In Pain? Call Caine

Can You Make Insurance Claim Without Police Report? Guide

5 Min read

By: Caine Law

Share

Yes, you absolutely can file an insurance claim without a police report in many situations. While that official report is a powerful piece of evidence, not having one doesn't automatically kill your claim—especially for minor accidents.

Think of a police report as a strong shortcut to proving what happened, but it's not the only path to getting your claim approved.

Understanding Claims Without a Police Report

After a car crash, the thought of filing a claim without any official police paperwork can be a little nerve-wracking. You might be worried that the insurance adjuster will take one look at your file and toss it aside.

Thankfully, that’s not usually how it works. The real question is how serious the accident was.

For a minor fender-bender with no injuries and barely a scratch, a police report is often optional. In these simple cases, you and the other driver can just swap insurance info, snap some photos, and file the claims directly. A lot of smaller claims get settled this way every day. In fact, some data shows that around 14% of vehicle-related insurance claims are filed without a police report, mostly for accidents with no significant injuries.

But the whole game changes when the accident involves:

Significant injuries to you, your passengers, or anyone else.

Major property damage that goes beyond a simple dent. (In Florida, the magic number is $500).

A dispute over who was at fault, where you and the other driver have very different stories.

A hit-and-run, where the other driver takes off.

In those situations, a police report goes from "nice-to-have" to "absolutely critical."

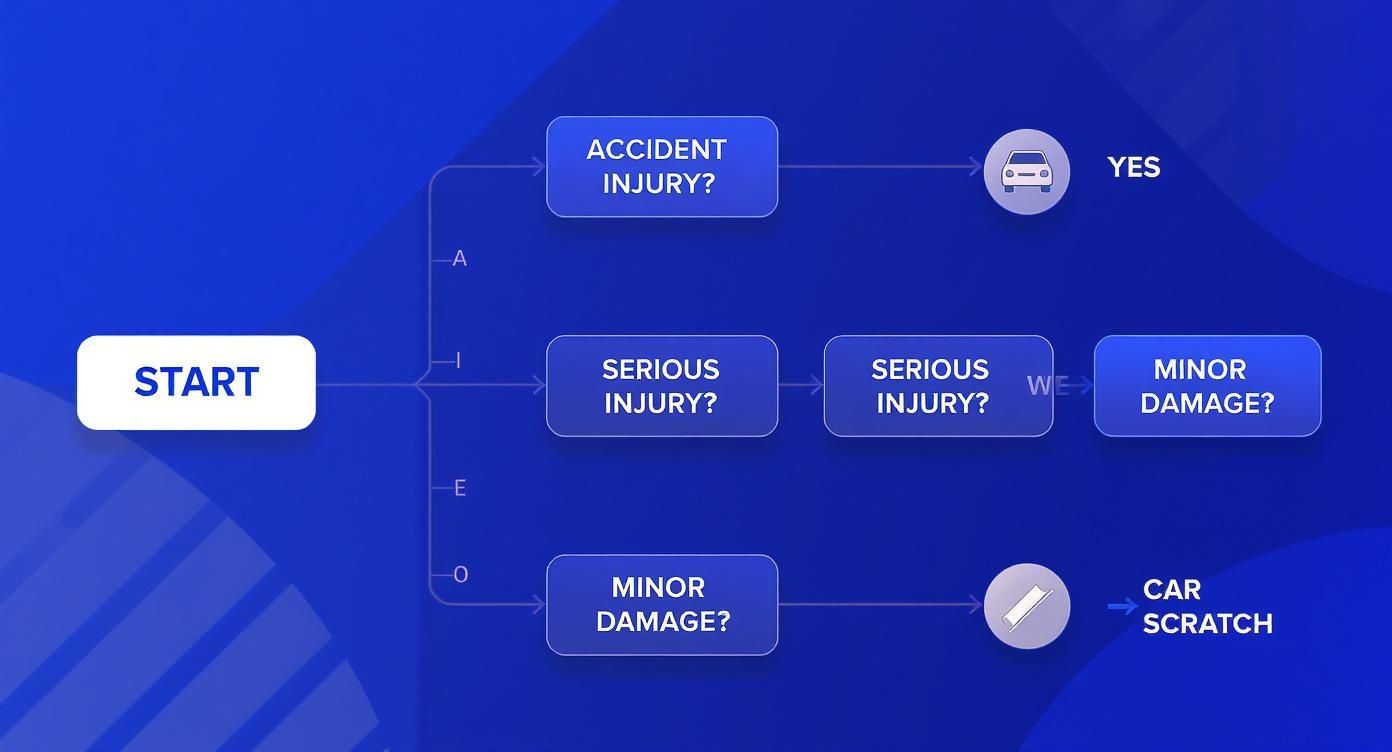

This flowchart gives you a simple look at how the decision-making process works and when that report becomes essential.

The bottom line is simple: the more serious the crash, the more you need a police report to back up your insurance claim.

When is a Police Report Necessary

To make it even clearer, here’s a quick guide to some common accident scenarios and whether you should push for a police report.

Incident Type | Police Report Status | Reasoning |

|---|---|---|

Minor Fender-Bender (No Injuries) | Often Optional | Insurers can usually figure things out with just photos and driver statements. |

Accident with Injuries (Any Level) | Highly Recommended | The report creates an official, unbiased record of the injuries, which is vital. |

Hit-and-Run Accident | Required | You'll need it to file a claim under your own uninsured motorist coverage. |

Disagreement Over Fault | Highly Recommended | A police officer's neutral assessment can break the tie between conflicting stories. |

If you've been in a crash and aren't sure what to do next, especially if you were hurt, don't try to handle the insurance company on your own. In pain? Call Caine.

Why Insurers Value a Police Report

To get why filing an insurance claim without a police report can get a little tricky, you have to put yourself in the insurance adjuster’s shoes. For them, a police report is the gold standard of evidence. It's an official, third-party account that cuts right through all the confusion and emotion that follows a crash. Think of it as a neutral referee’s notes from a chaotic game.

This one document does a lot of heavy lifting for the insurer, making their job of verifying your claim much simpler and a whole lot faster.

It Establishes a Clear and Credible Narrative

A police report immediately lays an objective foundation for the claim. It’s a snapshot of what happened, captured by a trained professional who has no skin in the game.

Typically, the report will include:

A Detailed Timeline: It locks in the date, time, and location of the incident, leaving no room for debate about when and where it all went down.

Official Identification: The report lists everyone involved—drivers, passengers, and witnesses—along with their contact information and insurance details.

Diagrams and Descriptions: Officers will often sketch the accident scene and write up a narrative describing the road conditions, where the vehicles ended up, and any visible damage they observed.

This official record helps an adjuster grasp the basic facts in minutes, saving them from having to piece together conflicting stories from people who are understandably upset.

It Provides an Initial Assessment of Fault

While a police report isn't the final word legally, the officer's initial take on who was at fault carries a ton of weight. Based on traffic laws, what drivers told them, and the physical evidence, the officer will often note contributing factors or even issue a ticket.

For an insurance company, an officer’s opinion on fault is a powerful indicator. It provides a strong starting point for determining liability, which is the cornerstone of any personal injury or property damage claim.

This assessment helps them back up your version of events and push back against any claims that you were the one responsible.

Without it, you’re often stuck in a "he said, she said" scenario, where the burden of proving the other driver’s negligence falls entirely on you. The absence of a report signals to the insurer that they need to dig a lot deeper, which can drag out your claim and invite some serious skepticism. When you're facing this uphill battle, having a legal expert on your side is critical. In pain? Call Caine.

Building a Strong Claim Without a Police Report

When there's no official police report, you have to shift gears and become the chief investigator for your own accident. The burden of proving what happened, who’s at fault, and just how much damage was done rests entirely with you.

Think of it this way: you’re building a case file for the insurance adjuster. The more organized, detailed, and undeniable your evidence is, the better your chances are for a smooth claims process. Without that neutral, third-party report, the insurance company is going to look at everything you submit with a magnifying glass. Your job is to assemble a collection of proof so strong it leaves them with no questions. This means moving fast to lock down the facts before memories get hazy and evidence vanishes.

Your Evidence-Gathering Checklist

Right after the incident, your top priority is to document everything. I'm not talking about a couple of quick phone snaps. You need to create a complete visual and written record of what went down.

Here’s what you should focus on:

Photos and Videos Are Your Best Friends: Get shots of everything from every possible angle. Start with wide shots to capture the whole scene, then move to medium shots showing where the vehicles are in relation to each other, and finish with close-ups of every single dent, scratch, and crack. Don't forget to photograph skid marks, scattered debris, nearby traffic signs, and even the road conditions. A short video walkthrough can be even better, giving a real-time feel for the scene.

Find Your Witnesses: Witnesses can make or break a claim. Politely ask for their full name, phone number, and email. If they seem willing, see if they’ll jot down a quick, signed note about what they saw while it’s still fresh. An unbiased account from a bystander often carries as much weight as an officer’s notes.

Write Down Your Story: As soon as you can, sit down and write out—or even record a voice memo—of exactly what happened. Be specific. Note the date, time, and weather. Describe what you were doing just before the crash and then walk through the event, step-by-step. The small details are what make your account believable. You can get more pointers in our detailed guide on what to do when accidents happen.

This collection of evidence becomes the backbone of your claim. It’s not just for car crashes, either. Think about non-collision events, like a tree branch falling on your car during a storm. A claim like that can absolutely succeed without a police report if you have solid photos and a statement from a neighbor who saw it happen. The key is having consistent stories from neutral observers and concrete proof like repair estimates.

Organizing Your Case File for the Insurer

Once you have all your evidence, the next step is presenting it in a way that makes sense. A messy, disorganized submission is easy for an adjuster to set aside. A clean, logical file shows them you mean business.

A well-organized claim file sends a clear message to the insurer: you have the evidence to back up your story. This level of preparation can discourage them from trying to delay or deny your claim based on "insufficient information."

Set up a dedicated folder, whether it’s a physical one or on your computer. Create clear sections for your photos, witness information, your personal statement, and any medical bills or repair quotes. When you present a coherent, well-documented case, you control the story from the start.

And if the insurance company still tries to give you the runaround? Don't go it alone. In pain? Call Caine.

How Insurance Companies See Claims Without a Police Report

When you file an insurance claim but don't have a police report, you're essentially handing the adjuster a puzzle with a key piece missing. It completely changes the game. Instead of a straightforward review, the process shifts into a much more detailed, almost forensic investigation.

The adjuster’s main job is to verify the facts of what happened. Without an officer’s neutral, third-party account, they have to lean entirely on the evidence you provide—and they're going to scrutinize every last bit of it.

This heightened level of review means you need to be ready for a thorough and sometimes frustratingly long process. The adjuster will almost certainly want to conduct recorded interviews with you, the other driver, and any witnesses you were able to identify. They are trying to cross-reference every story, looking for any inconsistencies that might cast doubt on your version of events.

The Adjuster's Investigative Playbook

An insurance adjuster doesn’t just wing it. They follow a structured approach designed to uncover the facts and figure out who was at fault. They aren't just glancing at your photos; they're trying to build a complete narrative of the incident from scratch.

Here's what that typically looks like:

Putting Your Evidence Under a Microscope: They will meticulously go over your photos, videos, and any written statements. They'll be looking for anything that contradicts your story, like damage on a vehicle that just doesn't seem to match the accident you described.

Taking Recorded Statements: Expect a formal, recorded phone call where the adjuster grills you with detailed questions about the crash. You need to be prepared to recount what happened clearly and, most importantly, consistently.

Contacting Everyone Involved: The adjuster is going to talk to the other driver and any witnesses to get their side of the story. You can bet that any conflicting accounts will be noted in their file.

An adjuster’s job is to protect their company's bottom line by making sure a claim is legitimate. A claim without a police report automatically raises a red flag, prompting them to dig deeper to ensure every single detail aligns.

When the Special Investigation Unit (SIU) Gets Involved

Sometimes, the lack of a police report might push an adjuster to flag your claim for the Special Investigation Unit (SIU). Think of the SIU as the detective squad of the insurance world. These are specialized investigators whose entire job is to sniff out potential insurance fraud.

Your claim might get escalated to the SIU if there are major inconsistencies in the stories or if the circumstances just seem fishy to the adjuster.

Insurance fraud is a massive concern for these companies. Globally, fraud is estimated to pop up in about 1 out of every 30 insurance claims, which explains why they get so nervous without official police paperwork. A recent survey even found that 35% of insurers reported a spike in claims fraud, which often involves completely fabricated stories. You can read more about this in a report on the global rise in insurance fraud.

Understanding this whole investigative process makes it crystal clear why your own evidence has to be as solid and convincing as possible. If your claim is complex or you're already getting pushback, trying to navigate these potential insurance disputes often requires professional backup. An experienced attorney can package your well-documented claim in a way that forces the insurance company to take it seriously.

If you find yourself stuck in a never-ending investigation or feel like the insurer is treating you unfairly, don't just wait it out. It's time to get help. In pain? Call Caine.

Understanding Florida Car Accident Reporting Laws

While you can often file a claim without a police report, Florida’s specific laws add a critical layer to the conversation. We're a "no-fault" insurance state, which means your own Personal Injury Protection (PIP) coverage is your first stop for initial medical bills, no matter who caused the crash. That can make it seem like figuring out who's at fault isn't a big deal, but making that assumption can be a dangerous mistake.

Ignoring the state's reporting requirements can cause serious headaches for both your legal standing and your insurance claim. Florida law is crystal clear on this.

When Reporting an Accident Is a Legal Duty

Under Florida Statute 316.065, you are legally required to report a car accident to law enforcement immediately if it results in any injuries or has apparent property damage of $500 or more. Think about the high cost of modern car repairs—even a minor fender-bender can easily clear that bar.

What this means is that for most accidents in Florida, calling the police isn't just a smart move for your insurance claim; it's your legal duty.

Failing to report a qualifying accident can get you a traffic citation. But more importantly for your claim, it hands the other driver's insurance company a powerful reason to question the severity—and even the legitimacy—of the whole incident.

How No-Fault Law and Police Reports Connect

Florida's no-fault system is really just designed to speed up payments for initial medical care through your PIP coverage, which typically covers up to $10,000. The problem is, PIP rarely covers all the costs of a serious injury, and it offers absolutely nothing for your pain and suffering.

If your damages blow past your PIP limits, you have to step outside the no-fault system and go after the at-fault driver's insurance. To do that successfully, you must be able to prove they were negligent.

This is where a police report becomes your most valuable player. It acts as the primary, official document that starts to establish fault. Without it, you’re stuck trying to prove the other driver was to blame using only your own evidence, which is a much tougher battle to win. An insurer might just deny your claim, arguing that without a report, there’s no credible proof their driver is liable. Trying to navigate that alone is a huge risk. In pain? Call Caine.

When You Should Call a Personal Injury Lawyer

Trying to handle an insurance claim on your own can feel like you’re fumbling in the dark, especially when a police report is missing from your file. While you might be able to manage a simple, clear-cut claim yourself, some situations are immediate red flags that it's time to bring in professional backup.

Knowing when to ask for help is one of the most critical decisions you'll make. It’s the difference between being treated like a number and being taken seriously.

The moment an adjuster learns you have an attorney, the entire dynamic of your claim shifts. They know they can't get away with the usual delay tactics or lowball offers, because now they’re up against someone who understands the law inside and out—and isn't afraid to go to court to get a fair result.

Clear Signals You Need an Attorney

Some scenarios make hiring a lawyer more than just a good idea; they make it essential. You should seriously consider calling an attorney if you find yourself in any of these situations:

You Suffered Significant Injuries: If your injuries are serious enough to require ongoing medical care, physical therapy, or have forced you to miss work, the financial stakes are simply too high to go it alone. A good lawyer knows how to calculate the full long-term costs of an injury, ensuring you don’t accept a settlement that leaves you short down the road.

The Other Driver is Disputing Fault: A "he said, she said" argument is an insurance company's dream come true, particularly without a police report to set the record straight. A skilled attorney knows exactly how to use other forms of evidence to piece together what really happened and establish who was responsible.

The Insurer is Delaying, Denying, or Lowballing: Are you getting the runaround? Did you receive a denial with a flimsy excuse, or an offer that wouldn't even cover your first medical bill? These are classic strategies adjusters use to wear people down until they give up or accept a fraction of what they deserve.

A personal injury lawyer does far more than just file paperwork. They build a solid, comprehensive case designed to withstand the toughest scrutiny from the insurance company. To get a better sense of our process, you can explore our approach to personal injury cases and see how we fight for our clients.

Don’t let the absence of a police report put you on the back foot. If you're facing any of these challenges, it’s time to level the playing field. In pain? Call Caine.

Frequently Asked Questions

Trying to get a claim sorted out can feel like navigating a maze, especially if you’re missing a police report. Let’s tackle some of the common questions and tricky situations that pop up after a crash.

What If the Other Driver Refuses to Cooperate?

It happens more often than you'd think. The other driver gets defensive, clams up, and won't hand over their insurance details. The most important thing you can do is keep a level head and not let it turn into a roadside argument.

Instead, shift your focus to gathering what you can. Use your smartphone to discreetly snap photos of their license plate, their car, and any damage you can see. Make a quick mental note—or even a voice memo—of what the driver looks like and the make and model of their vehicle.

This is a classic example of when you need to call the police, no question about it. In Florida, refusing to exchange information after an accident is against the law. And if they just take off? That's a hit-and-run, and you'll absolutely need a police report to have any hope of filing a claim through your own uninsured motorist coverage.

Can I File a Police Report After the Accident?

Yes, in most places you can. It's often possible to head down to the local police station and file what’s known as a counter report or a delayed accident report.

Now, let's be clear: a report filed right there at the scene by a responding officer is always going to carry more weight. But a report filed later is a whole lot better than nothing. It officially documents your side of the story.

This is always a better option than having no official documentation at all. Be sure to check with your local law enforcement agency, as their specific procedures for post-accident reporting can vary.

Does Florida’s No-Fault Law Make a Police Report Unnecessary?

This is a huge misconception, and the answer is a firm no. It’s true that your own Personal Injury Protection (PIP) coverage is your primary source for covering initial injuries, no matter who was at fault.

But that doesn’t get you off the hook. As we covered earlier, Florida law is very clear: you are legally required to report any crash that involves injuries or more than $500 in property damage.

Beyond the legal requirement, think about what happens if your injuries are serious. Once your medical bills and other losses blow past your PIP limits, your only option is to file a claim against the at-fault driver's insurance. To win that claim, you have to prove they were negligent. And the single most powerful piece of evidence you can have on your side is an official police report.

If you're dealing with a difficult claim, you don't have to face the insurance company alone. At CAINE LAW, we fight to get you the compensation you deserve. In pain? Call Caine. Contact us today for a free consultation.