long but critical stage called discovery. The entire point of discovery is for both sides to exchange all the information and evidence they have. It's a process designed to make sure nobody gets blindsided with surprises at trial.

Discovery is where the real work of a lawsuit gets done. It's an intensive fact-finding mission where both sides put their cards on the table, revealing the strengths and weaknesses of their arguments before ever stepping into a courtroom.

Here's what happens during discovery:

Interrogatories: These are written questions sent to the other side, which they must answer in writing, under oath.

Requests for Production: We'll make formal requests for documents, like medical records, cell phone records, or vehicle maintenance logs.

Depositions: This is out-of-court testimony where lawyers question witnesses—including you and the other driver—under oath, with a court reporter transcribing every word.

This process can take many months, but it's absolutely essential for building a rock-solid case for the final stages.

Mediation and Trial

The vast majority of Florida car accident lawsuits—over 95%—are resolved before they ever see the inside of a courtroom. One of the main reasons for this is mediation, which is a mandatory step in most civil cases here.

In mediation, both sides sit down with a neutral, third-party mediator. The mediator’s job isn't to pick a winner. It's to help guide the conversation and find common ground for a settlement. Think of it as a structured negotiation session that gives everyone a final chance to resolve the case without the risk and high cost of a trial.

If mediation doesn't work out, the case moves on to trial. This is where both legal teams present their evidence and arguments to a judge and jury. The jury then deliberates and delivers a verdict, deciding who was at fault and what amount of compensation, if any, should be awarded. While a trial holds the potential for a big win, it also comes with the very real risk of walking away with nothing, which is exactly why most cases settle.

Understanding this process helps you know what to expect. If you're facing this journey, you don't have to go it alone. In pain? Call Caine.

Why an Experienced Attorney Makes all the Difference

Trying to handle a car accident lawsuit in Florida by yourself is a recipe for disaster. It’s a bit like trying to perform your own surgery after watching a couple of online videos. You might grasp the general idea, but you’re missing the deep expertise, practiced skill, and specialized tools needed to navigate the maze of a personal injury claim.

Make no mistake: insurance companies have armies of adjusters and lawyers. Their entire job, day in and day out, is to pay you as little as possible—or nothing at all. And they are very, very good at it.

An experienced personal injury attorney completely levels that playing field from day one. They become your advocate, your translator, and your shield, taking over every single communication with the insurance company's representatives. This frees you up to focus on what truly matters: your physical and emotional recovery.

The Contingency Fee Advantage

So many people hesitate to call a lawyer because they’re worried about the cost. That's a completely understandable fear, but it’s one that the contingency fee model was designed to eliminate. It’s simple: you pay zero upfront costs. No retainers, no hourly bills.

An attorney working on contingency only earns a fee if they successfully recover money for you, whether that’s through a settlement or a jury verdict. Their payment is just a pre-agreed percentage of the total recovery.

This setup is designed to give everyone access to top-tier legal help, no matter their financial situation. It also means your attorney's goals are perfectly aligned with yours—the more successful your case is, the more successful they are.

Maximizing Your Financial Recovery

A great lawyer does so much more than just fill out forms and make phone calls. Their real value is in building a powerful case designed to maximize the compensation you receive.

Here’s a glimpse of what that actually looks like:

Digging Deep with a Real Investigation: They go far beyond a simple police report. This can mean subpoenaing cell phone records to prove distracted driving or hiring accident reconstruction experts to prove exactly how a collision happened.

Calculating the True Cost of Your Damages: A seasoned attorney makes sure every single loss is documented and accounted for. This includes future medical treatments, lost earning potential, and the very real emotional toll of pain and suffering. This step alone prevents countless people from accepting a lowball offer that doesn't cover their long-term needs.

Negotiating from a Position of Strength: When an attorney walks into negotiations armed with solid evidence and a deep knowledge of Florida law, the dynamic shifts. They can push back hard against the insurance company's standard tactics and argue for a truly fair outcome.

The legal world is always changing, and Florida is a particularly complex environment. In fact, Florida leads the nation in personal injury cases, with a recent rate of 127.41 cases filed per 100,000 residents—a number that absolutely dwarfs the national average.

Having a skilled guide is non-negotiable. You can learn more about how we handle these complex auto and motorcycle accidents on our site. You don’t have to face this system by yourself. In pain? Call Caine.

Answering Your Lingering Car Accident Questions

Even after walking through the entire lawsuit process, you probably have a few more questions rattling around. That’s perfectly normal. A car accident lawsuit in Florida isn't a simple, one-size-fits-all process, and it's the specific "what-if" scenarios that often cause the most stress.

Let's tackle some of the most common questions and concerns we hear from our clients every day. Think of this as a quick-reference guide to give you that last bit of clarity you need to move forward with confidence.

What if the At-Fault Driver Has No Insurance?

This is a scenario we see far too often on Florida roads, and it’s the exact reason why Uninsured/Underinsured Motorist (UM/UIM) coverage is so critical. This is an optional, but highly recommended, part of your own insurance policy that kicks in to cover you when the person who hit you can't.

If you have UM coverage, we can file a claim against your own policy to recover compensation for your medical bills, lost income, and pain and suffering—just as we would have against the at-fault driver's insurance. If you don't have it, your options get tricky. You can still sue the uninsured driver personally, but actually collecting any money from a judgment is tough if they don't have personal assets to go after.

Will My Insurance Rates Go Up if I File a Lawsuit?

This is a huge worry for a lot of people, but thankfully, it's one you can set aside. Florida law is crystal clear: your insurance company is legally forbidden from raising your premiums or dropping your policy for an accident that was not your fault.

You cannot be penalized for using your PIP benefits or for pursuing a claim against a negligent driver. Your insurance rates are supposed to be based on your own driving risk, not on your decision to seek the compensation you're legally owed after someone else injures you.

It's a common myth that any interaction with your insurance company after a crash will lead to a rate hike. Florida law was written specifically to protect accident victims from this kind of retaliation. Your right to get justice shouldn't be held back by fear of a financial penalty from your own insurer.

How Long Does It Take to Get a Settlement Check?

Once a settlement agreement is officially signed by everyone involved, things tend to move pretty quickly. In most cases, you can expect to have the funds from your settlement within about four to six weeks.

Here’s a simple breakdown of how it works:

The defense insurance company cuts the settlement check and mails it to your lawyer's office.

Your attorney deposits that check into a specially regulated trust account for safekeeping.

From that trust account, your attorney pays off any outstanding medical bills or liens related to your case.

Finally, they deduct their contingency fee as outlined in your agreement and issue the rest of the money—your net settlement—directly to you.

Handling these final financial steps is a crucial part of what an attorney does. We make sure every "i" is dotted and every "t" is crossed so you get the money you need in your hands as smoothly and efficiently as possible.

If you're still wrestling with questions or feel stuck on what to do next, you don’t have to figure it out alone. The legal team at CAINE LAW is here to offer the clear guidance and strong representation you need to protect your rights. In pain? Call Caine. Contact us today for a free, no-obligation consultation.