In Pain? Call Caine

average settlement for car accident in florida: Key factors

5 Min read

By: Caine Law

Share

When people ask me about the average settlement for a car accident in Florida, I know they’re looking for a simple number. But the truth is, there isn't one. It’s a question that sounds straightforward but is loaded with complexity.

That "average" figure you might find online is basically useless. It lumps together a $5,000 fender-bender settlement with a catastrophic, multi-million dollar verdict from a jury. The result is a number that represents no one's actual experience.

Why There Is No Simple 'Average' Settlement

Trying to nail down an "average" settlement is like asking for the "average" price of a house in Florida. Think about it—a small condo in a rural town isn't going to have the same price tag as a waterfront mansion in Miami. The specifics matter.

It's the exact same with a car accident claim. A minor whiplash case that resolves in a few months will never be valued the same as a case involving a permanent spinal cord injury.

Every single accident is its own unique event, with its own set of facts. The value of your claim is built piece by piece from factors completely specific to you: how severe your injuries are, what the police report says, and the mountain of medical bills you're facing. Because no two wrecks are identical, no two settlements are, either.

From Minor Sprains to Major Verdicts

To give you a real-world feel for this, let's look at the huge spectrum of potential outcomes. The final number is driven entirely by the level of harm and the unique details of what happened.

For example, a recent case we handled involving a severe bodily injury resulted in a $983,077.05 settlement. In another case, a couple injured in the same crash settled for a combined $400,000. These results show just how much the values can differ based on the specific circumstances.

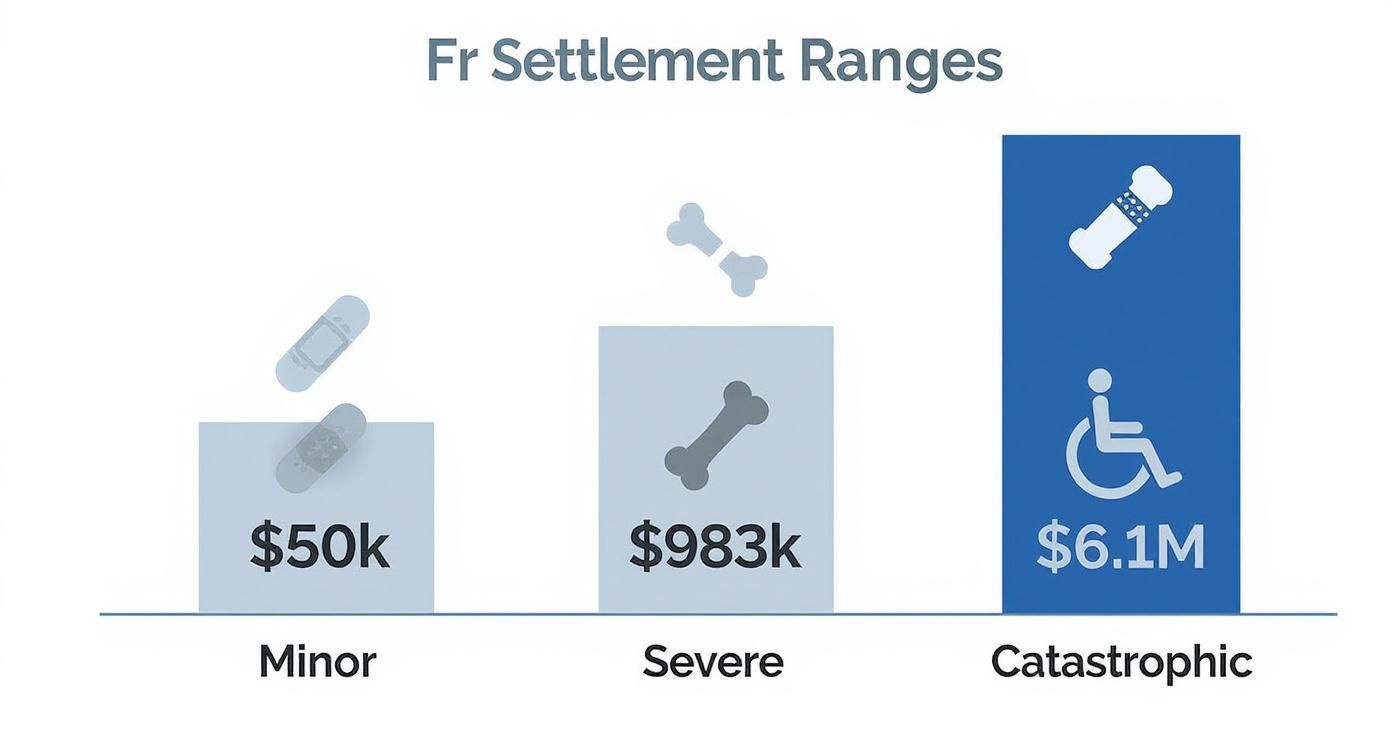

This infographic does a great job of showing how drastically the settlement ranges can change based on how badly someone was hurt.

As you can see, the value skyrockets as the injuries get more serious—climbing from tens of thousands for more minor issues to potentially millions for injuries that change someone's life forever.

To help illustrate this, here’s a breakdown of typical settlement ranges based on the severity of the injury.

Florida Car Accident Settlement Ranges by Injury Severity

This table gives you a general idea of how different injuries can impact potential settlement values in Florida.

Injury Severity | Common Injury Types | Typical Settlement Range |

|---|---|---|

Minor | Soft tissue sprains, whiplash, minor cuts, bruising | $10,000 - $25,000 |

Moderate | Herniated discs, bone fractures, concussion, minor TBI | $50,000 - $100,000+ |

Severe | Spinal cord injuries, severe TBI, amputations, paralysis | $250,000 - $1,000,000+ |

Catastrophic | Permanent disability, severe burns, loss of major bodily function | $1,000,000 - Multi-Millions |

Remember, these are just estimates. The final amount will always depend on the specific facts of your case.

Understanding Your Unique Situation

Here's the most important thing to remember: your case is not an average. Its true value is tied directly to your personal losses.

Things like your need for ongoing physical therapy, the wages you lost because you couldn't work, and the long-term impact on your daily life are what really determine the final number. The first step toward getting fair compensation is to understand all the details of your own personal injury claim.

Your settlement isn’t based on some generic average. It’s calculated based on the specific, documented damages you have suffered. The entire goal is to make you whole again by compensating you for your unique financial, physical, and emotional losses.

Focusing on an "average" will only set you up with false expectations. The only way to get an accurate valuation is through a detailed, professional analysis of your specific situation. If you’ve been injured and are watching the bills pile up, don't guess what your claim is worth. In pain? Call Caine.

The Critical Factors That Shape Your Settlement

Insurance companies don’t just pull a number out of a hat when they make a settlement offer. An accident claim's value is carefully pieced together from several key components, almost like a builder following a blueprint. Each factor is a building block that contributes to the final structure of your compensation.

Understanding these elements is the first step toward recognizing what a fair offer actually looks like. It’s about getting past the generic "average settlement" and seeing the real math behind your specific case.

Injury Severity and Long-Term Impact

The single most significant factor driving your settlement amount is the nature of your injuries. Let’s be frank: a minor case of whiplash that clears up in a few weeks just doesn't carry the same weight as a broken leg that needs surgery, pins, and months of grueling physical therapy.

Adjusters and attorneys focus on two critical aspects:

Severity: How serious is the injury? A herniated disc is valued much higher than a simple muscle sprain because the treatment is more intense and the pain is far greater.

Permanence: Will you ever fully recover, or will this injury haunt you for the rest of your life? A permanent injury causing chronic pain or limiting your ability to do daily tasks will lead to a substantially higher settlement.

For example, a traumatic brain injury (TBI) can create lifelong cognitive challenges, dramatically increasing a claim's value compared to a concussion that resolves completely.

The Full Scope of Medical Expenses

Medical bills are often the most concrete part of a settlement calculation. We call these economic damages because they have a clear dollar value attached. But it’s not just about the bills already sitting on your kitchen table.

A proper settlement has to account for all related medical costs, both what you've already paid and what you'll need in the future.

A huge mistake we see is people settling a claim too early, before anyone knows the full extent of their future medical needs. A fair settlement must cover the entire road to recovery, not just the initial emergency room visit. That road could last for years.

Your claim should include every single penny spent on treatment, including things like:

Emergency room visits and that first ambulance ride

Hospital stays and any surgical procedures

Diagnostic imaging like X-rays, MRIs, and CT scans

Follow-up visits with specialists

Physical therapy and rehabilitation

All prescription medications

Medical equipment, such as crutches or a wheelchair

The estimated cost of future surgeries or long-term care

Lost Income and Earning Capacity

If your injuries kept you out of work, you are absolutely entitled to be paid back for those lost wages. This is another type of economic damage that’s fairly simple to calculate by looking at your pay stubs and work history.

But what happens if your injuries are so bad you can’t go back to your old job—or can’t work at all? This is where diminished earning capacity comes in. It’s designed to compensate you for the future income you will lose over your entire working life because of the accident. Calculating this properly often requires an expert to project the full financial fallout.

Demystifying Pain and Suffering

Unlike medical bills, "pain and suffering" doesn't come with a neat invoice. This is what's known as a non-economic damage, and it’s meant to compensate you for the physical pain, emotional distress, and loss of enjoyment of life the accident has caused.

So, how is this number figured out? Attorneys often use a "multiplier method." We take the total economic damages (medical bills + lost wages) and multiply them by a number, usually between 1.5 and 5. That multiplier goes up based on how severe and permanent your injuries are.

For instance:

Minor Injury: Someone with $5,000 in medical bills for whiplash might get a 1.5x multiplier, adding $7,500 for pain and suffering.

Severe Injury: A person with $100,000 in medical bills for a complex fracture needing surgery could get a 4x multiplier, adding $400,000 to account for their immense pain and the long-term impact on their life.

Florida’s Comparative Negligence Rule

There's one final, critical factor here in Florida: comparative negligence. Under state law, your settlement award can be reduced by your percentage of fault for the crash.

If a jury decides you were 20% responsible for what happened, your final award gets cut by 20%. This is a favorite tactic of insurance companies to slash their payouts, which makes it essential to have solid evidence proving the other driver was the one primarily at fault.

Every one of these factors interacts to create the true value of your claim. Getting an accurate assessment requires a deep dive into the unique details of your case. If you're trying to figure out what your settlement might be worth, don't waste time with averages or online calculators. In pain? Call Caine.

How Specific Injuries Influence Settlement Values

While the big-picture factors set the stage, your specific medical diagnosis is what really starts to define the numbers on your claim. The type of injury you've suffered has a direct line to your potential settlement because it determines everything that comes next: the cost of your medical care, how long your recovery will take, and the permanent impact it might have on your life.

Think of it like this: your injury is the epicenter of the earthquake that just rocked your world. A minor tremor, like some soft tissue bruising, will have a limited, local impact. But a major quake, like a spinal cord injury, sends shockwaves through every part of your life, from your job to your daily comfort. Insurance adjusters and juries see it the same way—the more severe and far-reaching the consequences, the higher the value of the claim.

From Whiplash to Broken Bones

It’s a hard truth, but not all injuries are created equal in the eyes of the law. Understanding the general hierarchy gives you a much clearer picture of what the average settlement for a car accident in Florida might look like for you. Every diagnosis comes with an expected level of medical treatment, recovery time, and, of course, pain and suffering.

Here’s a quick breakdown of common injuries and why their values can be so different:

Soft Tissue Injuries (Whiplash, Sprains, Strains): These are easily the most common injuries we see after a car crash. And while they are genuinely painful, insurers often view them as less severe because they tend to heal with conservative care like physical therapy. Settlements here usually focus on covering those therapy bills, any lost wages, and compensation for a few weeks or months of discomfort.

Broken Bones (Fractures): A broken bone immediately kicks a claim’s value up a notch. The treatment is just more serious. We're talking about casts, surgery to install plates and screws, and a much longer, more painful recovery. The impact on your life is also far greater, limiting your ability to get around and do basic things for a long time.

Herniated Discs and Back Injuries: The spine is your body’s foundation, and any injury to it is taken very seriously. A herniated disc can lead to chronic, debilitating pain. It might require invasive treatments like steroid injections or even surgery, and it can leave you with permanent physical limits.

The High Cost of Neck and Back Injuries

Neck and back injuries, in particular, often lead to major settlements for one simple reason: they have the potential to cause lifelong problems. These injuries can make it hard to sit, stand, walk, or lift, completely upending your career and your quality of life. The need for ongoing pain management, the possibility of future surgeries, and permanent work restrictions all drive the value of these claims way up.

The data backs this up in a big way. For instance, the average settlement for neck and back injuries in Florida is $965,562, with the median settlement at $274,434. That huge gap between the average and the median shows you how a few catastrophic cases—like one $8 million award for a broken neck—can pull the "average" figure sky-high. You can find more details on these numbers in the full findings on neck and back injury settlement amounts. It’s a powerful reminder that while not every case is a seven-figure one, the potential for significant compensation is very real when the spine is involved.

Your diagnosis is more than just a medical term; it’s a roadmap for your future. A catastrophic injury like a TBI or spinal damage doesn't just mean more medical bills—it means a completely altered life, and the settlement must reflect that profound loss.

Catastrophic Injuries: Traumatic Brain and Spinal Cord Damage

At the very top of the scale are catastrophic injuries that permanently change a person's life. These cases rightly command multi-million dollar settlements because the damages are simply immense and last a lifetime.

Traumatic Brain Injuries (TBIs): A severe TBI can destroy cognitive function, memory, and even personality. Victims often need around-the-clock care, highly specialized therapies, and major home modifications. The costs can easily run into the millions over a lifetime.

Spinal Cord Injuries (SCIs): An SCI that results in paralysis—paraplegia or quadriplegia—is one of the most devastating things that can happen in an accident. The settlement has to cover a lifetime of medical care, assistive technology, a total loss of earning capacity, and the profound loss of independence.

Understanding where your specific diagnosis fits into this picture is the first step. For a clear-eyed evaluation of how your injuries might impact your claim, especially in different types of auto and motorcycle accidents, you need a professional assessment. Don’t guess what your injury is worth. In pain? Call Caine.

Navigating the Settlement Negotiation Process

Trying to understand how an insurance company calculates and negotiates a settlement can feel like watching a magic trick—you know there’s a method to it, but the details are hidden from view. The good news is that it’s not magic. It’s a predictable process that starts with adding up your losses and ends with a signed agreement.

Knowing the steps involved, and more importantly, the tactics insurers love to use, is what gives you a fighting chance. It shifts you from being a passenger in your own claim to being an informed driver.

Calculating the True Value of Your Claim

Before a single dollar amount is discussed, we need to build your case from the ground up by calculating the full, honest value of everything you've lost. This isn't guesswork; it's a careful accounting of two different kinds of damages.

First, we tally up your economic damages. These are the straightforward, black-and-white financial hits you’ve taken. We gather every receipt and document, from the initial ER visit and ambulance ride to ongoing physical therapy. This also includes lost income from time you couldn't work, and even the future earnings you might lose if your injuries limit your career.

Then comes the hard part: calculating non-economic damages. This is compensation for your human losses—the physical pain, the emotional distress, and the toll the accident took on your quality of life. To assign a number to something so personal, we often use what’s called the "multiplier method." We take the total of your economic damages and multiply it by a number between 1.5 and 5. A more severe, life-altering injury gets a higher multiplier.

The Step-by-Step Negotiation Journey

Once we have a solid number based on real evidence, the negotiation dance begins. This is a strategic back-and-forth with the insurance company, and you absolutely need a game plan.

Here’s how it usually plays out:

The Demand Letter: Our team drafts a comprehensive demand letter. This is far more than a simple request for payment. It’s a powerful legal argument that clearly states the facts, proves the other driver’s fault, details the extent of your injuries, and presents a full accounting of your damages, backed by all the evidence we’ve gathered.

The Initial Offer (The Lowball): The insurance adjuster reviews our demand and almost invariably comes back with an offer that’s insultingly low. This is a classic move. They’re testing you to see if you’re desperate or uninformed enough to take a tiny fraction of what your case is actually worth.

Counteroffers and Justification: This is where the real work happens. We reject their lowball offer and respond with a counteroffer, using evidence and legal arguments to show them exactly why their number is unacceptable and why ours is fair. This can involve several rounds of offers and counteroffers.

Reaching a Final Agreement: When both sides finally land on a number that properly compensates you for everything you’ve been through, a formal settlement agreement is drawn up. This document legally releases the at-fault party from any future claims in exchange for the payment.

Insurance adjusters are professional negotiators. Their job is to protect their company’s profits by paying out as little as possible. No matter how friendly or concerned they sound on the phone, they are not on your side.

Recognizing Common Insurance Adjuster Tactics

Insurance companies have a playbook of tactics they use to get you to settle for less. Once you learn to spot them, you can protect yourself from falling into their traps.

Be on high alert if an adjuster:

Rushes You into a Quick Settlement: They might dangle a check in front of you just days after the accident, long before you know the true extent of your injuries. It’s a bait-and-switch designed to close your case for pennies before you find out you need surgery or long-term treatment.

Disputes the Severity of Your Injuries: A go-to move is to dig through your medical history to claim your pain is from a "pre-existing condition" or to argue that your injuries aren’t as bad as your doctors say they are.

Asks for a Recorded Statement: They will tell you this is just a standard procedure, but their real goal is to get you on record saying something—anything—they can twist to undermine your claim later. You are not obligated to give them one.

Delays the Process: Sometimes, the strategy is to do nothing at all. They drag their feet, ignore your calls, and delay payments, hoping you’ll get so frustrated and financially stressed that you’ll accept a lowball offer just to be done with it.

Going up against a skilled adjuster by yourself is a massive risk. An experienced attorney knows every trick in their book and can build a case that forces them to negotiate fairly. If you’re dealing with an insurer and feel like you’re in over your head, don’t wait. In pain? Call Caine.

Why Online Settlement Calculators Are Misleading

When you're staring at a mountain of medical bills after a crash, the temptation to punch some numbers into an online car accident settlement calculator is completely understandable. You just want a straight answer about what your case might be worth.

But here’s the hard truth: those tools are notoriously unreliable.

Trusting one is a bit like using a generic symptom-checker website to diagnose a serious illness. It might give you a vague idea, but it’s a poor substitute for a real, professional evaluation. These calculators rely on simple formulas that are fundamentally broken because they can't possibly grasp the critical, human details of your accident.

A calculator has no way of knowing how strong your evidence is, whether your witnesses are credible, or the specifics of the insurance policies at play. It simply can’t understand the nuances an experienced attorney uses to build a powerful case and create real leverage against an insurance company.

The Problem with Averages and Simple Math

The biggest reason these calculators fail is their reliance on overly simplistic math. They usually take a basic formula, like multiplying your medical bills by a certain number, but they can't account for the massive difference between an "average" and a "median" settlement. This distinction is everything when trying to understand the average settlement for car accident in Florida.

Recent data shows the average car accident settlement in Florida is $212,325, but the median settlement is only $25,000. That huge gap tells a crucial story: a handful of multi-million dollar cases are pulling the "average" way, way up, while most people are settling for far less. You can dig into these personal injury law statistics yourself to see how a few outliers can paint a misleading picture.

An online calculator sees numbers, not your story. It can't quantify your sleepless nights, the chronic pain you feel, or how the accident has impacted your ability to enjoy your life. A fair settlement must account for these human losses, which no algorithm can measure.

Factors That No Calculator Can Analyze

The real value of your claim is tied to complex factors that demand human judgment and legal expertise. These are the kinds of things a simple online tool will always miss.

Witness Credibility: How believable are your witnesses? A strong, confident witness can make a case, while a shaky one can break it.

Jury Appeal: If your case ended up in front of a jury, how would they see you? How would they perceive the at-fault driver? This is a massive factor in settlement talks.

Attorney's Reputation: Insurance companies keep score. They know which law firms are ready and willing to go to trial and which ones will take a lowball offer to close a file. An attorney's reputation directly impacts the quality of the offers you get.

Pain and Suffering: The true depth of your physical pain and emotional trauma is a powerful part of your claim, but it's impossible to boil down into a simple formula.

These calculators often give accident victims a dangerously false idea of what their claim is worth, which can lead to disastrous decisions. Don’t bet your financial future on a flawed algorithm. Get a reliable, personalized case evaluation from someone who understands what's really at stake. In pain? Call Caine.

How to Protect Your Claim After a Florida Accident

When a car accident happens, the chaos of the moment can be overwhelming. But what you do in the minutes, hours, and days that follow is absolutely crucial. The steps you take—or don't take—can make or break your ability to get the compensation you deserve. Protecting your claim starts at the scene and doesn't stop.

Your first priority is always your health and safety. Get medical help right away, even if you think you're okay. Adrenaline can mask serious injuries like concussions or internal bleeding, which might not show symptoms for hours. If you wait to see a doctor, you're not just risking your health; you're handing the insurance company an easy excuse to argue your injuries weren't caused by the crash.

Next, you need to become a detective for your own case. Document everything. Take photos of the accident scene from every angle, get the names and numbers of any witnesses, and keep a folder for every single medical bill, receipt, and email you get from the insurance companies. This stack of evidence will be the foundation of your entire claim.

Why You Need a Skilled Attorney on Your Side

Trying to navigate a personal injury claim by yourself is a huge gamble. You’re up against insurance adjusters who are trained negotiators. Their one and only job is to protect their company's bottom line by paying you as little as possible.

Hiring an experienced attorney immediately levels the playing field. Here’s how:

They Know What Your Claim is Really Worth: A good lawyer understands how to calculate the full extent of your damages—not just the immediate medical bills, but also future treatments, lost income, and the real cost of your pain and suffering. They make sure no money is left on the table.

They Handle the Headaches: Your attorney will take over all communications with the insurance company. This protects you from their tactics, like trying to get a recorded statement they can twist and use against you later.

They Negotiate from a Position of Strength: Armed with solid evidence and a deep knowledge of Florida law, they can argue your case aggressively to get the best possible settlement.

A huge mistake people make is giving a recorded statement to the other driver's insurance company. These calls are designed to trip you up and get you to say something that weakens your claim. Never, ever agree to one without talking to your lawyer first.

Protecting your legal rights is the only way to secure the average settlement for a car accident in Florida that you’re entitled to. For a more detailed checklist, check out our guide on what to do when accidents happen. An attorney ensures your case is built to win from the very beginning. In pain? Call Caine.

Common Questions About Car Accident Settlements

Even after you get the basics of how settlements work, it's the practical, real-world questions that keep you up at night. The aftermath of a car wreck is confusing enough, so let's tackle some of the most common concerns we hear from our clients every day. Getting straight answers is the first step toward moving forward with confidence.

These aren't just hypotheticals; they're the real issues you'll likely face while fighting for the compensation you deserve.

How Long Does a Settlement Take in Florida?

There’s no magic number here. The timeline depends entirely on the specifics of your accident. A straightforward case with minor injuries and zero question of who was at fault might wrap up in just a few months. But if you're dealing with severe injuries, a debate over liability, or multiple vehicles, it could easily take a year or more—especially if a lawsuit becomes necessary.

The single most important milestone is reaching what's called Maximum Medical Improvement (MMI). This is the point where your doctors have a clear picture of your long-term prognosis. Settling before you reach MMI is a catastrophic mistake. Rushing things almost guarantees you'll leave money on the table that you'll desperately need for future care.

Do I Pay Taxes on My Car Accident Settlement?

For the most part, you can breathe a sigh of relief: no. The IRS doesn't typically view compensation for physical injuries as taxable income. That means the money you receive for your medical bills, lost wages, and your pain and suffering is usually tax-free.

But there’s a catch. If a portion of your award is for punitive damages—which are designed to punish the at-fault party for extreme negligence—that part is considered taxable. It's always a good idea to chat with a financial advisor to understand exactly how your specific award might be affected.

The key takeaway is that the core of your settlement, the part meant to make you whole again after an injury, is not taxed. This ensures the funds go where they're needed most—toward your recovery.

What if the At-Fault Driver Is Uninsured?

It’s a nightmare scenario, but you aren't out of options. First, Florida law requires every driver to carry Personal Injury Protection (PIP) insurance. This covers your first $10,000 in medical bills and lost wages, no matter who caused the crash.

After that, your own Uninsured/Underinsured Motorist (UM/UIM) coverage becomes your lifeline. This is the specific coverage you buy on your own policy to protect yourself from this exact situation. It allows you to file a claim with your own insurance company for the damages the other driver should have paid for.

How Much Does It Cost to Hire a Lawyer?

At Caine Law, we work on a contingency fee basis. Plain and simple, this means you pay zero upfront fees. We only get paid when we win your case, either by securing a settlement or winning a verdict at trial.

Our fee is a set percentage of the total recovery, which we agree on from day one. This system levels the playing field, ensuring that everyone can get top-tier legal help, no matter their financial situation. You can focus on healing, not on racking up hourly bills.

Navigating a car accident claim is tough, but you don't have to face the insurance companies alone. The team at CAINE LAW is here to answer your questions and fight for every penny you deserve. We know their tactics, and we have the track record to prove we know how to beat them. If you’ve been hurt, get the powerful legal advocate you need in your corner. In pain? Call Caine.