In Pain? Call Caine

average settlement for rear end collision: Quick insights

5 Min read

By: Caine Law

Share

Everyone wants a magic number, that one simple answer to the question, "What's my rear-end accident case worth?" The truth is, while many cases with moderate injuries like whiplash settle somewhere in the $30,000 to $55,000 range, that figure is just a ballpark. Your potential settlement isn't a pre-set price; it's a custom figure built from the ground up based on the specific, unique details of your crash.

Why There Is No Single Average Settlement

Trying to pin down an "average" settlement is a lot like asking for the price of an "average" house. Is it in Miami or Jacksonville? Does it have a pool? Is the foundation cracked? The final number depends entirely on the specifics. In the same way, the value of a rear-end collision claim is calculated based on your personal losses, not a national average.

Two crashes that look identical at first glance can lead to wildly different outcomes. One driver might walk away with some soreness that fades in a week. The other might end up with a herniated disc that requires surgery and months of physical therapy. This is exactly why a single "average" can be so misleading.

Understanding the Settlement Spectrum

A better way to think about it is on a spectrum. The value of your claim is put together piece by piece, accounting for every single loss you've suffered—from medical bills and lost paychecks to the very real, personal toll the injury has taken on your life.

Here are the core building blocks that determine where your case might land on that spectrum:

Medical Expenses: This is more than just the ER visit. It covers everything from the ambulance ride and diagnostic imaging to physical therapy, prescription medications, and even potential future surgeries.

Lost Income: This is straightforward compensation for the wages you couldn't earn while you were recovering. If your injuries have permanently affected your ability to work, that future lost earning capacity becomes a huge factor.

Property Damage: The cost to get your car repaired or replaced is one of the more clear-cut parts of the equation.

Pain and Suffering: This is the most subjective—and often the largest—part of a claim. It’s meant to compensate you for the physical pain, emotional trauma, and the general disruption the accident has caused in your daily life.

A settlement isn't just about paying bills. It’s about making you whole again. It must reflect the full scope of your financial, physical, and emotional damages.

Real-World Data on Settlements

To get a clearer picture, let's look at some real-world numbers. The data shows that the average settlement for all U.S. car accident injuries generally falls between $30,000 and $55,000, and rear-end collisions often fit right into this range. One study by Casepeer.com that analyzed over 4,500 car accident cases found an average payout of around $37,249. For cases with only minor injuries, that average dropped to between $10,000 and $15,000.

This data confirms what we see every day: a minor fender-bender might settle for a few thousand dollars, but as soon as you have documented injuries that need real medical care, the value climbs quickly. If you’ve been hurt in any kind of crash, your first step is understanding your rights. You can learn more about how we handle all types of auto and motorcycle accidents right here on our site.

To help you set some realistic expectations, the table below gives a general overview of how settlement ranges can vary based on how serious the injuries are.

Estimated Settlement Ranges by Injury Severity

This table provides a snapshot of potential settlement ranges for rear-end collisions based on the severity of the injuries sustained.

Injury Severity | Common Injuries | Typical Settlement Range |

|---|---|---|

Minor | Soft tissue strains, minor whiplash, cuts, and bruises | $10,000 – $25,000 |

Moderate | Herniated discs, concussions, more severe whiplash | $30,000 – $75,000 |

Severe | Traumatic brain injuries (TBI), spinal cord damage, surgery | $100,000+ |

Keep in mind these are just estimates. A case with "minor" injuries that leads to chronic pain could be worth far more than these initial numbers suggest. The unique facts of your case will always determine the final value.

The Key Factors That Shape Your Settlement Value

Ever wonder why two rear-end crashes that look almost identical can end up with wildly different settlement amounts? It’s because the final number has less to do with the crash itself and everything to do with the specific, provable details of your life after the crash.

An insurance adjuster or a personal injury attorney doesn't just glance at the police report. We dig deep, analyzing every single element of your case to calculate its true value. Think of it less like a simple math problem and more like building a house from the ground up. Your medical bills are the concrete foundation. Evidence of your lost income provides the structural support. Each piece has to be solid, documented, and fit together perfectly to build a strong claim.

The whole process starts by separating your losses into two distinct buckets: economic damages and non-economic damages. Getting a handle on what these mean is the first real step to understanding how your personal experience gets translated into a dollar figure.

Economic Damages: The Black-and-White Costs

These are the tangible, on-paper losses you suffered because of the accident. There's no guesswork here; economic damages are proven with receipts, bills, and pay stubs. They form the undeniable baseline of any settlement negotiation.

Most of the time, these include:

Medical Bills: This covers everything from the ambulance ride and ER visit to surgery, physical therapy sessions, prescriptions, and even the future care your doctors say you’ll need.

Lost Wages: If your injuries kept you out of work—even for a few days—you’re entitled to be paid back for that lost income.

Loss of Earning Capacity: This is for more devastating injuries. If you can no longer do your old job or work at all, this calculates the income you’ll miss out on over your lifetime.

Property Damage: This one’s simple: it’s the cost to fix your car. If it was totaled, it’s the fair market value of your vehicle right before the crash.

Your economic damages represent the cold, hard cash you've had to spend or have lost out on. Keeping meticulous records of every bill and every missed paycheck is absolutely critical. This is the foundation we build everything else on.

Non-Economic Damages: The Human Cost

While economic damages cover your financial setbacks, non-economic damages are meant to compensate you for the very real, but less tangible, human toll of the collision. Honestly, this is often the biggest piece of a settlement, but it’s also the most subjective and where the biggest fights with the insurance company happen.

These damages are meant to put a value on your:

Pain and Suffering: This is for the physical pain, chronic discomfort, and daily limitations your injuries have forced upon you.

Emotional Distress: A crash can leave deep psychological scars. This addresses the anxiety, fear, depression, or even PTSD that follows.

Loss of Enjoyment of Life: Were you an avid golfer, a gardener, or someone who loved playing with your kids? If your injuries took those joys away, this seeks to compensate you for that profound loss.

There's no simple calculator for this part. Insurance companies have their formulas, but what really drives the value here is telling a compelling story—backed by evidence—of how deeply this accident has disrupted your life.

Florida’s “Serious Injury Threshold”

Here in Florida, your ability to even claim non-economic damages like pain and suffering hinges on a very specific rule: the "serious injury threshold." As a "no-fault" state, your own Personal Injury Protection (PIP) insurance is the first line of defense for your medical bills, no matter who was at fault.

But to step outside that no-fault system and make the other driver pay for your pain and suffering, your injury has to be legally defined as "serious." That usually means the injury caused:

A significant and permanent loss of an important bodily function.

A permanent injury, confirmed with a reasonable degree of medical probability.

Significant and permanent scarring or disfigurement.

Death.

Meeting this threshold is the key that unlocks the door to full compensation. Without a qualifying serious injury, you could be stuck with a claim that only covers your economic losses. This is exactly why having clear, detailed medical records from your doctors is non-negotiable in Florida.

An experienced attorney knows how to work with your medical team to ensure your injuries are documented properly to meet this legal standard. If you’re trying to make sense of your medical charts and legal rights, we can clear things up. In pain? Call Caine.

So, What's a Realistic Payout? And How Long Does It Take?

Let's move away from the abstract legal talk and get down to brass tacks. You want to know what a real-world settlement looks like for a rear-end collision. While every single case is different, looking at some typical examples can give you a much clearer idea of what to expect.

The numbers swing wildly, and it all comes down to one thing: how badly you were hurt.

For instance, a pretty standard whiplash case that gets better after a few weeks of physical therapy might settle somewhere in the ballpark of $10,000. But if that same collision caused a herniated disc needing surgery, you're suddenly looking at a settlement well into the six figures. The final number isn't just about the injury itself; it's about the entire ripple effect it has on your life—every medical bill, every day of lost work, and every future consequence.

Breaking Down the Settlement Numbers

Rear-end collision settlements can be anything from a few thousand dollars to multi-million dollar awards in the most tragic cases. Here’s a general breakdown:

Minor Injuries: For soft tissue stuff like sprains and strains, settlements typically land between $2,000 and $50,000.

Moderate Injuries: A herniated disc, for example, sees an average settlement around $38,859, with many cases pushing up toward $50,000.

Severe Injuries: When you're dealing with serious spinal trauma or a brain injury, settlements often jump past $100,000 and can sometimes exceed $2 million. You can get more detailed insights into these kinds of neck and back injury settlement amounts.

This is exactly why getting a complete medical workup is non-negotiable. What feels like a minor ache right after the crash could easily turn into a chronic, expensive condition, completely changing the value of your claim.

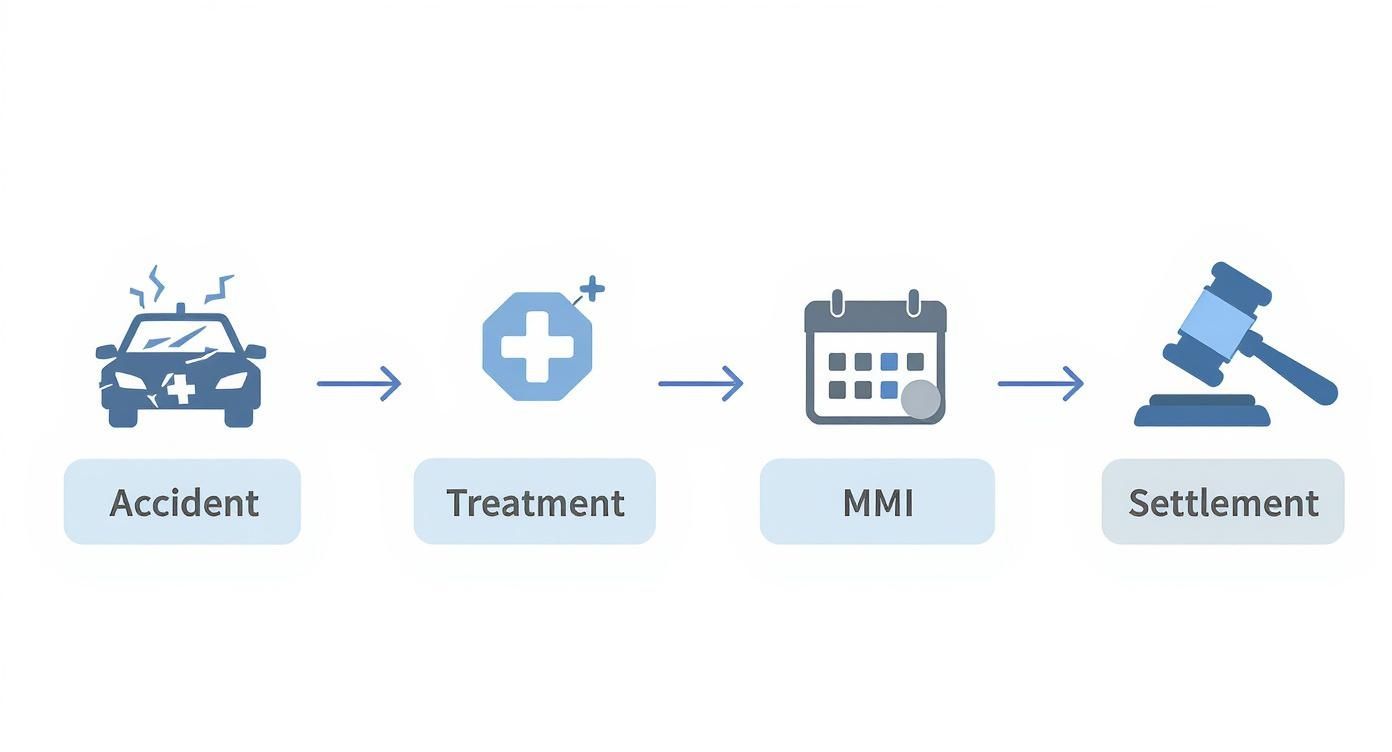

Why Patience Is Your Greatest Weapon

One of the first—and most important—questions I get from clients is, "Why is this taking so long?" The answer is simple, but it’s crucial: you can’t settle a claim until you know the full extent of the damage. Rushing the process is a gamble, and it’s one that almost always pays off for the insurance company, not for you.

The key here is a concept called Maximum Medical Improvement (MMI). This is the point where your doctor says your condition is as good as it’s going to get. Only once you’ve reached MMI can we get a complete, accurate picture of your losses, including:

Your Final Medical Bills: Every cost is tallied, from the first ER visit to the last physical therapy session.

Your Future Medical Needs: Your doctor can give a professional opinion on any future treatments, medications, or even surgeries you might need down the road.

Any Permanent Impairment: If the injury left you with a permanent disability or limitation, this is when we can finally put a real value on it.

Think of it like this: You wouldn't try to sell a damaged car before the mechanic has even looked under the hood. You have no idea if it just needs a new bumper or a whole new engine. In the same way, you can't calculate a fair settlement until your medical story is complete.

If you take an early offer from the insurance company, you sign away your right to ask for more money later. It doesn't matter if that "sore neck" turns into a major problem requiring surgery a year from now. Patience isn't just a virtue in personal injury cases; it's a financial strategy. It ensures your settlement covers every single dollar of your past, present, and future needs.

If an insurance adjuster is pressuring you to settle quickly, that’s a massive red flag. In pain? Call Caine.

How to Calculate the Value of Your Claim

Before you even think about talking to an insurance adjuster, you need to know what your claim is actually worth. Going into that conversation blind is the fastest way to get a lowball offer. I'm going to walk you through how we put an initial number on a case so you can negotiate from a position of strength.

The most common starting point attorneys and insurance companies use is something called the “multiplier method.” It’s not an exact science, but it gives us a logical way to translate your pain and suffering—what the law calls non-economic damages—into a concrete dollar figure.

The Multiplier Method Explained

Think of your claim's value as having two main components. The first part is easy: your economic damages. These are all the hard costs you can add up with receipts, bills, and pay stubs. No guesswork involved.

The second part, your non-economic damages, is where the multiplier comes into play. You take the total of your medical bills and multiply it by a number, typically between 1.5 and 5. The more severe and life-changing your injuries are, the higher that multiplier will be.

A minor whiplash case where you feel better in a few weeks might get a 1.5x multiplier. But a herniated disc that needs surgery and leaves you with chronic pain? That could easily justify a 4x or 5x multiplier.

Here’s the basic formula in action:

Calculate Economic Damages: Add up your total medical bills, lost wages, and property damage.

Estimate Non-Economic Damages: Multiply your total medical bills by your chosen multiplier (1.5 to 5).

Find Your Estimated Total: Add your economic and non-economic damages together.

Let’s run a quick example. Say you have $10,000 in medical bills and lost $4,000 in wages from being out of work. Your injuries were moderate—painful and disruptive, but you're expected to make a good recovery. We might assign a 3x multiplier.

Economic Damages: $10,000 (medical) + $4,000 (wages) = $14,000

Non-Economic Damages: $10,000 (medical) x 3 = $30,000

Estimated Claim Value: $14,000 + $30,000 = $44,000

This number isn't a final settlement, but it's a powerful, evidence-based starting point for your demand.

This process highlights why it's so important to wait until you've reached "Maximum Medical Improvement" (MMI)—the point where your doctor says you're as recovered as you're going to be—before you start talking numbers.

As you can see, you can't properly calculate your claim's value until your medical treatment is complete or has at least stabilized. Settling too early means you could be left paying for future medical needs out of your own pocket.

Building Your Demand with an Evidence Checklist

That calculation is just a number on a page without proof to back it up. To build a powerful settlement demand, you need documentation for every single dollar you're asking for. The insurance adjuster isn't just going to take your word for it.

Here’s a checklist of the core documents you’ll need to start gathering.

Evidence Checklist for Your Settlement Demand

Evidence Category | Specific Documents/Items | Why It's Important |

|---|---|---|

Medical Treatment | Itemized bills from every provider (ER, doctors, chiropractors, physical therapists, pharmacy receipts). All medical records and diagnostic reports (X-rays, MRIs). | This is the foundation of your claim. It proves your injuries, the cost of treatment, and directly impacts the pain and suffering multiplier. |

Lost Income | A letter from your employer on company letterhead confirming your job title, pay rate, and missed time. Copies of recent pay stubs or W-2s. | This provides concrete proof of the wages you lost because you were unable to work, making it a key component of your economic damages. |

Property Damage | Multiple repair estimates for your vehicle. If the car was a total loss, the official valuation report from the insurance company. | This establishes the clear, out-of-pocket cost to repair or replace your vehicle, separate from your injury claim. |

Accident Scene | Photos and videos of the scene, vehicle damage (both cars), and any visible injuries (bruises, cuts, casts). | Visual evidence is incredibly persuasive. It helps the adjuster understand the severity of the impact and your injuries. |

Official Report | The complete, official police or crash report. | This report contains the investigating officer's narrative, diagrams, witness information, and often an initial determination of who was at fault. |

Organizing this paperwork is half the battle. When you can present a clean, well-documented demand package, it tells the insurance company you're serious and prepared.

If gathering all this evidence and figuring out the right multiplier feels like too much to handle, that's what we're here for. In pain? Call Caine.

Navigating Insurance Company Negotiations

Stepping into a negotiation with an insurance adjuster after a rear-end collision can feel like you’re playing a game where they already know all the rules. Let's be clear: their job is to protect their company's bottom line, which means paying you as little as possible. This section is all about arming you with the knowledge to level that playing field.

One of the oldest tricks in the book is the quick, lowball offer. You might get a call just days after the crash from an adjuster who sounds incredibly friendly and concerned. They’ll offer a few thousand dollars to "get this all settled quickly for you." It's tempting, especially when you're stressed and bills are piling up. But they're banking on you taking the cash before you even know the full extent of your injuries or what future medical care you might need.

What to Say and What to Avoid

Those first few conversations with the adjuster are critical. What you say—and, more importantly, what you don't say—can dramatically shape the outcome of your claim. You have to be prepared and protect your rights from the very first phone call.

Here are a few ground rules:

Don't Admit Fault: Never, ever apologize or say anything that could even remotely be twisted into an admission of fault. Stick to the basic, undisputed facts of what happened.

Don't Give a Recorded Statement: You are under no legal obligation to provide a recorded statement to the other driver’s insurance company. Adjusters are trained to ask leading questions designed to trip you up and weaken your claim down the road.

Don't Downplay Your Injuries: It's natural to say "I'm fine" out of habit, but don't. The full impact of injuries like whiplash can take days or weeks to surface. Simply state that you are getting medical attention.

An insurance adjuster works for the insurance company, not for you. Their job is to resolve your claim for the lowest possible cost. Providing only basic, factual information protects you from unintentionally weakening your own case.

Knowing how to handle these calls is a huge piece of the puzzle, but it's not the only one. Delays and miscommunications can also cause serious problems. If you're running into roadblocks, you can find more valuable information about handling insurance disputes right here on our website.

Understanding Florida's Statute of Limitations

In Florida, the clock is ticking. You have a limited window of time to file a lawsuit after a car accident, a deadline known as the statute of limitations. For most personal injury claims, you have just two years from the date of the wreck to file. If you miss that deadline, your right to seek compensation in court is likely gone for good.

This timeline is absolutely critical because negotiations can drag on. The average settlement for a rear-end collision can take anywhere from 12 to 24 months, especially if there are arguments over injury severity or who was at fault. Keeping that two-year deadline in mind ensures you and your legal team have enough breathing room to build a strong case and negotiate from a position of strength.

If you feel like the adjuster is intentionally dragging their feet or you see that two-year mark getting closer, it’s a massive red flag. That's your sign to get professional guidance to protect your claim. In pain? Call Caine.

Why a Lawyer Can Maximize Your Settlement

After a rear-end collision, you *can* handle the insurance claim yourself. The real question is: should you?

The data is pretty clear on this. Accident victims who hire a lawyer consistently receive significantly higher settlement offers than people who try to go it alone. An experienced attorney does so much more than just fill out paperwork.

Think of them as your strategist, your advocate, and your shield against the insurance company’s tactics. Their one and only goal is to make sure every single damage—past, present, and future—is accurately calculated and aggressively pursued. This is how you avoid leaving money on the table that is rightfully yours.

The Strategic Advantage of Legal Counsel

Hiring an attorney immediately levels the playing field. While you’re focusing on healing, they get to work building a powerful, evidence-based case for you.

This involves a few critical steps that can make a huge difference in your final settlement amount:

Accurate Claim Valuation: An attorney knows how to use methods like the multiplier to calculate the true value of your pain and suffering. This is a far cry from whatever the insurance company’s software spits out.

Evidence Gathering: They know exactly what evidence is needed to prove fault and show the full extent of your damages. This could mean anything from securing expert medical testimony to preserving critical data from the accident scene.

Aggressive Negotiation: Let's be honest, lawyers are professional negotiators. They aren't intimidated by insurance adjusters and can counter lowball offers with cold, hard facts and legal precedent, forcing the insurer to justify their position.

The right lawyer doesn’t cost you money—they make you money. By preventing costly mistakes and fighting for every dollar, they ensure your settlement reflects the true impact the collision has had on your life.

Protecting You from Costly Mistakes

Insurance adjusters are trained professionals, and their job is to minimize payouts for their company. They might try to get you to give a recorded statement that can be twisted and used against you later. Or they might pressure you into accepting a quick, low settlement before you even know what your long-term medical needs will be.

An attorney acts as a vital buffer, managing all communication with the insurer. They know what to share and what to hold back, protecting your claim from being weakened by these common tactics. This protection is a key part of securing the full average settlement for a rear end collision in cases like yours. If you are struggling with a claim, you can learn more about our approach to personal injury cases and how we fight for our clients.

Hiring a skilled litigator takes the immense stress of this battle off your shoulders. It allows you to dedicate your energy to what really matters: your physical and emotional recovery. A professional consultation is the first step toward getting the compensation you truly deserve.

In pain? Call Caine.

Common Questions About Rear-End Collision Claims

When you're dealing with the aftermath of a car accident, it’s completely normal to feel overwhelmed and have a lot of questions. Let’s cut through the noise and get you some direct, straightforward answers to the questions we hear most often from folks in Florida who've been rear-ended. The goal here is to give you some clarity so you can figure out your next steps.

How Much Should I Settle for After a Rear-End Collision?

There’s no magic number, but here’s the bottom line: you should never settle for a penny less than the total value of your damages. That means every single dollar for past and future medical care, all your lost wages, and a fair amount for the pain and suffering you've been put through. Trust me, that first offer the insurance company throws out is almost always a lowball.

A fair settlement really hinges on how badly you were hurt. To give you a ballpark idea:

Minor soft tissue injuries, like a case of whiplash that gets better after a few weeks, might land in the $10,000 to $25,000 range.

Moderate injuries, think a herniated disc that needs months of physical therapy, often settle somewhere between $25,000 and $75,000.

Severe injuries that demand surgery or leave you with permanent problems can easily blow past $100,000.

A critical piece of advice: don't even think about accepting an offer until your doctor says you’ve reached Maximum Medical Improvement (MMI). That's the point where you’re as recovered as you’re going to get, and only then will you know the true financial cost of the accident.

What Is a Typical Pain and Suffering Settlement?

Figuring out a dollar amount for pain and suffering isn't simple, but it's directly tied to how severe your injuries are and how long they'll affect you. Insurance adjusters often use a "multiplier method," where they take your total medical bills and multiply them by a number, usually between 1.5 and 5.

For a minor sprain that’s just a nuisance for a few weeks, the pain and suffering part might only be a few thousand dollars. But for an injury that saddles you with chronic pain and messes with your daily life? That part of your settlement could be tens of thousands of dollars, or even more. The more the injury turns your life upside down, the higher that multiplier should be.

How Long Does It Take to Get a Settlement?

The timeline for getting an average settlement for a rear-end collision is all over the map. A straightforward claim with minor injuries could wrap up in just a few months, but anything more complicated is going to take a while.

On average, you can expect a personal injury claim to take anywhere from 12 to 24 months to finally resolve. Things like a fight over who was at fault, serious injuries needing long-term care, or an insurance company that just drags its feet can stretch that timeline out even longer.

Patience is your best friend here. If you rush to settle before you understand the full scope of your injuries and future medical needs, you're doing the insurance company a massive favor. It’s always better to wait and fight for the full compensation you are owed.

At CAINE LAW, we fight to make sure our clients get a settlement that truly covers everything they've lost. If you're trying to pick up the pieces after a rear-end crash and the whole process feels like too much, let us put our experience to work for you. In pain? Call Caine. Contact us today for a free consultation.